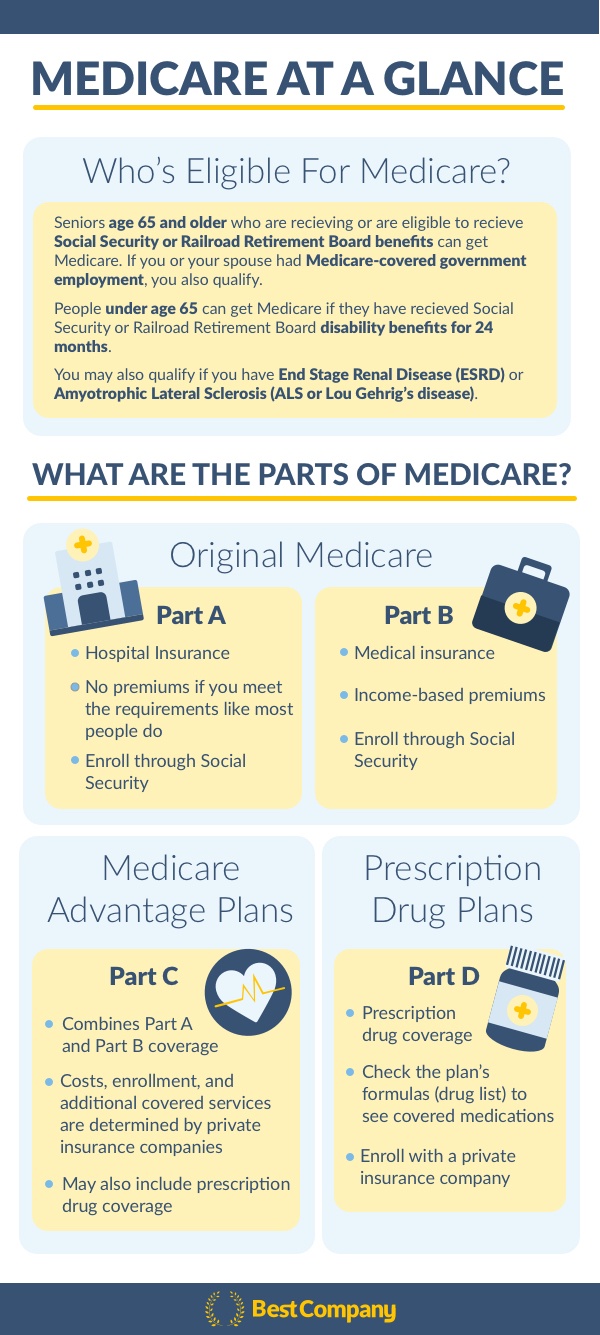

What Are the Parts of Medicare? [Infographic]

You're 65 years old. You've lived a long life, and hopefully, you're getting ready for retirement.

One important part of transitioning to senior life is enrolling in Medicare. Medicare is the government program that offers health insurance to people over age 65. Medicare also offers coverage to people under 65 who have received disability benefits from Social Security or have been diagnosed with End Stage Renal Disease (ERSD) or Amyotrophic Lateral Sclerosis (ALS).

Whatever your reason for seeking Medicare coverage, you need to become familiar with how Medicare's processes and plans work. They function a little differently than the kind of health insurance plans you may be used to.

Whatever your current understanding of health insurance, it’s important to understand the parts of Medicare, what they cover, and how to enroll as you transition into your golden years.

It's hard to fully summarize Medicare in one infographic. Medicare can be complex because it has several different parts that each work differently. The plan that makes the most sense for someone else may not make sense for you. Understanding how Medicare works will help you identify plans that work best for your situation.

For more details on Medicare's history, eligibility requirements, and each part's coverage, cost, and enrollment process, click on the icons or text in the menu below.

(If you're interested in learning more about Medicare Supplement Insurance (Medigap), check out "5 Questions to Ask About Medigap." Keep in mind that Medigap is only available with Original Medicare.)

History of Medicare

Medicare is a fairly recent federal health insurance plan. It was instituted in 1965. In its initial phase, Medicare only had two parts: Part A and Part B. Part A was hospital insurance. Part B was medical insurance. These two parts remain part of Medicare. They are sometimes referred to as Original Medicare or Traditional Medicare.

Part C and Part D were added to Medicare in 2003 with the Medicare Prescription Drug Improvement and Modernization Act (MMA). Part C is a Medicare plan option that offers the same coverage that Original Medicare does in one plan that is administered by a private company. Medicare Advantage plans are not under contract with Medicare, but Medicare must approve the plans.

Part D was first offered in 2006. It offers coverage for prescription drugs. It can be purchased by anyone with any part of Medicare, although some Medicare Advantage plans include prescription drug coverage. If your Medicare Advantage plan includes creditable prescription drug coverage, you are not eligible for Part D.

Eligibility and coverage

Medicare offers coverage to seniors age 65 and older. It also provides benefits to those younger than 65 in some cases.

If you’re 65 years old or older, you or your spouse must be receiving or be eligible for Social Security or Railroad Retirement Board benefits. Alternatively, you or your spouse must have had Medicare-covered government employment to qualify.

If you’re younger than 65 and have received Social Security or Railroad Board disability benefits, you may also be able to enroll in Medicare. You can also enroll in Medicare if you have End Stage Renal Disease (ERSD) or Amyotrophic Lateral Sclerosis (ALS) and meet certain additional requirements.

Use Medicare.gov’s online eligibility calculator to check eligibility and estimate premium costs.

The services Medicare covers is set by federal and state laws. Coverage decisions are also made by local companies that process Medicare claims.

Part A

Coverage

Part A is hospital insurance. It covers medically necessary stays in the hospital and skilled nursing facilities, but not long-term or custodial care in a skilled nursing facility. It also covers hospice and some kinds of home health care, like physical and occupational therapy.

Cost

If you or your spouse have been employed and paid Medicare taxes for at least 10 years, you do not have to pay a premium for Part A. You also must be receiving or be eligible to receive Social Security or Railroad Retirement Board benefits. Medicare-covered government employment also counts.

If you’re under 65, you may also be eligible if you’ve received Social Security or Railroad Retirement Board disability benefits for 24 months or have End Stage Renal Disease (ERSD) and meet other requirements to not be charged a premium.

If you have to pay monthly premiums, there is a cap on the cost of Part A premiums. However, if you’ve worked and paid Medicare taxes for seven and a half to nine and three quarters years, you’d be charged less.

Deductibles and premiums change year to year, so that’s something to watch.

For example, the Part A deductible was $1,364 in 2019. Coinsurance amounts for hospital stays start after that (nothing for first 60 days; $341 per day for days 61–90; $682 day 91 and over up to 60 days).

Enrollment

Sometimes enrollment is automatic, but is managed through the Social Security office since many of the eligibility requirements are tied to receiving Social Security benefits. The enrollment process for Part A is automatic if you’re over 65 and receive Social Security benefits.

If you won’t start getting Social Security benefits until after you turn 65, you’ll have to enroll yourself. You can apply online, over the phone, or in person.

Part B

Coverage

Part B is medical insurance that covers medically necessary treatment, outpatient services, and preventive care. It also covers some prescriptions, mental health care, and ambulance services. If you need Durable Medical Equipment, like a walker, crutches, blood sugar monitors, and oxygen equipment, Part B covers that as well.

Medicare doesn’t cover all health-related services, like long-term care, hearing aids, dentures, and acupuncture. For more information, check with Medicare directly to see if a health service is covered.

Cost

Part B premiums are automatically deducted from your Social Security, Railroad Retirement Board, or Office of Personnel Management benefits payments. Monthly premium amounts are based on your income from two years ago and also vary year to year.

The annual deductible is fairly low. For example, it was $185 in 2019. Once the deductible is met, you are responsible for a 20 percent copay.

If you don’t enroll in Part B when you’re first eligible, a late enrollment penalty is typically assessed on the monthly premium. The penalty is determined based on how many 12–month periods you’ve gone without Part B. The premiums can increase by 10 percent per 12–month period.

However, there are circumstances that allow people to enroll in Part B without the late enrollment penalty outside of the Initial Enrollment Period. For more details, you should contact Medicare directly.

Enrollment

To enroll in Part B, you must work with the Social Security Office and submit the Application for Enrollment Part B (CMS-40B). Before you can get Part B, you must also have Part A.

Part C

Coverage

Medicare Part C offers both medical and hospital insurance under one plan. Part C health plans are also referred to as Medicare Advantage plans. These plans are managed by private companies and are considered the private option for Medicare. While Medicare Advantage Plans must cover the same things that Original Medicare does, the out-of-pocket costs, premiums, and network structures vary plan to plan.

Medicare Advantage plans offer additional perks, like hearing aid discounts, dental coverage, vision coverage, and fitness memberships. These additional coverage options can vary by plan, so be sure to read through and understand what is included with a Medicare Advantage plan before enrolling.

Some Medicare Advantage plans, typically HMO and PPO plans, also offer good prescription drug coverage. If you have one of these plans and enroll in a Prescription Drug Plan (PDP), you will be disenrolled from your Medicare Advantage plan and enrolled in Original Medicare.

Medicare Advantage plans also differ from Original Medicare because they work more like traditional health plans with networks of physicians. There are also more plan–type options, including Private Fee-For-Service (PFFS) plans and Medical Savings Account (MSA) plans. MSAs are high-deductible health plans with a medical savings account that can be used to pay for medical services.

There are also specialized Medicare Advantage Plans that are geared for people with chronic conditions or people who also qualify for Medicaid. These plans are called Special Needs Plans (SNPs).

Cost

The monthly premiums and out-of-pocket costs of a Medicare Advantage plan differ health plan to health plan. Carefully analyze each health plan you consider to be sure that it meets your medical and financial needs. Take the out-of-pocket expenses and premiums into account when making your decision.

Enrollment

You must enroll in Part C with an insurance company. You also need to review your plan each year during Medicare Annual Enrollment because companies can make changes annually. Some Medicare Advantage plans may be discontinued year to year, so it’s a good idea to review your coverage during this period. If you're happy with your plan, you don't need to re-enroll during the Medicare Annual Enrollment Period.

When you’re first enrolling in Medicare, weigh your options carefully as you choose between Parts A and B and Part C. It can be a good idea to work with a licensed insurance agent to help you through the enrollment process. If you have other medical insurance from another source, check to see how enrolling in Medicare would affect that coverage.

If you enrolled in a Medicare Advantage HMO or PPO and enroll in a Part D plan, you’ll automatically be disenrolled from Medicare Advantage and enrolled in Original Medicare. Medigap policies are also not applicable for Medicare Advantage plans.

Part D

Coverage

Medicare Part D offers coverage for prescription drugs. These plans are also called Prescription Drug Plans (PDPs). While these plans are also managed by private insurance companies, they must meet a standard level of coverage determined by Medicare.

Each plan has a drug list called a formulary that lists the drugs it covers and how drugs are classified into tiers. Each drug tier has a different level of cost-sharing. The cost-sharing for prescriptions is based on the drug’s tier.

On a higher level, drugs are also categorized by type. While there may be several drugs that treat a condition, a drug plan would only have to cover two of them. Some plans may not cover the exact medication you take, but they will cover at least two alternatives that you can try. If you need a specific medication, make sure that it’s included in your prescription drug plan.

Drug formularies can change year-to-year, they can also change during the year. If your plan changes the drugs it covers, you must be given written notice at least 30 days before the change’s effective date or at the time you request a refill, provide written notice of the change and at least a month’s supply under the same plan rules as before the change.

If this happens you can also request an exception or try a new drug.

Cost

Like most health insurance plans, Prescription Drug Plans (PDPs) have monthly premiums and cost-sharing rules. These costs will vary based on the plan you choose.

Some Part D plans don’t have a deductible. There are limits to how high a Part D deductible can be. For example, it was $415 in 2019.

Premiums

If you do not have prescription drug coverage for a continuous 63 days or more once your initial enrollment period ends, you will have a late enrollment penalty fee assessed on your coverage.

The late enrollment penalty fee increases your monthly premium by one percent for every month you were without prescription drug coverage. As monthly premiums can change year-to-year, so can your penalty because it is based on a certain percentage of your premium.

If a penalty is assessed, you can appeal it by applying for a reconsideration decision. In some cases, the penalty may be removed entirely or reduced.

To avoid this penalty, it’s a good idea to make sure that you have qualifying prescription drug coverage when you complete your Medicare initial enrollment.

Coverage gaps

One feature of Part D plans is that there can be coverage gaps. Coverage gaps are when the insurance company has hit the plan’s limit for what it pays in cost-sharing. Until the coverage gap is closed, you will have higher out-of-pocket costs for your medications.

Typically, you will pay an additional amount of coinsurance or a certain percentage of what the insurance company typically pays under the plan.

For brand name medications, the annual deductible, coinsurance, copayments, and discounts count towards closing the coverage gap.

For generic medications, the copay and coinsurance are typically counted towards closing the coverage gap.

Once you’ve closed the coverage gap, you’ll still have to make some coinsurance or copay payments. This is referred to as catastrophic coverage. There are limits on what you’d have to pay out-of-pocket for this catastrophic coverage. These limits can change annually and may vary by plan, so be sure to talk to an agent and understand your plan before enrolling.

Enrollment

While you do want to make sure that you avoid the late enrollment penalty, it’s important to understand how enrolling in a Prescription Drug plan would affect your other health insurance.

For example, if you have coverage through Medicaid, COBRA, HUD, or something else, ask how enrolling in a PDP would affect your current coverage and make sure that your current health insurance would count as qualifying prescription drug coverage.

These plans are offered by private insurance companies. To view Part D plan options and enroll, you can use the Medicare Plan Finder on Medicare.gov or work directly with a carrier.

The Top Medicare Providers Companies

The Top Medicare Providers Companies

Related Articles

Medicare Providers

80% of Medicare Beneficiaries Are Unaware of This Costl...

By Guest

November 4th, 2021

Medicare Providers

What to Know Before the Fall Open Enrollment Period

By Guest

September 19th, 2021

Medicare Providers

Medicare Coverage While Traveling

By Guest

August 26th, 2021

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Medicare Providers and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy