Why Americans Are Done with Health Insurance Companies: 2019's 1-Star Reviews

Read our customer review report for 2020: "What Health Insurers Are Doing Right: 2020's Customer Reviews"

Your health matters. It directly affects your quality of life, ability to work, and longevity.

Health insurance is key to many people’s ability to access the health care they need, but accessing health care isn’t always easy even with insurance.

Because health is so central to our lives, it isn’t surprising that government policy around health care will be one of many important issues on voters’ minds in November.

Whether you’re a health insurance shopper, U.S. voter, or part of the health insurance industry, paying attention to what customers are saying will help you understand the state of the health insurance industry in the United States and identify ways it can be improved.

Want to skip to the review data? Jump to the Reviews Analysis

Why health insurance matters

A recent Freedom Debt Relief study found that affordable health care was the top concern when people ranked current issues in order of importance. Health insurance and health care costs are at the forefront of many Americans’ minds.

There is a strong correlation between having health insurance and accessing health care. According to a Kaiser Family Foundation brief on uninsured Americans found that “(43 percent) of uninsured people said they had problems paying household medical bills in the past year and are more likely to have medical debt than people with insurance.”

No one should have to make sacrifices in their health to maintain their financial security and avoid debt.

But, medical care is expensive, and people are making health sacrifices because of it. Freedom Debt Relief’s study found that only 28 percent of people hadn't skipped doctor or dentist appointment, delayed receiving a procedure, or rationed, found alternatives to, or didn't buy prescriptions.

While having health insurance usually increases access to health care, health insurance itself isn’t cheap. The uninsured rate in the United States rose slightly in 2018. Recent changes to health care policy may have had an effect according to a New York Times article. There was less advertising and education due to budget cuts. Subsidies available under the Affordable Care Act were also eliminated.

Medicaid enrollment has also been affected by other changes. Moves to request proof of eligibility more frequently and limiting access for those applying for green cards or citizenship likely caused the lower enrollment rates.

While the uninsured rate is still low compared to pre-Affordable Care Act levels, limited access to health insurance affects millions of people in the United States. The Kaiser Family Foundation brief found that cost was the main reason adults had for being uninsured. Forty-five percent of uninsured adults reported that cost was a barrier according to the brief. Other barriers to access included no employer-coverage, no Medicaid expansion, and ineligibility for subsidies or lack of knowledge of subsidies.

While some of these studies focus on access for U.S. citizens and documented immigrants, undocumented immigrants are not eligible for these programs, so they experience even more barriers when trying to access medical care.

Some of these barriers are related to government policy. However, the largest barrier was cost, which begs the question: What are the costs of health insurance that could be lowered to increase access?

The Freedom Debt Relief study sheds some light on this question and on what consumers would like to see in their health plans:

- Lower deductible (54%)

- Lower monthly payment (44%)

- Expanded coverage (31%)

- Coverage for whole family (27%)

These consumer insights combined with other studies offer valuable insight into current issues in health care and health insurance. Customer reviews add another dimension to these conversations because they document the challenges people face when dealing with insurance companies.

Why customer reviews matter

Unfortunately, as valuable as health insurance is, the pasture isn’t necessarily green once you have it. We looked at health insurance customer reviews left on Best Company during 2019 to learn more about the biggest issues people have with health insurance companies.

Reviews offer excellent insight into the customer experience because you find stories of how the company treated a customer and the value the customer gives the service rendered. Reviews can help shoppers avoid bad companies and choose good ones.

Given that "82 percent of buyers consider user-generated reviews to be extremely valuable," you probably looked at reviews the last time you made a purchase.

Reviews can also help companies understand what they’re doing well and how to improve to attract more clients in the future.

From an industry-level, reviews also show us the problems within the industry. Identifying the problems is the first step to finding innovative solutions. Health care is a major issue in the United States, and health insurance plays an important role in health care access.

Customer reviews are becoming more and more important for consumers and businesses. More customers are reading reviews before making purchases, which helps them understand the quality, value, and what to expect from their purchase.

Bad reviews are bad news for businesses, so it’s tempting to pay for good reviews or repress bad ones.

Companies sometimes pay for fake reviews. Companies also incentivize customers to leave reviews. While these reviews may not be fake, incentives increase motivation for fake reviews and even the real reviews may not genuinely reflect the customer experience.

In some cases, companies may be able to work with a review website to stop publishing bad reviews. Even if it’s tempting to pay for good reviews or to repress bad reviews, businesses can use better methods like responding to them.

Because review guidelines are not standardized across the industry and there are unethical practices in use, consumers need to understand a review site’s policies and practices regarding review publication.

While this review analysis is limited to Best Company reviews, it contributes valuable information to the broader discussion of health care access and health insurance. Best Company vets each review submission before publication to ensure that the review is genuine, not fake. It also publishes all genuine reviews — good and bad.

While analyzing reviews from Best Company yields a more accurate representation of the customer experience, there are a few limitations when analyzing 1-star reviews in aggregate. Best Company has 62 health insurance companies listed. Reviews (including 1-star reviews) are not evenly distributed between the companies. Some companies even have no reviews.

Companies also have different splits among 5-star, 4-star, 3-star, 2-star, and 1-star reviews. Companies with a higher proportion of 1-star reviews may skew the broader analysis. However, even though some companies may have fewer 1-star reviews, understanding the difficulties people experience with health insurance regardless of the company is valuable information for anyone trying to make health insurance better and anyone shopping for health insurance.

While there are some limitations related to sample size and scope, because Best Company verifies the reviews that come in and publishes all genuine reviews this analysis gives a good picture of how customers experienced the health insurance industry in 2019.

Health insurance reviews analysis

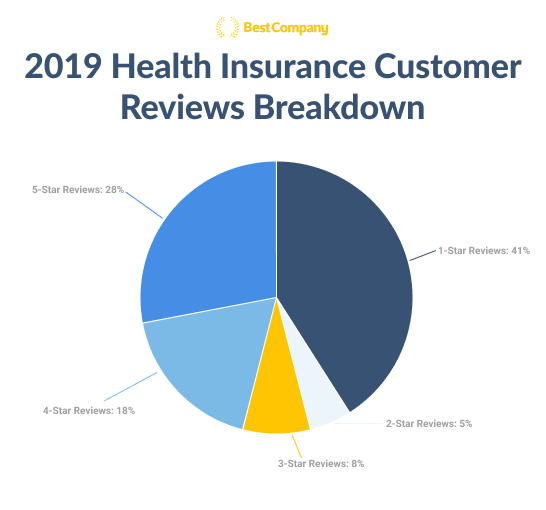

Overall, the review breakdown of the total 1066 reviews was 28 percent 5-star reviews, 18 percent 4-star reviews, 8 percent 3-star reviews, 5 percent 2-star reviews, and 41 percent 1-star reviews.

The combined total of 5-star and 4-star reviews helps paint a more hopeful picture of the industry. However, using these ratios to calculate a weighted score gives health insurance companies a 2.9 user star-rating on Best Company.

In other words, there’s room for improvement.

1-star review analysis

When we analyzed the 1-star reviews, complaints fell into the following categories:

- 42 percent of reviewers mentioned poor customer service

- 32 percent of reviewers mentioned coverage approval difficulty or denial

- 23 percent of reviewers mentioned claims process and payment difficulty

- 22 percent mentioned provider network satisfaction

- 21 percent talked about the cost vs value of the insurance plan

- 13 percent of reviewers mentioned company errors

- 7 percent referenced coverage misrepresentation

- 5 percent said they would have given a lower rating

- 4 percent sought additional help by filing formal complaints, getting an attorney, etc.

Reviewers mentioned as many as four of the above issues. Some mentioned fewer. The average length of a 1-star review was 117 words, while the average word count for a 5-star review was 42 words. When people had bad experiences, they had on average more than twice as much to say and typically mentioned more than one problem.

Poor customer service

If you’ve ever had an unfruitful or difficult interaction with a customer service representative, it’s no surprise that this complaint tops the list. Reviewers that complained about customer service mentioned poorly trained representatives, getting the runaround, not getting the help they needed for finding a provider or enrolling, and getting conflicting information.

While you can find similar customer service complaints in almost any industry, poor customer service in health insurance can affect people’s finances and health in important ways.

Coverage approval difficulty or denial

Reviewers who had difficulty getting prescribed medicine and treatment approved talked about how the delays with the process and denials affected their health. These reviews were the hardest to read.

Unfortunately, these difficulties aren’t surprising. Health insurance adjusters will look for cheaper treatment alternatives and may not always consider the unique circumstances, like allergies or negative side-effects associated with some drugs.

Some treatments, procedures, and surgeries are considered experimental, and insurance companies don’t always cover those because they have not yet become a widely accepted treatment.

It’s also important for insurance shoppers to realize that health plans have different rules regarding coverage and cost-sharing. You’ll want to carefully evaluate health plans with a trusted insurance agent to be sure that you understand the caveats and what the plan may not cover.

Claims process and payment difficulty

Some reviewers had difficulty using making premium payments either online, via phone, or with a check. While these payment difficulties are troublesome and can lead to loss of coverage, they are easier to fix and were mentioned less frequently in comparison to difficulties with the claims process.

Reviewers who had difficulty with the claims process were frustrated as they had to go back and forth between their provider and the insurance company. In some cases, claims weren’t paid or were denied because of a company error or an error in coding the health service received. Resolving these issues was not easy for most people. No one enjoys dealing with a difficult claims process, especially when they’re recovering from treatment or caring for a recovering family member.

An insurance company’s failure to pay claims also resulted in doctors stopping acceptance of the company’s insurance plans.

Provider network satisfaction

Health plans typically come with specific provider networks. Seeing in-network care providers tends to be cheaper for you and the insurer. Some plans offer coverage for out-of-network care. Although typically more expensive for you, having flexibility when choosing providers is nice.

Complaints about the provider network included a doctor’s bedside manner and interactions with patients and the difficulty of finding a network doctor nearby. Some complaints mentioned the insurance company’s failure to update its provider lists, which made it harder for plan members to find network doctors to get the treatment they needed while getting the most value from their plan.

Cost vs. value

While many factors affect the value of a health plan and a customer’s experience of value, not all reviewers explicitly referenced a disproportionate relationship between the cost of a plan and its value.

Cost usually referenced the monthly premiums. Value represents the coverage and cost-sharing customers received. Reviewers felt that the premiums were higher than the coverage and cost-sharing offered.

Company errors

Company errors fell into several categories: there were coverage errors, inaccurate billing, policy cancelations that took reviewers by surprise, poor record keeping by the company, incorrect network provider lists, and incorrect information given by company representatives. One reviewer even had difficulty with the prescription delivery service.

Some of these errors had an effect on the reviewer’s health. Others mostly affected the reviewer’s finances.

What’s most concerning about these complaints is that reviewers noted difficulty working with the company to resolve the errors. It took a lot of effort and consistent communication over time to get errors fixed. In some cases, the errors were not fixed.

Coverage misrepresentation

Coverage misrepresentation usually resulted from working with a third party or receiving bad information from a company representative. Most of this seems like it could have been unintentional, a result of poor training, or even miscommunication. While the reasons for the disparity between expectations and reality may be relatively benign, the effects on customers were serious because they affected their finances and access to health care in unexpected ways.

Lower rating

Some reviewers noted that they would have given a lower rating than 1-star if they could have. This came up frequently enough to track it. These comments reflect the deep dissatisfaction that consumers feel compared to what was expressed by other reviewers.

Sought additional help

A few reviewers felt they had been treated so unfairly that they were considering filing a formal complaint with a government agency or meeting with a lawyer. Several already had taken one of those steps.

Where we go from here

There are two ways to approach these results: from a company level and from a consumer level. We’ll go over action items for both.

Health insurers

1. Provide better training for customer service representatives

You can do a better job training their representatives. Training should involve professionalism on the phone and providing reliable information to customers. Well-trained representatives go a long way in improving the customer experience when asking questions and resolving issues.

2. Create a smoother prior authorization process

You can evaluate your prior authorization processes to help members achieve better health outcomes. Finding ways to be more efficient with this process will make it easier for members and doctors to work with companies while delivering or receiving the care they need.

3. Revisit your claims process

You can review the claims process. First, you need to be reliable in making payments to health care providers. When insurance companies are not consistently reliable, doctors stop accepting plans.

Second, find ways to make the claims process easier. What are your protocols for when claims issues arise? Are there processes you can change to make processing claims and dealing with disputes easier?

4. Make it easier to resolve issues and fix errors

You can make it easier to catch and correct errors in general. Most importantly, you need to evaluate your processes for resolving errors when they happen. If errors are faster and easier to resolve, they will not be as big of an issue for members who deal with them.

5. Offer robust provider networks

You can increase the value their plans offer by maintaining robust provider networks. Plans that make it easier to find in-network providers will help keep members with the company. Part of maintaining a good network includes making timely payments to doctors and hospitals when they make a claim.

Consumers

1. Be wary of companies with too many 1-star reviews

You should avoid companies with high percentages of 1-star reviews, especially if the reviews are recent and come from people in your area. Reading customer reviews from your area will give you a good sense of how a company treats its clients. If your options are limited to a poorly rated company, you’ll be prepared because you’ll know what difficulties to expect.

2. Check provider networks

When shopping for insurance, you should ask your provider if they accept any of the plans you’re considering. If you don’t already have providers, you should look at the network of doctors listed by the health insurer and in-network. Call a few to see if they still plan on participating in the plan’s network. This is extra work on your part, but it will help you know how accurate the provider lists are and give you an idea of how easy it would be to find an in-network doctor.

3. Keep your own records

You can also keep your own records of conversations with representatives and enrollment. This documentation can help you resolve errors if they arise, even if the resolution process may be difficult.

And, if your challenges need to be escalated to legal action or filing a formal complaint, you’ll already have the documentation to support your case ready.

Methodology

These results are based on a total of 1,066 health insurance reviews left on Best Company in 2019. Of those reviews, 439 had 1-star ratings. A random sample of 202 1-star reviews is the basis for the complaint analysis. Results of the 1-star review analysis have a 95 percent confidence level with a 5 percent margin of error.

The Top Health Insurance Companies

The Top Health Insurance Companies

Related Articles

Health Insurance

Pharmacogenomic Testing 101: DNA Testing Essentials You...

Health Insurance

12 Things to Consider Before Taking a DTC Genetic Healt...

Health Insurance

The Truth Behind Dieting

By Best Company Editorial Team

July 22nd, 2022

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Health Insurance and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy