4 Things I Wish I'd Known About Life Insurance

Maybe 2020 was the first year you've ever considered buying life insurance.

Life insurance offers valuable financial protection for your dependents. The death benefit can help your family finish paying off the mortgage and replace your income.

How life insurance works, its terminology, and its policy variations can be difficult to navigate, especially if you're applying for it for the first time.

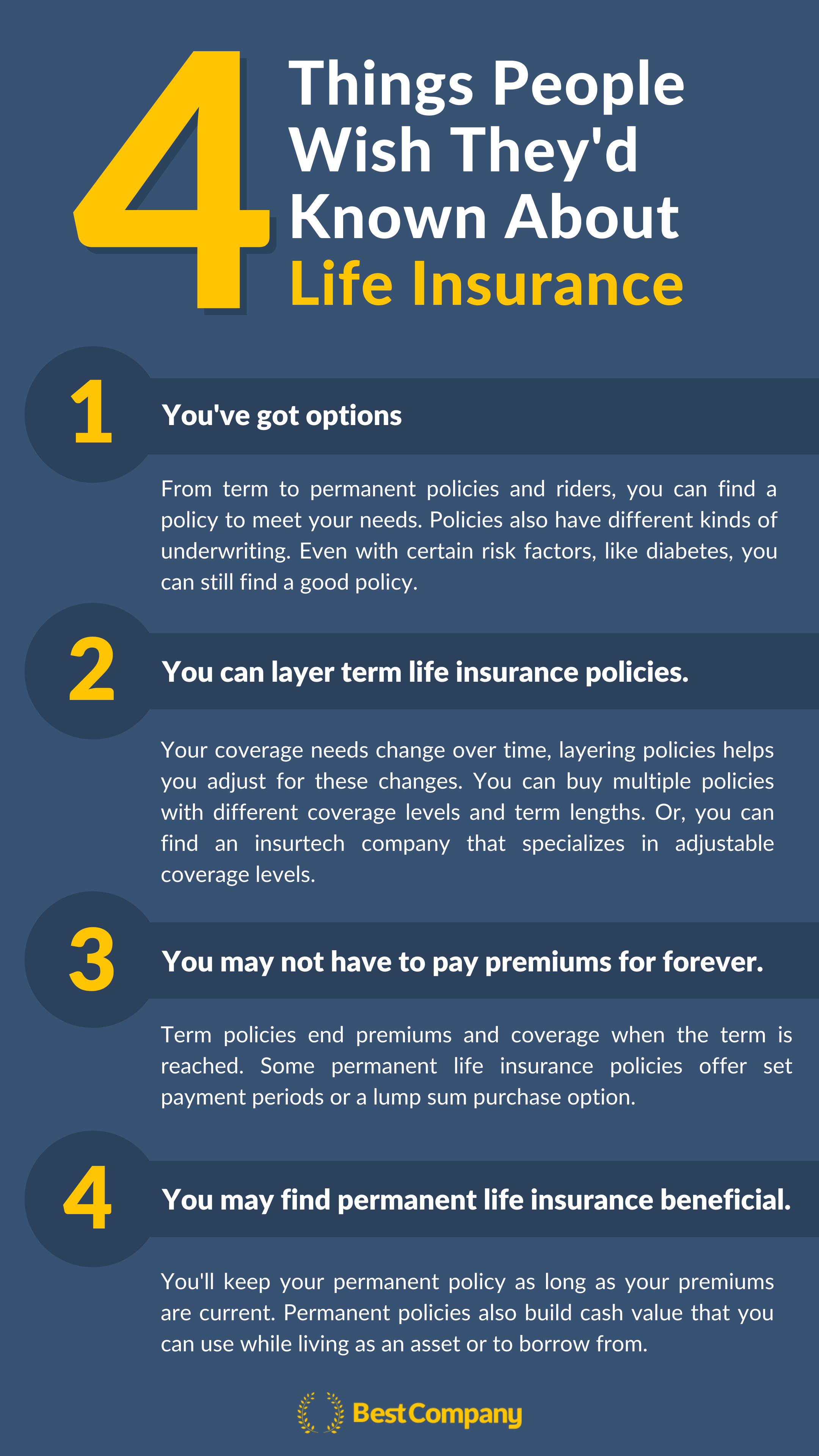

Here are four things people wished they had known about life insurance:

- You've got options.

- You can layer term life insurance policies.

- You may not have to pay a life insurance premium for the rest of your life.

- You may find permanent life insurance beneficial.

1. You've got options.

"What I wish I had known before purchasing life insurance, are all of the options. I purchased term life insurance because at the time it was most affordable, but with the intention of converting it to a permanent policy later on so that I would always have some coverage available. However now that I know of all the available options, it may have been more beneficial to start with a permanent policy." Nick Baldes, life insurance agent from Savewithcote.com.

Exploring and evaluating life insurance policy options will help you find a policy that meets your needs. You'll find a wide variety of life insurance policies on the market. With such variety, you can find policies that fit your budget and meet your needs.

"As for those that do not or have not yet purchased life insurance, the biggest "I wish I had known that" moment we always hear is that there is a policy for EVERYBODY. No matter what medical conditions one might have, there are life insurance options out there for people. There are policies where no medical exam is required, there are guaranteed issue policies you can have which will issue regardless of any underlying conditions," Baldes adds.

Life insurance policies vary in underwriting, policy length, coverage levels, and features. While some of these aspects are easy to evaluate on your own, others are not.

Underwriting is perhaps the most difficult to assess on your own. Insurers use underwriting to assess the risk of insuring someone. Certain policies require full underwriting. Others require minimal underwriting.

The level of underwriting can affect your premium rate. Policies with less thorough underwriting (e.g. guaranteed issue policies) usually have higher premiums than those that have more thorough underwriting (e.g. fully underwritten policies).

You'll also want to pay attention to how the insurer underwrites certain conditions. With life insurance, some insurers underwrite certain conditions more favorably than competitors. Working with a trusted life insurance agent or agency can help you find a good policy with the most favorable underwriting.

For example, Quotacy's agents anonymously shop your policy with multiple insurers to find the best policy fit for your needs, including the most favorable underwriting.

2. You can layer term life insurance policies.

"One thing I wish I had known before buying a life insurance policy is that you can layer fixed term policies, and this helps to keep your premiums low. Luckily, I found this out in good time." William Taylor, Career Development manager for VelvetJobs.

Your coverage needs can also change over time. If you bought life insurance to cover your mortgage and provide for dependents, you may need less coverage as time passes. Making payments on your home lowers your debt. As your dependents grow up, they probably won't rely on you as much for financial support. You can also prepay funeral expenses, which again reduces the coverage you need.

Although term life insurance is cheaper than permanent life insurance, saving on monthly premiums with layering frees up your monthly budget.

Another option to layering term life insurance policies, is to look into insuretech companies that have developed adjustable policies or policies that automatically adjust coverage over the life of the policy.

Ladder offers adjustable term life insurance policies. With one of these policies, you can decrease your life insurance coverage at any time, which lowers your monthly premium. If needed, you can also apply to increase your coverage. Increasing your coverage generally also increases your monthly premium.

Everyday Life takes a different approach. It offers policies that automatically lower your coverage level over the course of your term policy. Your premium rate also adjusts as your coverage level changes.

3. You may not have to pay a life insurance premium for the rest of your life.

"There are financed policies. They come with a higher cost but you only contribute for a few years." Jacob Naig, real estate agent and investor.

Term life insurance policies only require premium payment for the term of the policy. However, permanent life insurance policies can require premiums for your lifetime. Luckily, you can find policies with customizable payment plans or pay for a policy with a single lump sum.

Insurers offering these fully paid options for permanent life insurance include New York Life and State Farm.

4. You may find permanent life insurance beneficial.

"I have had Term Life Insurance coverage since I was 27. I am literally 55 years old today…and what I wished I had known was how much 'cash value' I would have been able to accumulate by now had I invested more premium payments up front.

I sincerely wish the two different agents who’d sold me the Term Life policies would have shown me the difference. I am grateful to have the coverage and I’ve essentially 'rented' the Term Life where I would have 'owned' a Universal Life or Whole Life Policy and this additional Asset for my family." John Stellar, Everyone's PR and Stellar Universe, Inc.

The cash value offered by permanent life insurance policies can be accessed without making a claim. For example, you can borrow from it. Keep in mind that the death benefit will be reduced by the cash value amount you haven't paid back. You'll also want to pay attention to your policy's terms to ensure that you don't overborrow from the cash value and lose your policy. Depending on what your insurer offers, you may be able to add an over loan protection rider.

Although permanent life insurance offers nice advantages, it may not be the best fit for every situation. Carefully assess your life insurance needs and budget as you choose between term and permanent life insurance policies. Working with a trusted life insurance agent or financial advisor can help you determine your needs and wants.

Be aware that permanent life insurance policies are usually fully underwritten, so the application and approval process can take longer than other policies. However, if you're looking for an online, quick application process, Vantis Life offers online applications and approval for whole life insurance.

The Top Life Insurance Companies

The Top Life Insurance Companies

Related Articles

Life Insurance

How Much Life Insurance Do Dads Need?: Breaking Down th...

By Guest

June 24th, 2021

Life Insurance

New Parents and Life Insurance: What to Consider

By Guest

May 20th, 2021

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Life Insurance and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy