5 Questions to Ask Before Enrolling in Health Insurance

Topics:

Buying health insurance

Open enrollment is upon us! From November 1 through December 15 people will have the opportunity to either sign up for health insurance, or make changes to their existing coverage.

If you're on Medicare, the Open Enrollment Period started October 15 and ends December 7. Read these articles about Medicare Annual Enrollment and Medigap to learn more about Medicare and how to take advantage of the Annual Enrollment Period.

Below are some important dates for Open Enrollment that you'll want to pay attention to as you make your decisions:

November 1, 2021: Open Enrollment Starts

December 15, 2021: Last Day to Enroll or Make Changes for Coverage starting January 1, 2022

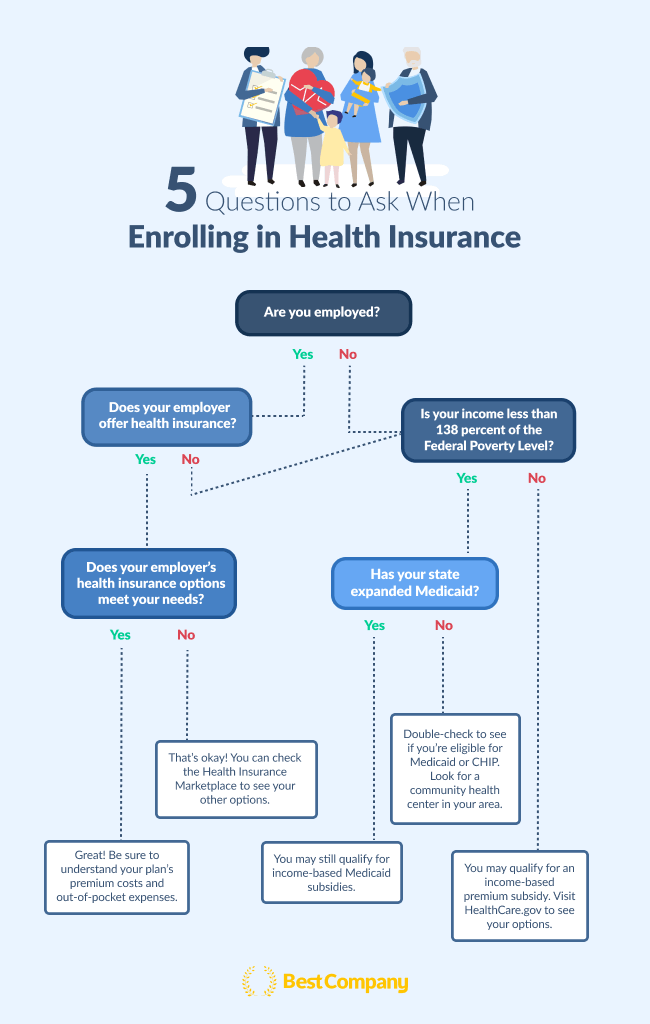

Of course, if you've never signed up for health insurance before, there are some questions you'll need to ask yourself about your situation before you enroll. Health insurance in this country can be complicated, so before you can know what your options are, you need to understand how your circumstances influence your access to health insurance.

Are you employed?

While you don't need to be employed to have access to health insurance, it certainly helps. Many employers in the country offer some kind of health benefits to their full-time employees. Some also offer it to their part-time employees.

Does your employer provide insurance?

Of course, not every employer offers health insurance. As healthcare costs increase, fewer and fewer businesses can afford to provide health insurance benefits to their employees. If you're employer doesn't offer health insurance, you can see what insurance companies offer to individuals and families. You may even qualify for an income-based subsidy or another government health insurance program.

Is your job-based insurance sufficient?

By "sufficient" we mean, does the insurance coverage your employer provides able to meet all of your healthcare requirements? This question might be more difficult to answer than you think. How do you know if your employee benefits are enough or not? Unfortunately, the answer to this question depends on a lot of factors: your preexisting conditions, what benefits and packages are available, and whether you can afford necessary add-ons to your policy.

First, it's important to do some research on the insurance provider your employer has partnered with. We've identified and reviewed some of the major health insurance companies in operation today. You should also talk to your company's human resources representative (if you have one) to discuss your specific needs, and whether your company's insurance will be able to address these needs with the packages available.

If your employee benefits are enough

If the insurance provided by your employer is enough to cover all your healthcare needs, then great! You're in good shape; however, it's still important to familiarize yourself with some crucial terms related to your health insurance policy.

If your employee benefits aren't enough

If your insurance policy does not quite cover all of your healthcare needs, that's okay! You can look at your options on your state's health insurance exchange. These Health Marketplace plans can give you access to group premium rates that may be cheaper than other options with comparable coverage. You can also consider other options through insurance companies, like off-exchange plans. Off-exchange plans do not cover all of the essential health benefits, so pay attention to what services are covered if you're looking at these plans.

Is your income less than 138 percent of the Federal Poverty Level?

The Federal Poverty Level is a standard against which you can determine whether you qualify for cost assistance when buying insurance through the Health Insurance Marketplaces.

If you make less than 138 percent of the Federal Poverty Level, you may qualify for Medicaid or CHIP (Child Health Insurance Program), depending on whether your state has expanded Medicaid coverage (more on that later).

If your income is greater than 138 percent of the Federal Poverty Level

You'll still have a number of health insurance options available to you. The Health Insurance Marketplace offers a insurance packages on a sliding scale, meaning your income (along with other factors) can influence the number and variety of benefits you can potentially receive. If you fall into this group, you may also qualify for certain insurance subsidies, as follows:

Premium Tax Credits

Based on income, these premium tax credits can go towards paying for a portion of your health insurance costs by either lowering your premium, for factoring into your annual tax return. More specifically, if you make between 100 percent and 400 percent FPL, you may qualify for these credits.

Out-of-Pocket Cost Assistance

Out-of-pocket cost assistance (also known as cost sharing subsidies) will help lower the amount of money you yourself pay towards specific health insurance costs. These include deductibles, copayments, and coinsurance costs. In order to qualify for these subsidies, you must be making between 100% and 250% FPL.

Has your state expanded Medicaid?

Right now, one of the major issues affecting health insurance access is the expansion of Medicaid. Medicaid is a health care program (jointly funded by the federal government and the individual states) specifically designed for low-income people. It covers children, the elderly, the blind or otherwise disabled, and others who qualify for federally assisted income maintenance payments.

Currently, Alabama, Georgia, Kansas, Florida, Mississippi, Missouri, North Carolina, Oklahoma, South Carolina, South Dakota, Tennessee, Texas, Wisconsin, Wyoming are the only states that have not expanded their Medicaid programs.

If your income is less than 138 percent of the Federal Poverty Level, and your state hasn't expanded Medicaid

You should still apply for Medicaid coverage, as you still may qualify. However, if you still don't qualify for Medicaid and your state hasn't expanded this type of coverage, you may not be completely out of luck. In some areas, there are Federally Qualified Health Centers that offer primary care services in areas with underserved people. The Health Resources & Services Administration funds these centers through its Health Center Program.

You can also buy a catastrophic health plan. These plans only offer coverage for emergency medical care and serious injuries. Because the coverage is so limited, the premiums tend to be much lower. If you're 30 or older, you have to file a hardship exemption form before you can purchase one of these plans.

If your income is less than 138 percent of the Federal Poverty Level, and your state has expanded Medicaid

You may qualify for Medicaid or CHIP. Rules for Medicaid will vary state to state, so it's important that you check state laws to see how Medicaid has been specifically expanded. As for CHIP, there are some important step, including visiting www.insurekidsnow.gov, selecting your state, then filling out a Marketplace application.

Understanding your health insurance options

In conclusion, the health insurance world doesn't need to be so intimidating. There are a lot of great resources available for first-time health insurance enrollees. Just be sure to closely examine your situation, the needs of your family, and never be afraid to ask those who have been there before. Health insurance is one of those things you'd rather have and not need, rather than need and not have. The clock on open enrollment is ticking, so sign up today!

The Top Health Insurance Companies

The Top Health Insurance Companies

Related Articles

Health Insurance

Pharmacogenomic Testing 101: DNA Testing Essentials You...

Health Insurance

12 Things to Consider Before Taking a DTC Genetic Healt...

Health Insurance

The Truth Behind Dieting

By Best Company Editorial Team

July 22nd, 2022

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Health Insurance and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy