Short-Term Health Insurance: What Top Companies Offer

Topics:

health insurance guidesShort-term health plans can be a good option if you need coverage before your health plan kicks in or if you missed the enrollment period. These plans usually have cheap premiums, but their coverage is also more limited compared to more traditional health plans.

Short-term health insurance offers the most basic health coverage. It helps with doctor visits, diagnostic tests, and emergency services. These plans are not compliant with the Affordable Care Act. Pre-existing conditions are not covered with these plans.

For more information and expert insight on short-term insurance plans, read part one of this series: Short-Term Health Insurance: What You Need to Know.

Not all health insurers offer short-term health plans. Only two of Best Company’s top 10 health insurers offer short-term plans. However, there are a few other companies worth considering. We'll review what the following companies offer:

Note: Screenshot headings are from April 28, 2020.

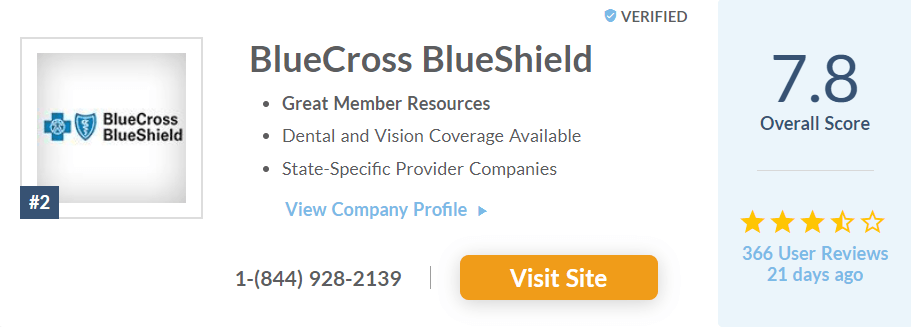

BlueCross BlueShield

BlueCross BlueShield is ranked number two on Best Company. It has earned an overall score of 7.8/10 and a user star rating of 3.6/5. BlueCross BlueShield’s offers short-term health plans through some of its subsidiaries. You’ll need to check with your local subsidiary to see what’s available in your area.

For example, BlueCross BlueShield of South Carolina offers short-term plans called Blue TermSM. These plans do not cover pre-existing conditions. They also only offer coverage for visiting in-network providers.

You can customize your Blue TermSM plan by choosing the length of time you want covered. You’ll find several plan options for each specified length of time with varying premiums, deductibles, and out-of-pocket maximums. The cost-sharing rules (e.g. coinsurance) also varies by plan.

BlueCross BlueShield Customer Reviews

Learn more about BlueCross BlueShield by reading customer reviews.

Read Reviews

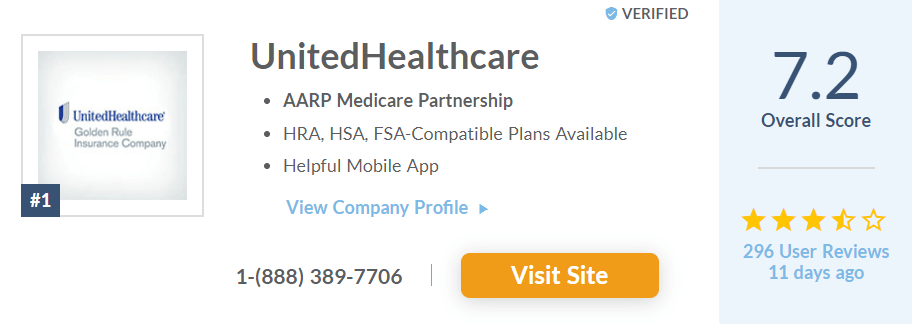

UnitedHealthcare

UnitedHealthcare is ranked number six on Best Company. It has an overall score of 7.2/10 and a user star rating of 3.1/5. UnitedHealthcare offers two kinds of short-term health insurance plans: Short Term and Enhanced Short Term. These plans can last 30 days to close to a year. Plans are not guaranteed issue plans, so you'll need to go through underwriting for approval.

These plans offer coverage for doctor visits, ER care, hospitalizations, labs, and may offer some coverage for prescriptions

The Short Term plan is available in 27 states, including Florida, Illinois, and Texas.

While there is variability by state, UnitedHealthcare offers three different lifetime maximum benefits that each have a few plan options in a majority of these states. The per-person lifetime maximum benefit amounts are $250,000, $600,000, and $2,000,000.

Each option offers choices for the deductible amount. Some also offer coinsurance choices. The level of customization and flexibility is a nice feature of these plans.

The Enhanced Short Term plan is available in 19 states, also including Florida, Illinois, and Texas.

These plans also vary by state. However, offerings in a majority of states are the Plus Elite, Copay/Direct, Plus/Direct, and Value/Direct plans. Each plan’s cost-sharing rules differ, which allows you to choose what matters most to them in cost sharing. If you prefer lower premiums, you can choose a plan with higher out-of-pocket costs. You can also choose a plan based on how you want to control your out-of-pocket expenses. Some of these plan structures are only available for specific lifetime maximum benefit amounts.

Plus Elite, Copay/Direct, and Value/Direct plans are available with the $500,000 per-person lifetime maximum benefit plans. These plans allow you to choose your deductible amount.

Plus Elite, Copay, Plus, and Value plans are available with a $2,000,000 per-person lifetime maximum benefit. These plans also allow policyholders to choose their deductible.

UnitedHealthcare Customer Reviews

Learn more about UnitedHealthcare by reading customer reviews.

Read Reviews

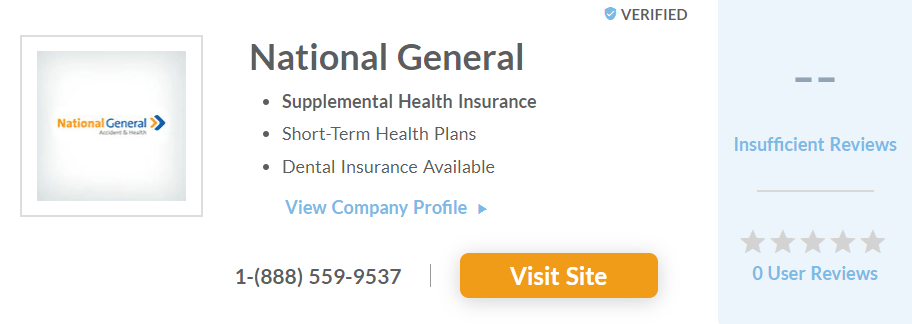

National General

National General has yet to earn a rank on Best Company because there aren't enough reviews to give a score. National General offers short-term plans with Aetna and Cigna PPO networks. Aetna network plans are available in 32 states and Washington, D.C. Cigna PPO network plans are available in 17 states.

Plan features vary by state and network chosen. However, I’ll briefly review the options available in the majority of states for both networks.

Both Cigna PPO and Aetna PPO network plans include LIFE Associate Membership, which gives you access to telemedicine, pharmacy discount card, negotiators for hospital bills, and wellness perks.

Both also offer options to buy renewable plans or consecutive plans. These options may not be available in every state.

With the renewable option, you can have some costs covered for pre-existing conditions after the first 12 months. Your deductible and coinsurance reset with each new coverage period, but the maximum benefit does not. If you'd like to lock in your premium rates, you can, but it's not a standard part of the renewable option. With this option you can buy three years of coverage.

Buying consecutive plans is similar to the renewable option. The differences are that there is no guaranteed rate option, the maximum benefit resets each period, and you can buy two years of coverage.

Plans with Cigna PPO network

National General offers two plan options with the Cigna PPO network: Enhanced PPO and Copay PPO. Each option offers different deductible amounts and cost-sharing structures.

The maximum benefit, referred to as the coverage period maximum, is $1,000,000 for the Enhanced PPO plans and $5,000,000 for the Copay Enhanced PPO plans.

Plans with Aetna PPO network

Plans and plan availability varies by state. In a majority of states, National General offers four plans:

- Essentials PPO

- Enhanced PPO

- Copay Enhanced PPO

- Guaranteed Issue PPO

Each of these plans have different coverage period maximums: $250,000, $1,000,000, $5,000,000, and $100,000 respectively.

Once you've chosen the kind of plan that best suits your needs, you can choose from available deductible and cost-sharing structure options.

The IHC Group

The IHC Group has yet to be reviewed by customers, so it does not currently have a score on Best Company.

When you visit IHC Group’s website and decide to shop for short-term health plans, you can click on a link that directs you to healthedeals.com. There you can get quotes on short-term health plans. You can filter your quotes by how frequently you want to pay the premium (all at once or monthly) and how long you’d like to have coverage.

Plans vary by area, so it’s best to research options on your own.

Think Short-Term Health Insurance Is a Good Fit?

Learn more about short-term health plans by looking at the top-rated companies and their customer reviews.

Learn MoreThe Top Health Insurance Companies

The Top Health Insurance Companies

Related Articles

Health Insurance

Pharmacogenomic Testing 101: DNA Testing Essentials You...

Health Insurance

12 Things to Consider Before Taking a DTC Genetic Healt...

Health Insurance

The Truth Behind Dieting

By Best Company Editorial Team

July 22nd, 2022

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Health Insurance and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy