2021 Review: Quotacy vs. Policygenius [Infographic]

Topics:

buying life insuranceUpdated February 2021.

Independent life insurance agencies or brokers are advantageous because they allow shoppers to find and compare life insurance premiums on similar policies from different companies. This feature simplifies the shopping process because clients do not have to work with multiple companies to learn about their coverage options.

Policygenius and Quotacy both offer assistance comparing life insurance policies from multiple insurers. While the two companies are similar, here are a few differences:

- Customer ratings and reviews

- Scope of offerings

- Staff and client services

- Quote process

- Application process

Customer ratings and reviews

Highlight: Quotacy and Policygenius are highly rated by reviewers.

Both companies have above average ratings for the industry in trust, customer service, quality, and value.

Policygenius is ranked first on Best Company. Its average star rating is 5 stars based on 24 customer reviews.

Customers praise Policygenius's easy and fast process (54 percent of reviews), customer service (50 percent of reviews), low rates (38 percent), and good communication (29 percent of reviews).

Best Company reviewers rate a company's trust, customer service, quality, and value on a 5-star scale. In each of these categories, Policygenius's averages are above the industry averages.

Policygenius scores a 4.9/5 in trust, customer service, and value compared to the industry average of 3.8 in each of these categories. Quality is Policygenius's best score with a perfect 5. The industry average for quality is 3.8.

Reviewers are also very likely to recommend Policygenius. Its net promoter score is 9.6/10.

Although these findings are based on 24 reviews, Policygenius's hard-to-beat ratings make it an attractive choice.

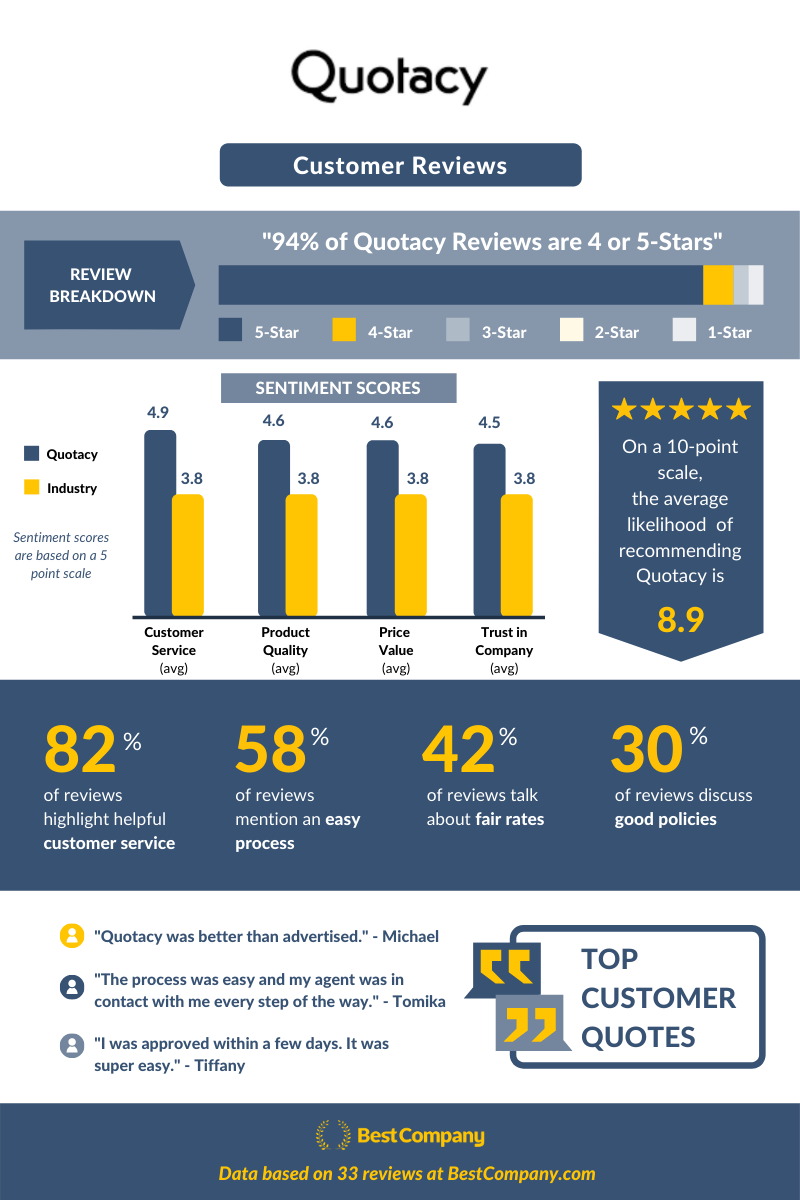

Quotacy is ranked 13 with an average star rating of 4.8 stars based on 33 reviews.

Customers have similar praise for Quotacy as Policygenius. Praise in Quotacy's reviews includes good customer service (82 percent), easy process (58 percent), fair rates (42 percent), and policies that met reviewers' needs (30 percent).

Quotacy's average ratings are also above industry averages but are a tad lower than Policygenius's.

Quotacy scores a 4.6/5 for quality and value compared to the industry average 3.8 for both categories. In trust, Quotacy receives a 4.5 compared to the industry average of 3.8. Customer service is Quotacy's highest score, with a 4.9 compared to the industry average of 3.8.

Reviewers are also likely to recommend Quotacy. Its net promoter score is 8.9/10. Although this is lower than Policygenius's score, it is higher than the average score for the industry: 6.8/10.

While these findings are based on 33 reviews, they show that Quotacy is a competitive option when buying life insurance.

Data as of Feb 9, 2021. Quotacy reviews are primarily from 2018. However, there are a few from 2019 and 2020. Policygenius reviews are from 2020 and 2021.

Scope of offerings

Highlight: Policygenius offers assistance with many types of insurance while Quotacy focuses on life insurance.

You can use Policygenius's platform to buy disability insurance, renters insurance, pet insurance, auto insurance, home insurance, and more. Quotacy offers a complimentary LegacyShield account to its life insurance clients. You can also work with Quotacy to find disability insurance.

Policygenius offers term and whole life insurance policies. Beyond life insurance, it offers disability, renters, pet, auto, homeowners, health, vision, long-term care, jewelry, identity theft, and travel insurance. Individuals can also compare prescription discount cards through Policygenius. This scope of insurance offerings is advantageous for individuals looking for a one-stop shop for all their insurance needs.

Business owners can also use Policygenius to find insurance policies to offer their employees. While specific details about how businesses can use Policygenius are difficult to find online, business owners can benefit from the Policygenius platform to find quality insurance products and good rates to offer their employees.

Quotacy was founded by life insurance experts with industry knowledge and experience. Through Quotacy, individuals can purchase term life insurance, whole life insurance, and disability insurance. While the scope of insurance offerings isn’t as large as those from Policygenius, Quotacy has a high level of industry-specific expertise.

Quotacy also offers its clients a complimentary LegacyShield account with a life insurance purchase. The LegacyShield account can be used to securely store legal and financial documents, like a life insurance policy, will, 401(k), bank account, and social media logins. The account also allows you to record life stories for family and friends or record your wishes for funeral or life celebration arrangements. Access to a LegacyShield account is a nice perk of working with Quotacy.

Both Quotacy and Policygenius work with trusted life insurance companies with high financial stability rankings. This ensures that the products customers purchase through their company are high quality and reliable.

Policygenius is a good option for people looking for a one-stop shop for their insurance needs. It’s also a great resource for business owners looking to find good insurance deals for their employee benefits package.

Quotacy brings a lot of life insurance industry experience and expertise. If you’re only looking for a life insurance or disability insurance policy, Quotacy is an excellent choice.

Staff and client services

Highlight: You can benefit from personal assistance from insurance agents with both companies. Quotacy agents continue to be available for assistance once you're a policyholder.

As you're looking for life insurance policies, you'll benefit from assistance through the process whether you work with Quotacy or Policygenius. Quotacy remains the point of contact after you've purchased a policy if you want to make any changes.

Both Quotacy and Policygenius have licensed life insurance agents available to answer your questions and help you through the quote and application process. Assistance is available through live chat, email, and phone. Quotacy will also communicate via text if that’s what a client prefers.

Quotacy does not upsell its clients to a different kind of life insurance policy. Instead, the Quotacy team focuses on finding the best company match for the client's desired coverage while considering the underwriting process.

Once you purchase a life insurance policy through Quotacy, its team is still available to help you. If you want to make changes or have questions, you don’t have to reach out directly to your life insurance carrier. Quotacy will do that for you.

The assistance available to clients throughout the quote and application process is high at Quotacy and Policygenius. Quotacy goes further and offers complete service to its clients. Its services don’t end once you purchase a life insurance policy. This level of service makes it convenient for clients to make changes and ask questions without having to find a new contact with their insurance carrier.

Quote process

Highlight: While taking different approaches, both companies focus on offering realistic quotes.

Policygenius prioritizes getting accurate pricing information from its partnered insurers. When the final price comes, it's typically within $10 of the initial quote. Quotacy also focuses on offering realistic quotes and works with insurers to help you find the best fit.

Before Policygenius offers a life insurance quote, it completes some underwriting. The underwriting process is how life insurance companies determine the insurability of an applicant and determines the monthly premium. Underwriting typically includes a medical questionnaire and can include a medical exam in some cases.

Policygenius requires some health information and contact information before you can receive policy and pricing details. After you submit your information, a Policygenius expert will contact you with more information about quotes, policies, and applying.

Policygenius also works closely with life insurance companies to ensure that the life insurance rates listed on its website are up-to-date. This approach helps ensure that quotes are accurate. Around 80 percent of policies purchased through Policygenius are within $10 of the online quote. The high level of accuracy is especially nice for life insurance shoppers because the value and the cost of the life insurance policy are clear early in the process.

Working through Quotacy, website visitors can get a quick premium estimate for term life insurance policies by providing information about their zip code, age, and gender. After this number is shown, visitors have the option to fill out additional health information to get a more accurate and personalized quote. It’s convenient to see the estimate sooner, rather than filling out a health history form.

If you’re interested in whole life insurance or disability insurance, the process requires a phone conversation. These policies can be more complex, so this difference is understandable.

If you’re just interested in looking at quotes online and don’t have a specific kind of life insurance policy in mind, Quotacy is a good resource. However, both companies offer personal assistance with comparing policies and completing the application process.

Application process

Highlight: Both companies keep their clients' information confidential.

Once you apply for a life insurance policy through Quotacy or Policygenius, your information is protected. With either company, you'll only receive communication from them, not another insurer.

Policygenius does not sell its clients information as leads to life insurance companies. This is nice for consumers because no one enjoys getting sales phone calls that they didn’t sign up for. Policygenius representatives follow up directly with people who submitted an application on their site.

Quotacy’s online quote processes naturally lead into an application. You do not have to fill out the same forms twice. Once you see the available policies and the quotes, you can pick one and apply through the company.

After applying, Quotacy’s life insurance underwriters will look at your application and work with life insurance companies directly to find the best fit for what you want and your situation. Throughout this process, Quotacy agents keep your information anonymous from companies until you decide to buy life insurance.

Everyone has different health circumstances and life needs. Some companies are better in some situations than others. For example, diabetes affects life insurance premium rates. Some life insurance carriers have better rates for diabetic people.

Quotacy’s holistic approach of finding the best fit for the client without upselling another policy means that clients are better able to find good value in their life insurance policy, not just a good deal.

After clients purchase a policy, Quotacy agents still help clients make changes to their policy and answer questions.

Both companies take care of their clients information. Policygenius and Quotacy work with their clients directly after the application is submitted instead of selling the information to other companies as leads.

Our recommendation

Both Policygenius and Quotacy have high ratings from reviewers on BestCompany.com. Although the review count for both companies makes it difficult to draw firm conclusions, these high ratings are promising.

Beyond reviews, these companies respect their clients information and do not sell it to life insurance companies for lead generation. Whether you use Quotacy or Policygenius, you can trust that you'll only receive calls from Quotacy or Policygenius.

Policygenius ranks first on BestCompany.com, and offers its clients a lot of convenience. It’s a great resource for comparing insurance quotes from multiple companies for many different kinds of insurance.

If you're also looking for other insurance quotes, like health, jewelry, or long-term care insurance, Policygenius offers quotes on more than life insurance coverage. Policygenius is also a great tool for business owners to use. Its quotes are highly accurate as well.

Life Insurance from Policygenius

Learn more about Policygenius by reading customer reviews.

Read Policygenius ReviewsQuotacy’s sole focus is life insurance. Clients can receive estimates and quotes for term life insurance online without providing contact information. You can also contact Quotacy for assistance purchasing whole life insurance. Quotacy agents can also find long-term disability insurance quotes. It keeps its clients' information anonymous as it works with life insurance carriers to find the best fit and best rate for a client’s situation.

Quotacy agents also continue to offer customer support to clients after they have purchased a life policy. If a client wants to make changes or has questions, Quotacy agents will answer questions and help make changes.

Quotacy also offers its clients a free LegacyShield account that they can use to store legal and financial documents so that they are easy for their beneficiaries, family members, and friends to locate.

While both companies are great options for buying life insurance, Quotacy brings a higher level of industry knowledge and the convenience of online quotes. The insurance agency also takes good care of its clients by offering a LegacyShield account and helping clients even after they have purchased a policy.

Life Insurance from Quotacy

Learn more about Quotacy by reading customer reviews.

Read Quotacy ReviewsThe Top Life Insurance Companies

The Top Life Insurance Companies

Related Articles

Life Insurance

How Much Life Insurance Do Dads Need?: Breaking Down th...

By Guest

June 24th, 2021

Life Insurance

New Parents and Life Insurance: What to Consider

By Guest

May 20th, 2021

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Life Insurance and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy