Medicare General Enrollment Period Guide

Topics:

Medicare Enrollment

Medicare's many enrollment periods can be confusing, which makes it easy to miss an enrollment opportunity. Missing a timely enrollment can lead to higher premiums and leave you without needed coverage.

The beginning of each year brings two simultaneous Medicare enrollment periods: General Enrollment and Medicare Advantage Open Enrollment. We'll cover everything you need to know about the General Enrollment Period here. For more information on Medicare Advantage Open Enrollment, read our other article.

Key facts

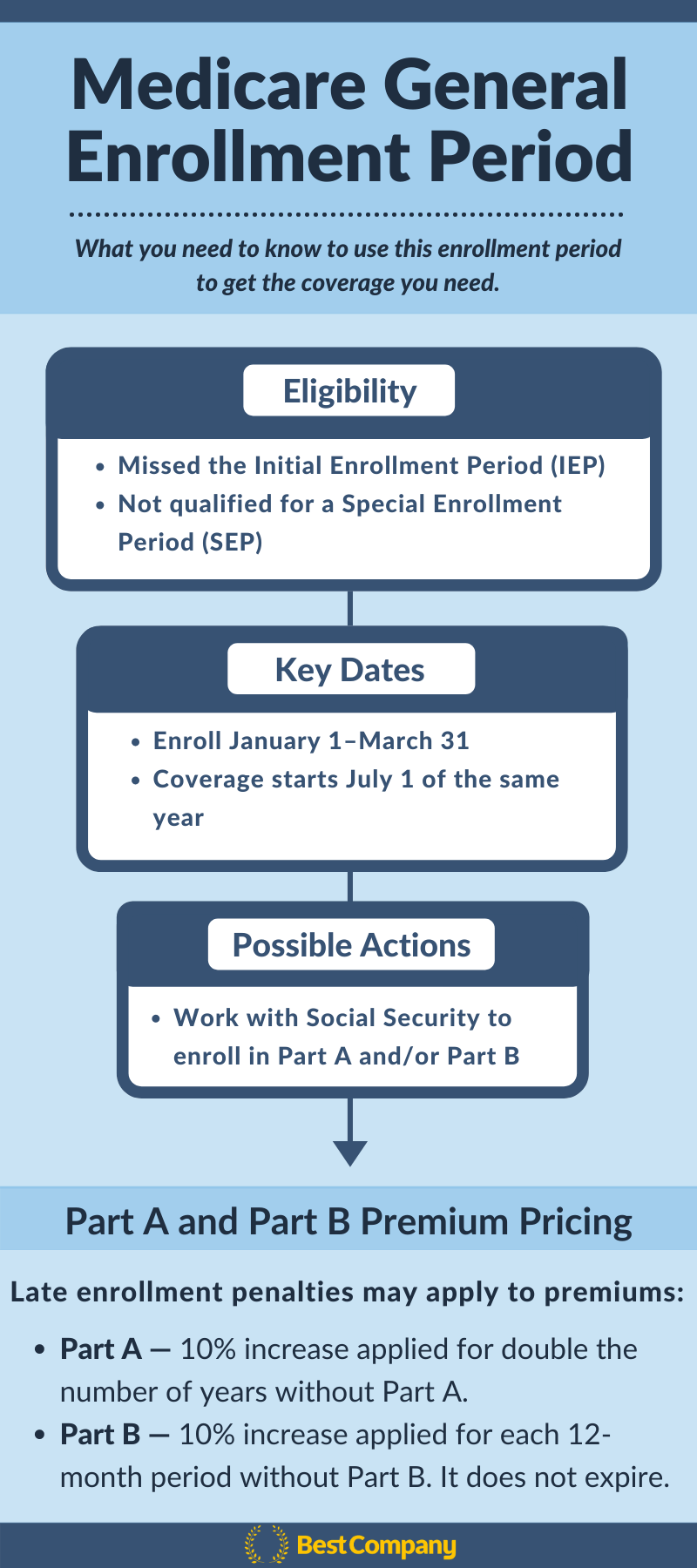

Eligibility: Missed your Initial Enrollment Period and are not eligible for a Special Enrollment Period

Enrollment Dates: January 1 through March 31 annually

Coverage Start Date: July 1

Actions to Take: Enroll in Medicare Part A and Part B

Note: The 2020 BENES Act made changes to the General Enrollment Period. These changes will start January 1, 2023. The new General Enrollment Period dates will be October 1 through December 31. Your coverage will start at the beginning of the month after the month you enroll. Learn more about these changes from BoomerBenefits.

What to expect

If you're enrolling in Medicare during the General Enrollment period, be prepared to see higher prices for premiums. These higher prices result from financial penalties for not enrolling in Medicare during your Initial Enrollment Period to prevent people from only buying coverage when they need it.

With Part A, your premium may increase 10 percent for late enrollment. Fortunately, you won't have to pay the higher premium for as long as you keep Part A. You'll only pay the higher premium for the number of years you didn't have Part A times two. So, one year without Part A means two years of paying a higher premium for Part A once you enroll.

Part B premiums can increase 10 percent for each year you didn't have Part B. In this case, years are 12-month periods, not necessarily calendar years. Unlike the Part A penalty, the Part B penalty is permanent.

How to enroll

You'll need to work with Social Security to enroll in Part A and Part B. You can apply online, over the phone, or in-person.

If you just need to add Part B enrollment, you'll need to complete form CMS-40B, the Application for Enrollment in Part B.

Coverage offered

If you're enrolling in Original Medicare, keep in mind that there aren't annual out-of-pocket maximums. Out-of-pocket maximums help control your medical costs because once this limit is reached, the insurer will take responsibility for costs of covered care.

Since Original Medicare doesn't have these out-of-pocket limits, you'll want to consider enrolling in a Medigap plan. Medigap plans also don't have out-of-pocket limits. However, these plans offer additional cost-sharing beyond what Medicare Part A and Part B do.

As you apply for a Medigap plan, keep in mind that you will likely have to go through underwriting before being issued a policy. Depending on your circumstance, you may not pass underwriting.

Original Medicare also doesn't cover prescriptions. You'll need to buy a prescription drug plan from a private insurer for this coverage. You can buy a prescription drug plan April 1 through June 30th after your Part A and Part B sign-up during General Enrollment.

As you consider prescription drug plans, use this checklist to ensure that your needs are met and don't forget to read customer reviews.

Some Medicare beneficiaries opt for a Medicare Advantage plan instead of signing up for Original Medicare. While you can only sign up for Original Medicare during General Enrollment, you can switch from Original Medicare to a Medicare Advantage plan April 1st through June 30th following your enrollment in Part A and Part B.

Best Medicare Companies

Learn more about top Medicare companies by reading customer reviews.

Learn MoreThe Top Medicare Providers Companies

The Top Medicare Providers Companies

Related Articles

Medicare Providers

80% of Medicare Beneficiaries Are Unaware of This Costl...

By Guest

November 4th, 2021

Medicare Providers

What to Know Before the Fall Open Enrollment Period

By Guest

September 19th, 2021

Medicare Providers

Medicare Coverage While Traveling

By Guest

August 26th, 2021

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Medicare Providers and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy