Lenders and the PPP: Customers Evaluate Their Performance

2020 was a wild ride for small and mid-sized businesses nationwide, and the Small Business Administration's Paycheck Protection Program (PPP) has been a key part of that ride for the more than 5.1 million businesses that received PPP funds before lending ended August 8. Since then, a second round of PPP loans has been rolled out and applications are open until the program's extension date of June 30, 2021.

Connecting business owners with lenders that could help them with application, approval, and funding was anything but straightforward. And the hurdles aren't over, with many business owners still left hanging with loan forgiveness technicalities.

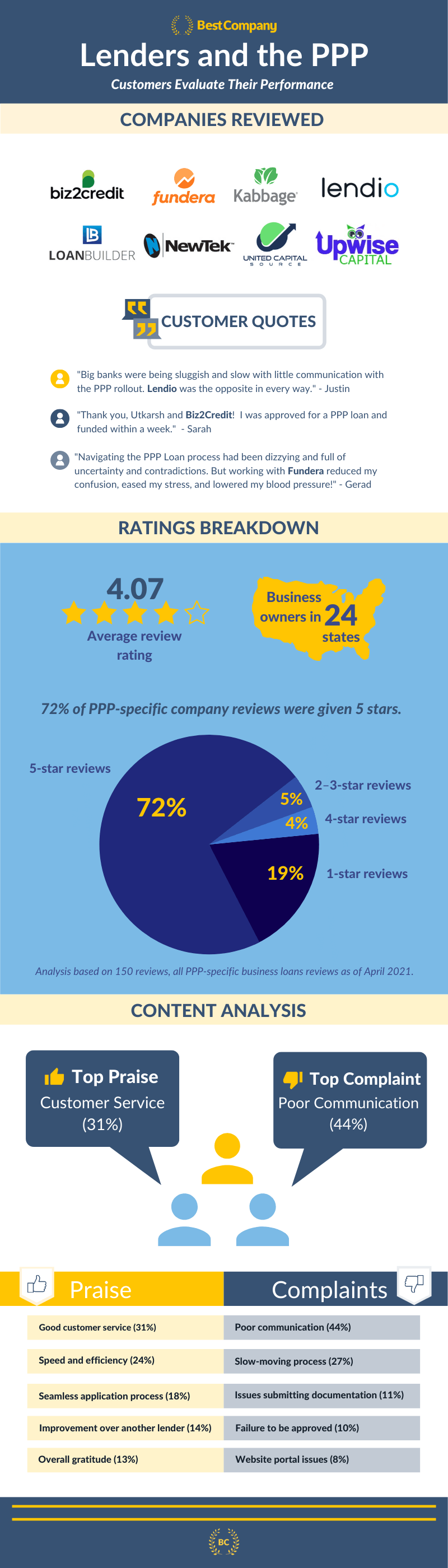

But certain lending companies have emerged as leaders in this unprecedented process, as evidenced by Best Company's 2020–2021 consumer reviews that explicitly mention experiences with PPP funding. And repeated themes across reviews reveal the most important elements that defined an experience as positive or negative.

Read on to explore Best Company reviews statistics, themes, and analyses. With this knowledge, business owners can identify lenders to consider working with in the future, and lending companies can improve their processes for future large-scale business loan facilitation (of SBA loans and other loan types alike).

Further PPP analysis

Top praises in positive reviews

Top complaints in negative reviews

Top praises in positive reviews

Good customer service — 31 percent

Specific comments within this theme include the following:

- Patient and helpful company reps

- Had their questions answered

- Had the process personally explained to them

- Received return calls and emails

- Was assigned a dedicated funding specialist for the entire process

- Received follow-up even after documentation was submitted

- The company stayed in touch even through obstacles like errors and delays

Kabbage review:

Customer Review: Karen from California

"Ryan W. was a tremendous support for the stressful and sometimes confusing PPP loan application process. It was so great to connect with a live person who understood the challenges we were facing and guided us through the process."

United Capital Source Review:

Customer Review: Frederick from California

"I worked with Jon B to secure a loan underneath the PPP program. Jon went out of his way to be helpful, and guided me through the process in an efficient and complete manner. Have nothing but positive things to say about my experience with United Capital Source."

Speed and efficiency — 24 percent

Specific comments within this theme include the following:

- Company identified a funding source quickly

- Received funding quickly (under 48 hours, within one week, etc.)

Biz2Credit reviews:

Customer Review: Jeff from Illinois

“Wow. 2 days from application to funding of my PPP loan...I accidentally found Biz2Credit, and I'm so thankful I did. My loan specialist walked me thru everything, and answered whenever I called.”

Customer Review: Ed from Oregon

“My loan officer, (Joseph S) made everything run very smooth and was instrumental in helping me complete the required documents in a timely, professional manner. I had never applied for a business loan prior to this (so I have nothing to compare with), and I was very pleased to have someone willing to help me complete the application process for a PPP loan. From start to funding took less than 4 days. Impressed!!”

Fundera review:

Customer Review: John from Virginia

“Matched me to a company that could handle my PPP Loan in a fast and efficient manner. Very impressed!!! Thank you for all of your help!!!!!!!!”

Seamless application process — 18 percent

Specific comments within this theme include the following:

- Utilized good technology

- Equipped to assist independent contractor/gig worker

- Well-explained interface for application

- Everything was accessible online

- Easy to navigate, submit, and sign

Biz2Credit review:

Customer Review: Vee from Louisiana

“The PPP loan process was simple and straightforward, particularly for someone in my category. That is, an independent contractor/gig worker. The Biz2Credit system is set up in a way to help "micro" business owners. Staff was very communicative, not relying on just one mode of outreach.”

United Capital Source review:

Customer Review: Shabnam from New York

“United Capital Source was able to apply for a PPP loan for me and it was approved! Their forms were all online and very easy to use and they emailed me for any additional files needed. The loan documents were also easy to sign and the money was in my accounts a few days later. All in all it was an excellent experience that could not have been easier. Thank you!”

Improvement over another lender — 14 percent

Specific comments within this theme include the following:

- Deemed ineligible by another bank or lender

- Another bank, lender, or local agency was not equipped to serve them

- Another bank or lender stopped taking applications

- Bank wouldn't help a non-customer

- "Ghosted" by another bank or lender

- Applied with multiple lenders and this was the quickest to respond

Lendio review:

Customer Review: Devon from California

“I applied for PPP with 3 other companies and Lendio was a quick turnaround, within 24 hours.”

Biz2Credit reviews:

Customer Review: Michael from Nevada

“My company's bank stopped taking PPP applications before I had my documents ready. My personal bank would not help me since my company accounts were not with them. Several other lenders also declined taking applications for non-customers. I tried another internet firm that submitted my package to a lender but I never was approved. With time running out I tried Biz2Credit who had an approval in 2 days.”

Customer Review: Kalena from Florida

“Biz2Credit helped my small business get a PPP loan. Three other lenders had simply given me the run around including Wells Fargo, my primary business bank for over 20 years.”

Overall gratitude — 13 percent

Specific comments within this theme include the following:

- Made the PPP funding possible

- Gratitude expressed to specific company reps

- Gratitude for help with loan forgiveness

- Initially rejected but the lender found a way to get it for them

- Relieved to be able to keep employees on the payroll or rehire them

Kabbage review:

Customer Review: Lee from Tennessee

"Stephenie W. was terrific -- she really helped me out quite a bit and she was very patient and helpful...it wasn't until I reached Stephenie that I was able to find someone to assist. She basically made my PPP loan possible and I'm very grateful to her."

Upwise Capital review:

Customer Review: Robert from New York

"Working with Upwise was a breath of fresh air during this crazy time. I tried applying for relief financing with my bank and in 6 weeks, got one email from them saying that they received my application for the PPP loan. At my wits end and not knowing what else to do, I found Upwise in a quick search and was so glad that I did. I was able to get Frank on the line who was very nice, personable and knowledgeable. He had me apply through an easy link, and I was approved and funded in just a few days! I'll be sure to be calling Frank again with any other financing needs I might have in the future. Thank you Frank and Upwise Capital, you guys ROCK!"

Top complaints in negative reviews

Poor communication — 44 percent

Specific comments within this theme include the following:

- Handed from one company rep to another

- Calls or emails were ignored

- Hung up on by loan representative

- A scheduled call was canceled

- No communication after document submission

1-star review:

Customer Review: David from California

“Their customer service is ZERO. They were 100% nonresponsive, they failed to reply to an overnight letter, and email requesting a simple phone call. Their phones auto answers then times out and hang up. Because of their horrible service I was not able to apply for a PPP loan.”

3-star review:

Customer Review: Christina from California

“Our advisor was knowledgeable and helpful on our initial 2 phone calls. While not particularly timely, our advisor did follow up with us after our initial application attempts failed and instructed us to resubmit our loan application with an online vendor. While the subsequent online application was submitted successfully, that is where the contact completely stopped - I was not able to get a response from our advisor even one time after that application was successfully submitted but not processed due to lack of funds (1st round PPP funding ran out). The 3-star rating is only because our loan was ultimately approved during the 2nd round of funding, but we never received any more communication from our advisor while our application was suspended and we were waiting for additional funding.”

Slow-moving process — 27%

Specific comments within this theme include the following:

- Took a long time to process the application

- Took a long time to receive funding

- Lender was "sitting on" the approved money

2-star review:

Customer Review: Louie from Florida

“Application for our 3 corporations were submitted on 4/9/20 for PPP. It was handed from one representative to another. This happened 4 times. Documents were requested over and over again. I realized that only 1 corporation was processed and funded the last week of May. The other 2 PPP applications fell into the cracks. I have to diligently follow up every day and resent all documents again...Finally, after non-stop of emails, the two accounts were finally approved and funded the first week of June. I understand that this is a very busy time for [company] but customers need to be informed on what's going on with their applications. The portal is useless. It doesn't give you any updated information on applications. I was lost in the dark in this whole application process.”

1-star review:

Customer Review: Amy from Texas

“My credit union gave over our PPP loan to [company], as the 3rd party processor. I applied 6 weeks ago. Approved with [company] 4 weeks ago, and SBA 3 weeks ago. Still have not received my PPP. When asked if [company] was sitting on our approved money from SBA, earning interest, they would not answer. Small businesses are going under waiting to be funded and [company] is not releasing the approved money!!!!"

Issues submitting documentation — 11%

Specific comments within this theme include the following:

- Complicated or unclear process

- Asked repeatedly to send in documents

- Documentation was lost

- Lender didn’t include all information provided by customer for submission to SBA

- File mistakes were made

- Difficult to submit documents in different folders (rather than one)

1-star review:

Customer Review: Jafar from California

“The left-hand does not know what the right hand is doing. I had to resubmit the same document over and over again. The person who was working on my file did not even look at the emails and kept asking for the same documents. We had two companies and filed for both. For one mysterious reason, only one company was processed and I did not get a reasonable answer to why the other company was lost.“

2-star review:

Customer Review: Thomas from Georgia

“Communication for my PPP loan was very difficult. All published phone and cell phones #'s either non-working or voice mail that does not get returned. Schedule a call form receives a response that parties are too busy and schedule call will be canceled. At the very last minute on my file mistakes were made and I was told it was too late to correct before the deadline, costing me several thousand in loan amount.”

Failure to be approved — 10%

Specific comments within this theme include the following:

- Denied because of claimed lack of documentation which actually was submitted

- No explanation for the rejection

- Approved for a smaller amount than expected

- Ran credit even when rejected for funding

1-star reviews:

Customer Review: Cari-Anne from New Mexico

“Wow! Received three different approval amounts for ppp Loan. The last amount was hysterical.. a few hundred dollars. This took about a month. Even though My client had an approval for 30,000.00 - it must be illegal. Called SBA and they said they must fund the letter of approval that they gave my client. They wouldn't respond to phone calls or emails. Finally received a response stating you are welcome to apply elsewhere even though they knew that most places had used up their funds."

Customer Review: Alison from California

“When I submitted my application, they wrote my application is under review and they will let me know if they need any additional information/documents. 48 hours later, I get an email that they have denied my request because my application was lacking information they requested. And very conveniently, there is no number to call to see what was missing and on their site, they write their decision is final. Yet, they still ran my credit!!!!”

Website portal issues — 8%

Specific comments within this theme include the following:

- Trouble logging in

- System errors

- Data was repeatedly lost

- System not user friendly

1-star review:

Customer Review: Ivy from California

“[Company] always has problems in logging into their website, lots of system errors and hiccups. Also it's really crappy when it's never on the same page as keeping the documents that as uploaded. I applied for my PPP here and had to reset password, security question countless times in order to login. Their system will automatically wash off all your data and report: No viewable loan after the next day. Helpless and careless employees when you call. I only got two answers from them: "reset your passwords" and " I don't know, reapply!"

Which lending company performed best?

Regarding the PPP reviews specifically, the average review rating for the top five companies reviewed is above 4 out of 5 stars. Due to their averages within the context of larger sample sizes, we can most confidently recommend Biz2Credit and Lendio.

Click the company name to browse the reviews section for each company individually.

Biz2Credit's average PPP review rating: 4.27 (75 reviews)

Lendio's average PPP review rating: 4.11 (36 reviews)

Upwise Capital's average PPP review rating: 5 (8 reviews)

United Capital Source's average PPP review rating: 4.7 (7 reviews)

Fundera's average PPP review rating: 5 (2 reviews)

Who offers the best business loans?

Overall rankings for all lending companies reviewed here (plus hundreds more) can be found on the best business loans landing page.

Learn MoreThe Top Business Loans Companies

The Top Business Loans Companies

Related Articles

Business Loans

How to Develop a Memorable Brand Identity

By Guest

July 22nd, 2022

Business Loans

How to Use Animated Logos for Your Business [with Examp...

Business Loans

Pandemic Workforce Impact: Keeping Employees Involved W...

By Guest

July 22nd, 2022

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Business Loans and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy