6 Things to Look For in a Medicare Advantage Plan

When you become eligible for Medicare, you have lots of decisions to make. You can opt for Original Medicare, which is managed by the Centers for Medicare & Medicaid Services, or a Medicare Advantage plan offered by a private insurer.

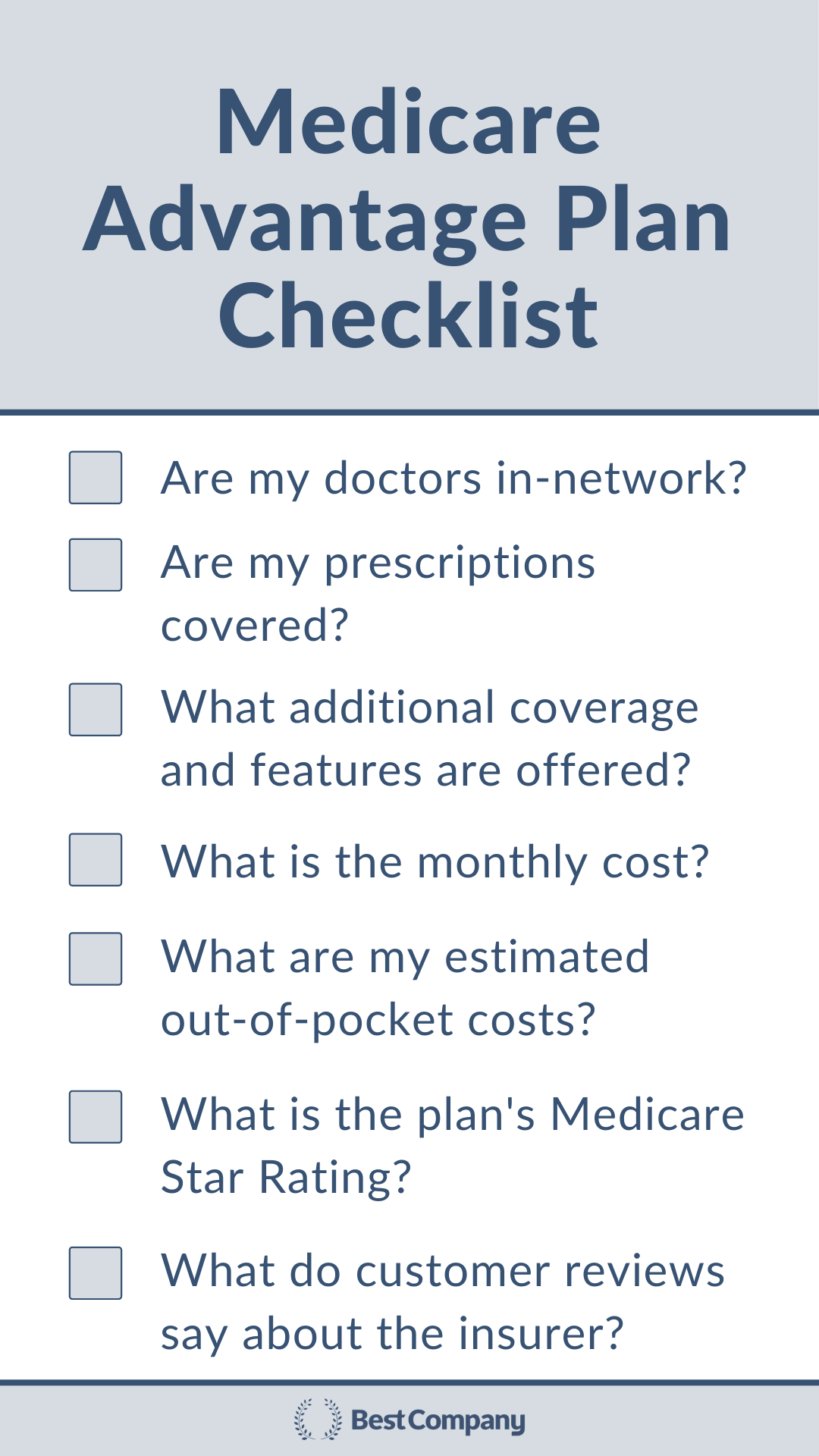

If you're looking for a Medicare Advantage plan — whether it's your first time enrolling in Medicare or you're participating in Medicare's Annual Election Period — here are six things you need to consider before buying in a Medicare Advantage plan:

- Provider Network

- Drug Formulary

- Cost

- Additional Coverage

- Medicare Star Rating

- Customer Reviews

1. Provider Network

Unlike Original Medicare, Medicare Advantage plans have set provider networks. These networks can be specific to your plan and to your area.

"The first and most important factor are networks. You want to make sure your regular doctors accept your plan and your preferred healthcare facilities nearby are also in their network. You should compare PPO and HMO plans to see where you have the best access to care," says Adam Hyers, Hyers and Associates, Inc.

If your Medicare Advantage plan has an Health Maintenance Organization (HMO) network structure, you'll only have insurance coverage when you visit in-network providers.

If you have a Preferred Provider Organization (PPO) network structure, you'll have the flexibility to visit out-of-network providers with higher out-of-pocket costs.

If you're considering a Medicare Advantage plan, be sure to check your provider network to make sure there are doctors in your area who can give you the care you need.

Most insurers offer an online "Find a Provider" tool that allows you to search for doctors in your area that accept your plan. Since networks can change, it's worth reaching out directly to doctor's offices to double-check that they'll continue to accept your plan in 2021 before you enroll in it again.

2. Drug Formulary

Most Medicare Advantage plans include qualifying prescription drug coverage. If your Medicare Advantage plan offers this coverage, you don't need to purchase a separate plan to cover prescriptions.

As you evaluate Medicare Advantage plans, check the drug formulary to make sure that the medications you need are covered. Even if they're covered on your current plan, they may not be covered for 2021.

If there's a medication that you think may work better than your current medication, you should also look for that drug to be listed on the formulary and how cost-sharing works.

"Some Medicare Advantage plans will give you better pricing on your prescriptions than others. All other things being nearly equal, prescription costs can be a differentiating factor," says Hyers.

In addition to checking that your medications are listed on your plan's formulary, you should also pay attention to what tier they fall under. Each tier has different cost-sharing rules. Some tiers have higher out-of-pocket costs. Understanding how your drugs are categorized will help you anticipate costs.

The insurance company should provide you with the drug formulary before you enroll in a plan. You may be able to find it online as you learn about plans online.

3. Cost

As you look at Medicare Advantage plans, you'll want to consider the out-of-pocket costs and any monthly premium amounts you'll have.

"Many Medicare Advantage plans these days are offering a $0 premium, so the deductible and copayments or coinsurance requirements are deserving of a closer look," says Christian Worstell, licensed insurance agent.

Low monthly premiums are especially friendly when you're on a fixed income dealing with a rising cost of living.

"Before you enroll in an Advantage plan, it’s important to understand why these plans have low to zero dollar premiums. They come with many additional out of pocket costs in the form of copays, deductibles, and coinsurance. Medicare pays the Advantage carrier around $1,000 per month to take on your risk. Then they collect cost-sharing from the beneficiary as they use the benefits," says Lindsay Engle, Medicare expert.

Knowing that you'll likely be taking more responsibility out-of-pocket for your care, project your prescription and medical services costs based on what you predict you'll need.

Consider the copays or coinsurance, the annual deductible, and out-of-pocket maximum. Understanding these costs will help you find a plan that will protect your budget and meet your needs in the long-run.

4. Additional Features

Medicare Advantage plans are required to cover the same services that Medicare does. With prescriptions, Medicare groups similar medications and plans have to cover at least one drug per group.

Medicare Advantage plans often include additional coverage. Some plans offer some dental, vision, and hearing coverage. Medicare Advantage programs may also include fitness programs, access to telemedicine, and other features.

Keep in mind that the additional coverage offered by Medicare Advantage may not be as robust as choosing a separate dental or vision plan. However, the additional coverage and features can be nice perks of choosing a Medicare Advantage plan.

Some Medicare Advantage plans are Special Needs plans. These plans are tailored to meet the specific needs like dual eligibility for Medicare and Medicaid or chronic illness. If you have specific needs, looking into a Special Needs plan may be beneficial.

5. Medicare Star Rating

The Centers for Medicare & Medicaid Services (CMS) rates Medicare Advantage plans annually for the quality of their services. These ratings consider clinical recommendations and plan member feedback. These quality ratings can help you understand the care quality offered through Medicare Advantage plans.

New Medicare Advantage plans are not rated.

6. Customer Reviews

Customer reviews can also help you evaluate how well insurers treat their members. Each member's experience will vary based on their personal needs, location, and plan; however, reviews can also help you gauge the quality offered by an insurance company.

You can trust reviews posted on Best Company because we have a verification process to ensure that reviews are left by real people. We also don't suppress reviews, so you can get an unfiltered understanding of the customer experience with insurers.

As you read customer reviews, pay attention to what reviewers say about their plan. Private insurers offer Medicare Advantage, prescription drug, and Medigap plans. Give more weight to reviewers that have a similar plan to the one you're looking for. This will help you get a better sense of how good the plans you need are from the insurer.

Medicare Customer Reviews

Learn more about Medicare companies by looking at the customer ratings and reviews.

Learn MoreThe Top Medicare Providers Companies

The Top Medicare Providers Companies

Related Articles

Medicare Providers

80% of Medicare Beneficiaries Are Unaware of This Costl...

By Guest

November 4th, 2021

Medicare Providers

What to Know Before the Fall Open Enrollment Period

By Guest

September 19th, 2021

Medicare Providers

Medicare Coverage While Traveling

By Guest

August 26th, 2021

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Medicare Providers and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy