Preventing Home Buyer’s Remorse: 13 Common Mistakes and What You Can Do to Avoid Them

According to a recent Bankrate survey, millennials (age 25–40) are the most likely group to experience home buyer's remorse. In fact, the data shows us that nearly 64 percent of millennials experience regret or remorse after a home purchase.

What is home buyer's remorse?

Home buyer's remorse is a deep regret felt after buying a house. Because homes are large purchases, if not one of the largest purchases many consumers will ever make, feelings of remorse or regret are common. While these feelings typically fade over time, you can avoid some common mistakes, which can help you feel more at ease after buying a home.

What are the most common home buying regrets?

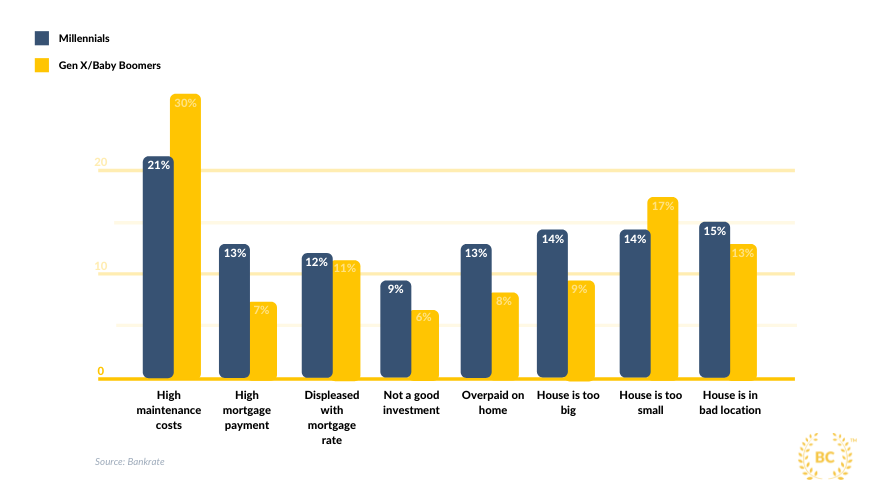

According to Bankrate, the biggest finance-related regrets that millennial home buyers have include some of the following:

- High maintenance costs (not accounted for) (21%)

- High mortgage payment (13%)

- Displeased with mortgage rate (12%)

- Don’t think buying a home was a good investment (9%)

- Overpaid on a home (13%)

Additional regrets include physical characteristics of a property, including millennials who felt they bought a house that was too big (14 percent), a house that was too small (14 percent), or a house in a bad location (15 percent).

Multiple factors contribute to these common home purchase regrets, including a competitive market with record-low mortgage rates, not shopping around for a mortgage, and skyrocketing lumber prices. The competitive market provides a sense of urgency in putting an offer on a home and closing as quickly as possible, which can result in more unfavorable payments and costs, compounded with the fact that materials are just more expensive today than in the past.

13 common mistakes and how to avoid them

.png)

- Underestimating the commitment level involved

- Not shopping around for a mortgage

- Neglecting to consider all costs

- Forgetting about your emergency fund

- Assuming "new" means "better"

- Visiting your potential property only once

- Not taking time to see the neighborhood

- Buying a fixer upper you can't afford to repair

- Skimping on a quality home inspection

- Not taking one last look at the property

- Not getting a home warranty

- Making renovation decisions independently

- Not tracking project costs

1. Underestimating the commitment level involved

A house is a big purchase, and that typically comes with increased responsibility. For example, when you get a mortgage to buy a house, you are committing to make subsequent payments on that home loan for the next 15 to 30 years, which is a large financial investment.

Tip: Analyze, strategize, and counsel

Approach your home purchase like the large investment that it is — a house should never be an impulse purchase. Take time to establish what you want and need in a property and its location, analyze all the pros and cons of purchasing, and speak with friends, family, and real estate professionals to assess whether or not you’re ready to become a homeowner.

2. Not shopping around for a mortgage

Shopping around for a mortgage is one the most important steps in the homebuying process, but a step that is frequently overlooked by the majority of home buyers. Yes, it might take you more time to pre-qualify with multiple lenders, and rates are fairly similar across the board, but saving even the smallest margin of a point in interest could save you thousands of dollars over the life of your mortgage loan. And you won’t know what rates are available to you if you don’t shop around and pre-qualify with multiple lenders.

Tip: Read customer reviews

Rates and fees will be entirely dependent on your personal finances, including your credit score and debt-to-income ratio (DTI). But if you want an idea of what the rates and fees are like with a specific mortgage lender, reading customer reviews can be a game-changer. Since mortgage products and services and fairly similar among lenders, it’s important to get an idea of whether or not a company is trustworthy and if they provide reliable customer service — a mortgage is a large investment, so you wouldn’t want to be locked in with a lender that you can’t get a hold of or that can’t answer any of your questions.

Read Mortgage Company Reviews [From Real Customers]

Compare rates and fees, and see what customers have to say about the mortgage process experience with specific companies.

Read Reviews3. Neglecting to consider all costs

There are a lot of homebuying costs to consider, and that’s just a fact. The down payment is the big one that’s usually on the top of mind, but don’t forget about closing costs, moving expenses, home furnishings, and home maintenance costs that will inevitably come up. Crunch some numbers before you get too far in the homebuying process, or to simply map out the costs that might arise.

Tip: Don’t just focus on the down payment

Luke Babich, CSO/Co-founder of Clever, recommends the following:“I'd recommend anyone considering buying a house to make a balanced analysis of whether or not they can actually afford to buy a house. There's a common saying that just because you can afford the down payment does not mean you can afford the mortgage! Make sure you factor in important variables: house maintenance (which is on average $13,000 a year), mortgage payments, home insurance, and security.”

4. Forgetting about your emergency fund

The homebuying process includes many large upfront costs, not to mention that you will need to budget out your monthly mortgage payments throughout the life of your loan. Thus, it can be tempting to save up all money necessary to cover your home purchasing costs, but if you neglect to save up some money for emergencies, you may find yourself in deep water later on. Therefore, when you’re saving up to buy your dream home, also save up for your emergency fund.

Tip: Buy less house than you can afford

John Grimes, Realtor at BHGRE Metro Brokers, recommends the following:“It is very important that they draw the line at a level they're comfortable with going forward with no rosy assumptions of increased income. Ideally, a dual income couple should buy a house that either one of them can swing on their one income. That almost never happens, but it would reduce stress in the household. Buying below one's means leaves room for savings, vacations, entertainment, charitable giving, and other priorities.”

5. Assuming “new” means “better”

Daniele Kurzweil, the Friedman Team at Compass, explains how a new home doesn’t necessarily mean it’s “better”:

“Everyone loves walking into a home and seeing that there is no work to be done. Bring your toothbrush and you are home. Many developers and home flippers are catering to people who want new new new and design their projects to conform to whatever the latest trends are. Our clients walked into an apartment and fell in love with the open concept look with very modern finishes.

Fast forward six months and our clients realized that while an open concept floor plan might be wonderful for a two-story house, in an apartment it poses its own unique challenges. Sound travels, and when you have one big open room you have nowhere to escape to. The modern finishes were beginning to look dated, and since everything was out in the open, it was the only thing they could focus on.”

Tip: Consider the pros and cons of a new buy or build

Kurzweil continues:

“Design trends are just that — trends. When purchasing a home, be sure to consider what your needs are. Is this for starting a family? Empty nesters? First-time home purchase? Think of buying a new construction home kind of like buying a car: the second you drive it off the lot, it starts depreciating in value. You are buying new construction because it has never been lived in, and as such you are paying a premium. But when you go to sell, one of the biggest draws will no longer be there. . .it will no longer be new.”

6. Visiting your potential property only once

Imagine that you find a property that you can just feel is the right one. The neighborhood is beautiful and quiet. The neighbors seem nice. You’re ready to put down an offer right there and move in the next day. While this can happen and your gut feelings shouldn’t necessarily be ignored, you might want to visit the property again on another day.

When you only visit a property once, you might miss out on important factors, such as after school traffic, that might not actually be ideal. Additionally, a one-time visit might not provide you with enough time to take a close look at the property, which could cost you in the future if there were repairs or issues that you missed on your one and only visit to the property.

Tip: See the property at different times on different days

Gerard Splendore, Broker at Warburg Realty, recommends the following:“I sold a one-bedroom apartment to a first-time buyer and we only viewed it when school was in session, not at the beginning of the day for drop off or end of day for pick up. At the walk through the day before closing the street in front of the building was clogged with school buses and parents in cars. This came as a complete surprise to the buyers.

I always suggest seeing properties during the week at various times, in the evening, and on weekends. This is a great way to avoid any surprises about the surrounding area.”

7. Not taking time to see the neighborhood

Alison Bernstein, founder and CEO of Suburban Jungle, was the first of her friends and colleagues to leave the big city to live in the suburbs. She and her growing family found an area that seemed perfect on paper, but it turned out, after they moved, that the area wasn’t what they had anticipated at all and they realized that they really wanted something different.

The trouble is that real estate agents don’t always know neighborhood and community nuances, so it can be hard to get a complete picture of an area. For this reason, Bernstein started The Suburban Jungle, a company committed to helping families make the move to suburbia by making connections in the communities they’re interested in.

Tip: Meet people and make connections

Bernstein recommends the following:

“Talk to as many people that live [in the neighborhood] and try to get the real, non-sale pitch to understand what their day is like. Maybe meet them and run a few errands with them and see if you can see yourself there. You know, like even going to the school pick-up if you have kids, or going to some preschools and being there at the time of drop-off or pick-up. Those things go a long way because a lot of people see community on a Saturday and they're like, "oh, this looks fabulous," but it tells a different story on like a Tuesday afternoon.”

8. Buying a fixer upper you can’t afford to repair

Perhaps you’ve spent some time watching HGTV and have been entranced by shows like Fixer Upper or Good Bones. Maybe you think that buying a run-down home could be a fun and easy project. This could be true if you have a background in construction or home renovation, but for the average individual, buying a fixer upper home could cause more headaches and stress than you really want or need.

Tip: Don’t get in over your head

Alison Bernstein from Suburban Jungle explains:“If you have the appetite for fixing up and you don't get in over your head, and that's what you're excited about, then great. It's important to make sure that people have enough time because a lot of people are working full-time or have kids, and it is definitely a very time-consuming process. So as long as you can enjoy it and take it on, and like I said, more importantly, enjoy the process, then it's great. If you don't have a choice, you're stuck and you're renovating because you have to, I think it takes on a different light, but hopefully it's well worth it.”

9. Skimping on a quality home inspection

One of the best ways to induce remorse or regret is by skimping on a home inspection. In many cases, this might be a required part of your mortgage process. But if it isn’t, that doesn’t necessarily mean that it should be optional.

Tip: Pay more for a highly qualified inspector

Wally Conway, president of HomePro Inspections, recommends the following:“The single best way to avoid buyer’s remorse is to have clarity on what you are buying and have protection for the unexpected.

Your home inspection should be performed by the most experienced and technically competent home inspector that money can buy. Most buyers are taking on a 30-year mortgage, and that’s a long time to live in regret. It's also 360 mortgage payments! Wouldn't it seem wise to invest a mortgage payment to ensure that you have done as complete a job in due diligence as is humanly possible?

Consider protecting your home after the inspection is done by choosing a home inspection that includes protection to cover the cost of the unexpected problems that will come up with home ownership, such as live sewer line failures, mold, and roof leaks.”

10. Not taking one last look at the property

David Pipp, Personal Finance Blogger at Living Low Key, shares his experience not noticing an issue that could have been avoided:

“Shortly after we moved into the house, we had a massive rain storm and ended up with water in our basement. It wasn't until that issue arose that we noticed there were no gutters on the back side of the house where water got in. $2,000 later we had new gutters on the house and our water problem was fixed.

Since we moved in, we have had to add a water filtration system to the well, replaced both of the decks on the house, replaced a leaking toilet, and countless other small fixes totaling close to an additional $10,000. Next summer we plan to have the house re-insulated because it gets really cold during the Minnesota winters.”

Hire a second home inspector

One way you can ensure that nothing is missed, or any issues are overlooked, is by hiring a second home inspector. This might be an additional upfront cost, but having a second opinion at the start, and a comparison to your initial home inspection, could save you thousands of dollars later on.

11. Not getting a home warranty

After putting money into a mortgage, a home inspection, and more, you may want to shrug off getting a home warranty — after all, it would just be one more expense, right?

However, you never know what could happen once you close on your home. Perhaps, just days after closing, your water heater breaks or your air conditioning stops working. Without a home warranty, you could be spending a large amount of money out of pocket, whereas a home warranty could save you from some of these expenses in the long run.

Tip: Understand how a home warranty works

Jlyne Hanbak, REALTOR® Keller Williams Realty, explains:“A home warranty is a relatively inexpensive way to protect the major appliances and systems of a home for a specific period of time after the home is purchased. A home warranty can — and should — be negotiated into the contract on behalf of the buyer so that they are protected after their home closes.”

12. Making renovation decisions independently

When renovation decisions come up, it can be helpful and important to have a second, professional opinion on your next steps. While you might think that you could save more money by doing a Google search or seeing what other people have done on YouTube, these options may not be the best for your specific situation and could cost you more overall.

Tip: Hire a professional

When buying a fixer-upper home you need to get advice from a home improvement professional on its overall potential for making the improvements you're expecting to make.

13. Not tracking project costs

John Bodrozic, co-founder of HomeZada, explains:

“When you don’t budget and track costs on home remodel projects, you can end up way over budget. Plus, you don’t have a record of costs that can help you adjust the tax basis of your home at tax time.”

Tip: Budget and record expenses from day one

Keep a record of your home expenses from the very beginning, it’s really as simple as that.

Move forward without regret

The answer to avoiding home buyer’s remorse really comes down to three things: financial preparation, education, and awareness.

Learn about the different mortgage products available to you. Get loan offers with interest rates from multiple lenders. And before settling on a particular lender, read customer reviews about the top-ranked mortgage lenders. Are there hidden lender fees? Are the loan officers prompt to return calls and emails? Are other borrowers pleased with their experience?

Remember that a professional opinion could be a big money and time-saver. While it may seem like a hassle to get a contractor, home inspector, or other home professional to take a look at your property, it could save you from stress later on.

Buying a home, unfortunately, can often come with some buyer’s remorse — it is a large purchase after all. But if you prepare properly and learn from the mistakes of others, you can make the best decision possible without looking back.

Compare Top-Rated Mortgage Lenders

Read verified customer reviews and find the best mortgage lender for your needs.

CompareArticle updated by Kalicia Bateman

Contributors:

Luke Babich, CSO/Co-founder of Clever

John Grimes, Realtor at BHGRE Metro Brokers

Daniele Kurzweil, the Friedman Team at Compass

Gerard Splendore, Broker at Warburg Realty

Alison Bernstein, founder and CEO of Suburban Jungle

Wally Conway, president of HomePro Inspections

David Pipp, Personal Finance Blogger at Living Low Key

Jlyne Hanbak, REALTOR® Keller Williams Realty

John Bodrozic, co-founder of HomeZada

The Top Mortgage Lenders Companies

The Top Mortgage Lenders Companies

Related Articles

Mortgage Lenders

Planning to Refinance Your Mortgage? 5 Questions You Sh...

By Guest

April 12th, 2023

Mortgage Lenders

How Much Harder Is It to Get an Investment Property Loa...

By Guest

April 12th, 2023

Mortgage Lenders

When Should You Take Out a Second Mortgage?

By Guest

October 27th, 2022

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Mortgage Lenders and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy