Do I Need Life Insurance?

You may find yourself wondering: Is life insurance really worth it? Do I even need it?

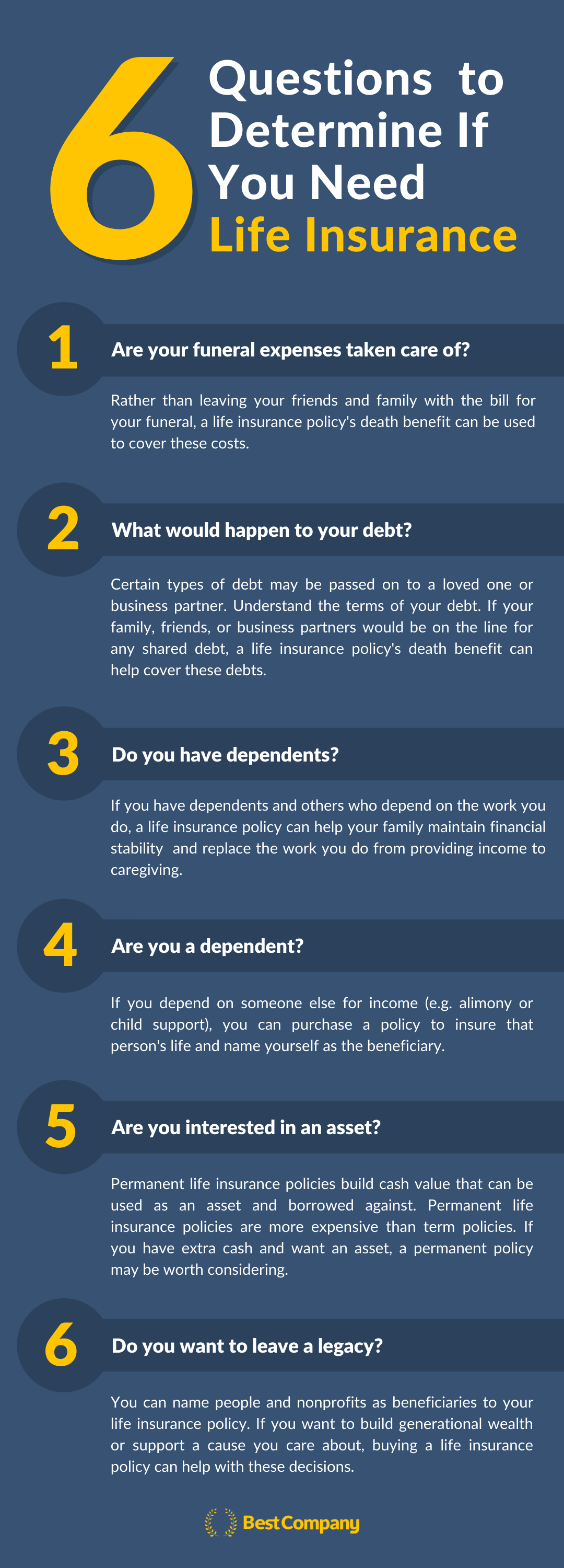

The answer to these questions depends on what your life looks like. As you assess your life insurance needs, here are six questions to consider:

- Are your funeral expenses taken care of?

- What would happen to your debt?

- Do you have dependents?

- Are you a dependent?

- Are you interested in an asset?

- Do you want to leave a legacy?

1. Are your funeral expenses taken care of?

When was the last time you saw a GoFundMe fundraiser for a funeral? The National Funeral Directors Association reported that the median cost for funerals in 2019 were $9,135 for burials and $6,645 for cremations.

Ask yourself the following questions:

- Are your funeral costs taken care of? (You can set aside your own savings, purchase things like burial plots in advance, or work with a funeral home to prepay your funeral.)

- Can your friends or family cover the funeral costs while waiting for your will to be processed fully?

If you answered either of these questions "no," considering a life insurance policy can help your family pay their respects and focus on their grief rather than how they'll fund your funeral.

Personal experience

Randy VanderVaate president and owner of Funeral Funds, "I learned first-hand the importance of life insurance when my father died on May 10, 2017, without life insurance.

When my father died without life insurance, our family had to figure out how to pay for his final expenses, which was emotionally stressful and financially burdensome. This experience reinforced my conviction that people need life insurance if they don't want their family or friends to struggle emotionally or financially after they're gone."

2. What would happen to your debt?

Some debts are shared. Others are not. Review your debt to be sure you understand what debts would become the full responsibility of another or just be collected from your estate if you passed away.

If any of your debt would become someone else's responsibility personally or professionally, be sure to have a life insurance policy in place to cover these debts.

Personal experience: Business loans

Matt Schmidt, Diabetes 365 Founder, "There are many reasons an individual may need life insurance coverage, but one popular example of why you may need a policy is to satisfy obligations for a SBA Loan. Every year, thousands of people will apply for a SBA loan. One little known fact that many are unaware of is that the lender will require a life insurance policy for collateral assignment.

I personally went through this process about 10 years ago and got through to the very end before they stated to me that I needed a policy for a specific amount. While I was thrown a little bit off by this requirement, it obviously made perfect sense as to why the lender would require this type of collateral.

Being able to find a very affordable life insurance policy was a relief, and ultimately the loan went through without a hitch. Obviously receiving the loan amount was of tremendous use."

Learn more about entrepreneurs and life insurance.

3. Do you have dependents?

Whether you work or not, a life insurance policy is especially important if you have dependents. Consider what your partner and dependents would need to replace the work you do.

If you provide income for your family, make sure you buy enough life insurance coverage to replace your income.

If you are a full-time parent, think about the costs of child care, food preparation, tutoring, cleaning, etc. when deciding how much coverage to buy.

Personal experience: Growing family

Kelan Kline, personal finance expert and cofounder of The Savvy Couple, "We recently got life insurance when we started to grow our family and felt the need to protect them better if something were to happen to my wife Brittany or myself. Since we run an online business, it's even more important to have all of our ducks in a row with our will and life insurance.

We both got policies from Haven Life after shopping around for a bit. We ended up both getting a 30-year term life insurance policy covering us each for $500,000. We also recently set up our will so everything is in place and our family is protected."

(Incidentally, Haven Life ranks first on Best Company's list of life insurance companies and agencies. Read customer reviews of Haven Life.)

Personal experience: Special needs child

Kari Lorz, Head Mama Money Nerd for MoneyfortheMamas.com, "My husband and I have a few different life insurance policies in place, although we didn't intend to do this. We have a very typical 25-year term insurance policy for each of us (different amounts); we did this when we purchased our first home. Term policies are great to bridge the gap until you have enough in savings to be self-insured. My husband is 20+ years military, so he has a smaller policy through an ARMY package as well.

We have a 5-year-old daughter together, and she has Cerebral Palsy. We're unsure of her future ability to earn enough income to support her needs. As part of a larger dependant care plan (Revocable Living Trust for us, a Special Needs Trust for her, an ABLE account, etc.), we found we were $1.2 million short of having enough to cover her costs for her lifetime.

Hearing that dollar amount was comically sobering (I even laughed out loud a bit when our planner told us our figure). To help bridge the gap, we took out a whole term policy to leave behind significantly more funding. Yet, it still (most likely) won't be enough.

A special needs parent's greatest fear is what will happen to their child after they aren't there anymore. I never want her to have to worry about money, so we are doing everything possible to make sure we reach that $1.2 million!"

4. Are you dependent?

If you depend on someone else's income for support, you can buy a life insurance policy to insure their life and name yourself as the beneficiary.

If you receive alimony or child support, buying a life insurance policy on the person paying these costs can help you maintain your income and financial stability.

5. Are you interested in an asset?

Permanent life insurance policies grow cash value. The cash value can be used as an asset as long as the policy remains in force. This asset can be useful in some circumstances.

However, it should not be your primary reason for buying a life insurance policy, unless you have extra cash lying around.

Personal experience

Karen Condor, insurance expert for TheTruthAboutInsurance.com, "When my husband and I became engaged in our early twenties, my father-in-law advised us to get life insurance. We didn’t see the point of it given our age, not planning to have children, and not wanting an additional expense. But he kept urging it, so we acquiesced.

And he was right, of course: Our life insurance helped 10 years later when we had the opportunity to move from Pennsylvania to California for job promotions. We needed money upfront for moving expenses, with our company reimbursing us after the move.

But we were strapped for upfront money since both of us were wrapping up a decade of paying off our student loans, working second jobs to make ends meet. We also didn’t want to dip into what little savings we had, in case of any emergencies.

But since whole life insurance builds cash value, we were able to “borrow” the money we needed and repay the account over time at favorable terms.

Without having life insurance, I don’t know if we would have been able to accept those better jobs and experience a better life."

6. Do you want to leave a legacy or pass on wealth?

Life insurance policies can be used to build generational wealth because the death benefit is not subject to income tax. If you have extra money and want to use it to buy a life insurance policy to leave your children, it can be a nice way to grow your family's wealth over time.

Even if you don't have dependents, you can use a life insurance policy to leave a legacy. Maybe there's a non-profit you care about. You can name this organization as the beneficiary of your life insurance policy.

If this is your only reason for buying a life insurance policy, then it's not necessarily a need.

Life Insurance Policies and Companies

If you need life insurance, check out our top life insurance companies and agencies based on customer reviews.

View Top CompaniesThe Top Life Insurance Companies

The Top Life Insurance Companies

Related Articles

Life Insurance

How Much Life Insurance Do Dads Need?: Breaking Down th...

By Guest

June 24th, 2021

Life Insurance

New Parents and Life Insurance: What to Consider

By Guest

May 20th, 2021

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Life Insurance and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy