What Health Insurers Are Doing Right: 2020's Customer Reviews

Topics:

research2020 brought the importance of health insurance and health care access into sharp relief as we followed implications of the COVID-19 pandemic.

It also heightened the importance of the customer experience in client retention as companies adjusted operations along COVID-19 guidelines.

Regardless of industry, customer reviews play an important role in understanding what clients want.

We analyzed health insurance customer reviews received in 2020 to understand more about what matters to health insurance plan members.

Key Takeaway: Health insurers can improve the customer experience in 2021 by focusing on the areas listed below.

- Customer service

- Coverage options

- Provider networks

- Claims processing

- Affordability

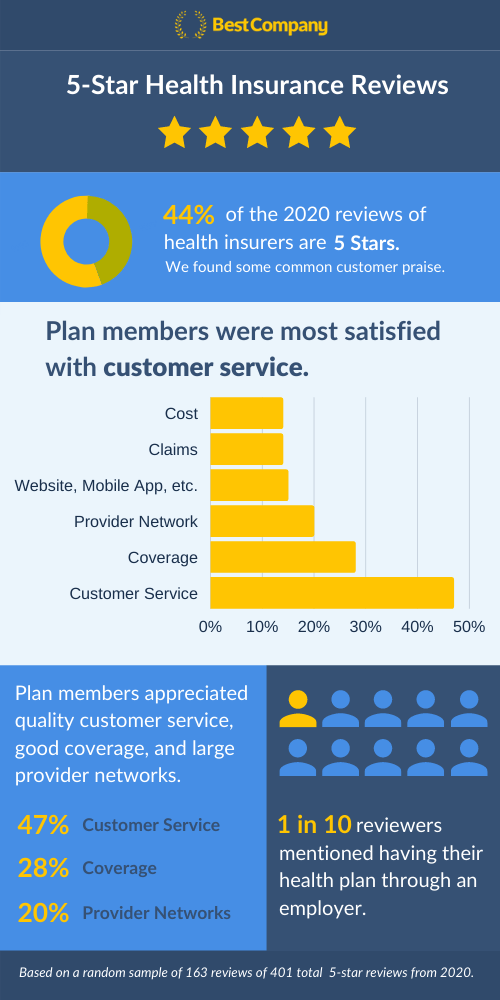

2020 Customer Review Breakdown

Best Company received 905 total reviews for the health insurance industry in 2020, slightly below 2019's 1066 total reviews. (Read the full 2019 report.)

Here's how 2020's review star ratings came out:

- 44 percent 5-star (compared to 28 percent in 2019)

- 21 percent 4-star (compared to 18 percent in 2019)

- 6 percent 3-star (compared to 8 percent in 2019)

- 5 percent 2-star (compared to 5 percent in 2019)

- 24 percent 1-star (compared to 41 percent in 2019)

The biggest difference between 2019 and 2020 reviews is the increase in 5-star reviews and the decrease in 1-star reviews. This change in review data makes the health insurance industry more hopeful than last year: 65 percent 4-star and 5-star reviews in 2020 versus 46 percent 4-star and 5-star reviews in 2019.

These differences in review percentages may indicate that health insurers are doing a better job when providing services. However, we only have two years of similar analyses. Until we have more data, whether health insurers responded to 2019's complaints is uncertain. It's also unlikely considering the more pressing issues of responding to COVID-19.

5-star review analysis

Since the largest proportion of 2020's reviews are 5 stars, we dug deeper to understand what plan members value about their experience:

- 47 percent mentioned good customer service

- 28 percent discussed coverage satisfaction

- 20 percent talked about provider networks positively

- 15 percent mentioned positive user experience with the insurer's platforms

- 14 percent of reviewers were happy with claims

- 14 percent of reviewers discussed cost satisfaction

- 7 percent of reviewers mentioned affordable out-of-pocket costs (counted separately from general cost satisfaction)

Interestingly, 9 percent of 5-star reviewers mentioned being on a health plan through an employer.

Customer service

When you have a question or need to resolve something with a company, good customer service makes a big difference.

Our data analysis found that praise for customer service included short wait times, quick response times, and knowledgeable representatives. Health insurers can continue to deliver high quality customer service by focusing on these aspects.

Coverage

You buy health insurance for the coverage, so good coverage is important. With health insurance, it's key to balance cost and coverage. Health insurers can make it easier to find good coverage that fits your price point by offering a variety of health plans.

In customer reviews, reviewers liked having a variety of coverage options. Adjectives describing coverage also included "excellent" and "great."

Customer Review: Nathan from Broomfield, Colorado

"I have always been impressed with the quality and quantity of coverage I have gotten from Blue Cross Blue Shield. They have helped me get through some very trying times and pay for my medication!"

Provider network

The third most frequent praise was about provider networks. Reviewers mentioned either their plan's wide acceptance or praised the quality of their care providers and facilities.

Finding a doctor you trust that provides good care matters. Large provider networks make it easier to find a good in-network, which helps you keep your out-of-pocket costs down.

Platforms

Reviewers also appreciated how easy their insurer's platforms were to use. These included the company's website, online member portal for tracking claims, tools for finding providers, and the mobile app.

Customer Review: Rahim Sabadia from Yorba Linda, California

"Excellent overall care. Very responsive and their online platform and tools make it very easy to keep track of appointments, lab results and communications with health care providers."

Telemedicine is also included in this category because it can be accessed through platforms connected with an insurer.

Platform interfaces and ease-of-use mattered even more in 2020 as we did more things remotely.

Cost

The cost satisfaction category included general statements about cost and affordability. In some reviews, it seems like these references were about monthly premiums. However, some reviewers may combine premiums and out-of-pocket costs when commenting on cost generally.

Seven percent of reviewers specifically mentioned satisfaction with out-of-pocket costs. These were counted separately.

Claims

Claims satisfaction was just as common as cost satisfaction in 2020 5-star reviews. Reviewers mention never experiencing a denial or timely processing and payouts.

Customer Review: Patti Miller

"I had BC&BS for 27 years through my work place. Never had a claim denied. Not alot of time past before payments were made. Customer service was always available to answer questions."

2019's complaints and 2020's praises

It's not hard to imagine that 1-star reviewers and 5-star reviewers have very different experiences with a company and an industry. Considering 2019's high number of complaints alongside 2020's high number of praises reveals a helpful parallel.

|

2019 Complaints

|

2020 Praises

|

Top complaints in 2019 strike similar notes as 2020's top praises. This congruity highlights the importance of each of these factors to the overall customer experience. Health insurers should pay attention to these areas as they train employees and serve plan members.

Methodology

These results are based on a total of 905 health insurance reviews left on Best Company in 2020. Of those reviews, 401 had 5-star ratings. A random sample of 163 5-star reviews is the basis for the praise analysis. Results of the 5-star review analysis have a 90 percent confidence level with a 5 percent margin of error.

The Top Health Insurance Companies

The Top Health Insurance Companies

Related Articles

Health Insurance

Pharmacogenomic Testing 101: DNA Testing Essentials You...

Health Insurance

12 Things to Consider Before Taking a DTC Genetic Healt...

Health Insurance

The Truth Behind Dieting

By Best Company Editorial Team

July 22nd, 2022

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Health Insurance and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy