5 Things to Look For in a Prescription Drug Plan

If you opted for Medicare Part A and Part B, you don't have coverage for prescriptions. Fortunately, you can purchase a separate plan from a private insurer to cover your medications.

If you delay enrollment in a prescription drug plan or lapse in coverage, you'll be charged higher premiums for the delay. If you anticipate needing medications in the future, it can be smart to buy and maintain a plan sooner rather than later.

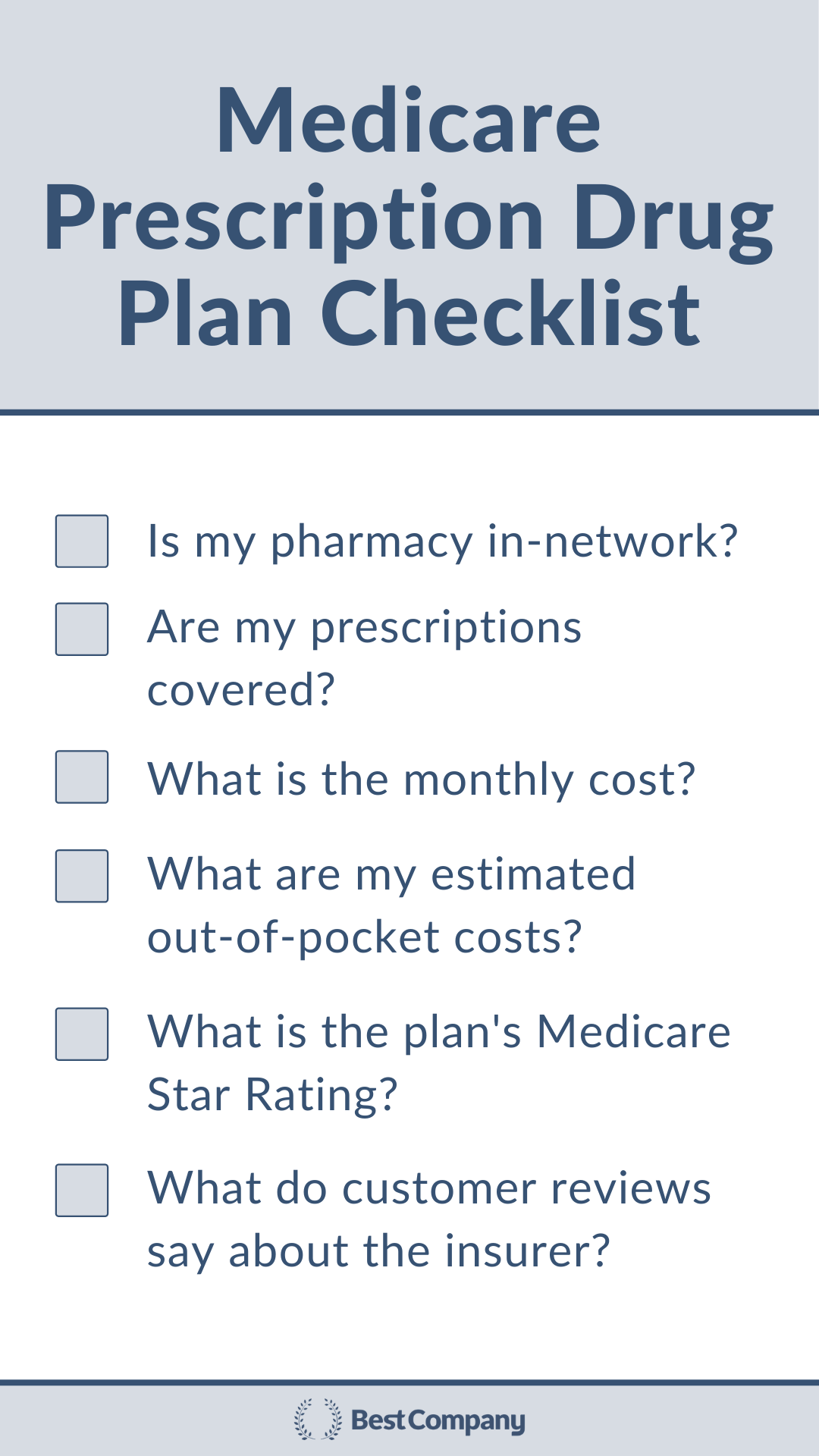

As you look for the best fit, here are five things to evaluate before choosing a prescription drug plan:

- Pharmacy Network

- Drug Formulary

- Cost

- Medicare Star Ratings

- Customer Reviews

1. Pharmacy Network

Prescription drug plans have pharmacy networks. Be sure that there's an in-network pharmacy in your area before you buy a plan. If you fill prescriptions out-of-network, you may not have coverage for your medications.

Generally, prescription drug plans also cover mail delivery. Opting into this service makes getting your medications convenient and saves you a trip to the pharmacy.

"Coverage for mail delivery of prescription drugs has become an important plan feature in 2020 with the elevated risks of going inside a pharmacy due to potential COVID-19 exposure," says Christian Worstell, licensed health insurance agent.

2. Drug Formulary

Checking the drug formulary is perhaps the most important part of evaluating a prescription drug plan. The drug formulary is the list of medications that your plan covers, so you need to check to see if your medications are covered by the plan.

"To make this process easier, write down a list of your drugs that you use regularly or ones that you may need if you have a medical episode. Also, consider any potential changes in your health this year that may require medication next year.

- Drug Name

- Dosage (750 mg, 1 mcg, etc.)

- Frequency (2 times per day for 30 days = 60 pills per month)

- Optional — Why do you take this medication?

- Optional — Which doctor prescribed this medication?

Keep this list in a safe place and try to remember to update it when your meds change. This is also useful for a family member should you need help picking up or managing your medications," says Bethanie Nonami of Real Talk Medicare.

Multiple medications treat the same illness or symptom. Medicare categorizes medications based on what they treat. Plans are not required to cover every drug that treats a diagnosis, but must cover at least two of those medications.

"Every year, Medicare defines a list of covered drugs. But every plan doesn’t offer every drug that is available to us or approved by Medicare. Every year the list of formularies change.

You should do your due diligence to verify with your plan or proposed plan for 2021, if your drugs are covered," says Nonami.

If you have prescriptions that are working for you, you'll want to be sure that your prescription drug plan covers these specific medications.

Even if you plan to keep your current prescription drug plan during an Annual Election Period, double-check the formulary because the drug list can change.

"You can search online to verify the Formularies that your Medicare Insurance plan covers. The Formulary List is a list of what drugs are covered. This comprehensive list that often breaks the drugs out by Tiers, Drug Dosages, Requirements, and Limits. Your insurance company has their own version of a Formulary List, which may also be called a Prescription Drug List (PDL). In fact, many insurance companies have multiple Formulary Lists.

Before you look for your drugs triple check the Formulary List for two critical components:

- First, make sure you are looking at the PDL for the next plan year of 2021, not the current year.

- Second, please make sure that you are viewing PDL for your plan for your state. Plans, coverages, and limitations may vary by state," says Nonami.

If there are prescriptions that are not covered by your plan that you'd like to have covered, you can look for another plan or work through your plan's prior authorization for step therapy.

You may have to start with a less expensive, generic medication to see if it's effective first. Your doctor can also work with your insurer for an exception to allow you to start directly with the more expensive medication with coverage if the generic one would cause adverse health effects or if it's medically necessary to start with the more expensive drug.

3. Cost

Aside from evaluating the monthly premiums, you also need to consider the out-of-pocket costs. Medications are categorized in tiers, and each tier has different cost-sharing rules. Look for how your prescriptions are categorized under your plan and project your out-of-pocket costs for your medications.

"Do you prefer a higher monthly premium in exchange for a lower deductible or cost-sharing? Or would you rather pay less upfront per month but pay a little more for each prescription? There's no universal right or wrong and each plan shopper should ask themselves how they would most prefer to spend their money," says Worstell.

You'll also need to consider the coverage gap. Your plan has limits on the amount it contributes to your prescriptions. When the insurer has reached its limit, you'll be charged higher copays for your medications until the gap is closed.

4. Medicare Star Ratings

The Centers for Medicare & Medicaid Services rate Medicare prescription drug plans each year. These ratings score the quality of prescription drug plans by considering clinical recommendations and plan member feedback. Five is the highest rating. New plans are not rated.

"Plan quality should not be ignored either. Each year, plans are rated on a scale of one to five stars for quality and customer experience. Shoppers should pay attention to a plan's rating before buying," says Worstell.

5. Customer Reviews

Customer reviews also offer insight into the customer experience with Medicare prescription drug plans. While reviews are sorted by company, reading reviews can help you understand how an insurer treats its Medicare plan members.

Pay attention to what plan reviewers mention. Private insurers offer Medicare Advantage, prescription drug, and Medicare supplement (Medigap) insurance plans. Weigh what reviewers writing about prescription drug plans say over what Medicare Advantage or Medigap members say.

Note what year the reviews are from. Prescription drug plans can change, so the most recent reviews are the most helpful, even though the plans may change each year.

You can trust the reviews on Best Company because we do not repress reviews. All reviews that pass our verification process are published — positive or negative. Our verification process helps prevent the publication of fake reviews.

Medicare Customer Reviews

Learn more about Medicare companies by looking at the customer ratings and reviews.

Learn MoreThe Top Medicare Providers Companies

The Top Medicare Providers Companies

Related Articles

Medicare Providers

80% of Medicare Beneficiaries Are Unaware of This Costl...

By Guest

November 4th, 2021

Medicare Providers

What to Know Before the Fall Open Enrollment Period

By Guest

September 19th, 2021

Medicare Providers

Medicare Coverage While Traveling

By Guest

August 26th, 2021

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Medicare Providers and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy