8 Things to Know About Gifting Life Insurance

A life insurance policy reflects long-term commitment. It is a nice gift to give loved ones. Buying a life insurance policy on your life and naming your partner as the beneficiary is a valuable way to show your partner you care about them and their future.

You can also consider purchasing a whole life insurance policy for your children. Once they are old enough, you can pass the policy on to them. Using the cash value of the policy can help them pay for school and other life goals.

Before you decide to get a life insurance policy as a gift, you need to consider your financial needs and goals. Consider whether or not your family members need life insurance. Work with a trusted financial adviser to determine whether life insurance is a good financial move.

Depending on your situation, life insurance may not be a good fit as a gift. For example, if you've only been dating for a week, a life insurance policy is at least overkill and at worst a red flag. (You most likely won't be able to show insurable interest anyway.)

Farmers Agency Owner John Williams says life insurance can be worthwhile gift under certain circumstances:

"It’s a great gift if it is to cover your loss of income, expenses, and debts for your loved ones. It’s a good gift if your other option is receiving nothing. And it’s a pretty smart gift to protect the future insurability of your children or grandchildren."

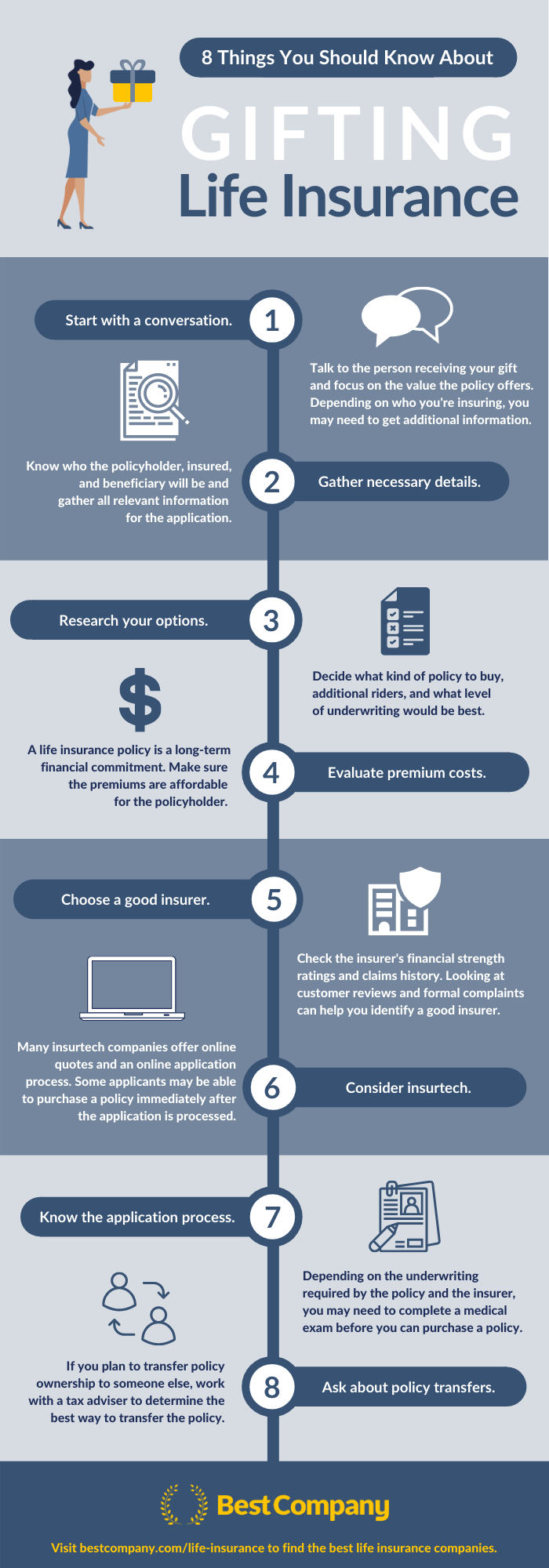

If life insurance is a good fit for your family's situation, here are eight things to know as you look into buying life insurance as a gift:

- Start with a conversation.

- Gather necessary details.

- Research your options.

- Evalutate premium costs.

- Choose a good insurer.

- Consider insurtech.

- Know the application process.

- Ask about policy transfers.

1. Start with a conversation.

If you're buying an insurance policy to insure someone else's life, you'll want to have a conversation with them before you start the process. The insured has to provide information for underwriting, and you don't want them to be surprised when they're contacted by the insurer.

While this makes a life insurance policy not a surprise, it does show your thoughtfulness and planning.

If you're buying a policy for a minor, you'll usually need to understand the applicable rules. Felix Malitsky, Fortis Lux Financial president, identifies a few:

- "Generally, insurance coverage will be limited to a maximum percentage of the coverage on a parent.

- All siblings must have an equivalent amount of coverage.

- The child must be at least 15 days old.

- Ages 15 and younger need parental sign-off even if the policy is owned by a grandparent."

If you're a grandparent, you'll need to have a conversation with your grandchild's parents about buying a life insurance policy.

You may be able to make your gift a surprise if you're buying a life insurance policy to insure your life and naming your partner as the beneficiary.

Depending on family dynamics, a conversation can still be worthwhile, especially if the person you're buying the policy for will take responsibility for premium payments.

Jacob Irving, Willamette Life Insurance Founder, recommends approaching these conversations focused on the value of the policy:

"Explain why you are providing this gift. It could be to leave kids/grandkids an inheritance, charity donations, or to provide a lasting legacy. Build a value that you know they will be able to understand and see."

2. Gather necessary details.

Before you apply for a policy, know whose life you're insuring, who the policyholder will be, and who you'll name as beneficiaries.

As you choose the policyholder, insured, and beneficiaries, you'll want to avoid the Goodman triangle. If all three parties are different people (even if you name multiple beneficiaries and one is also the policyholder), the policyholder will be subject to gift taxes.

To avoid these issues you can work with a tax professional to discuss using an irrevocable trust as the policy's beneficiary.

More simply, you can have the policyholder and the beneficiary be the same person or the policyholder and the insured be the same person. (The insured person cannot also be the beneficiary for obvious reasons.)

When you apply for a policy, you'll want to have basic information about the insured: name, gender, birthdate, and health history. These details are necessary to complete the application and underwriting.

"When buying a life insurance policy as a gift you will also need to know the person you are insuring personal information such as a driver’s license and Social Security number. Finally, make sure you know the health of the person so you can answer the medical questions completely and accurately," advises Manny Lirio, Vantis Life AVP Consumer Direct Marketing.

You will also have to provide insurable interest, which shows you have a reason to buy an insurance policy. For example, you can't just buy a policy on your favorite singer. You have to have a familial tie or strong financial connection.

"It should be a direct relative, or perhaps even a business partner with a mutual business interest, but should always be discussed with the person who you are purchasing the policy beforehand as they may have to answer questions or have tests done to determine their eligibility," says Duncan France, State Farm Agent.

3. Research your options.

There are many types of life insurance policies. You can find temporary and permanent policies. Some policies are fully underwritten, which means a longer and more thorough application process. Others require a less thorough application and review like guaranteed issue life insurance. Policies can be customized with riders that add benefits or protect your policy.

"Some policies accumulate cash value, such as whole life, final expense, or universal life policies, where others, such as term policies, can maximize your dollar but are only in force for a set period of time. Cash value policies can be accessed by the owner of the policy at any time, so keep that in mind when gifting insurance," says France.

All of these options can be daunting, so understand why you're buying life insurance and what your needs are. Working with a trusted life insurance agent or agency can also help you explore and narrow down your options to find a good fit.

4. Evaluate premium costs.

"Gifting life insurance is a great idea, as long as you understand that most of the time it is not going to be a one-time gift. You will need to understand the type of policy and the premiums (cost) associated with the policy. There may be annual premiums that will need to be paid each and every year for a set period of time or forever," says Michael Foguth, Foguth Financial Group founder.

The policyholder is responsible for covering monthly premiums. If you're the policyholder, know what your budget looks like and how much you can spend on premiums.

If you plan to transfer ownership of the policy, be sure you have a sense of how much the new policyholder can afford in terms of the monthly premium.

However you plan to handle your gift of life insurance, be sure that you or your gift recipient are prepared for the financial commitment.

5. Choose a good insurer.

Be sure that you purchase a policy from a trusted insurer. A.M. Best rates insurers for their financial strength. The highest ratings are A-, A, A+, and A++. Insurers with these ratings are financially stable and will likely be able to make claims payments.

Aside from choosing a financially strong insurer, you'll want to consider the customer experience, particularly when it comes to claims. Read trusted customer reviews and check government sites for formal complaints.

If you decide to work with an insurance agent, you'll want to find someone trustworthy and with good experience. Customer reviews and referrals from friends or family can help you with this. It can also be worthwhile to double check that your agent has a license to sell insurance in your state.

Top Life Insurance Companies

Learn more about your life insurance options by looking at the top-rated companies and their offerings.

Learn More6. Consider insurtech.

Insurtech companies are making applying for life insurance simpler, faster, and more convenient. You can apply for temporary and permanent life insurance policies online. In some cases, you'll need to complete medical underwriting either with a medical exam or with an at-home kit.

Most insurtech companies offer policies from highly rated insurers. Before you work with an insurtech company, check the insurer that underwrites the policies for its financial strength ratings.

If you're looking for a quick application process, purchasing life insurance through an insurtech company is a great option.

Life Insurance InsurTech Companies

Learn more about eight insurtech companies by looking at their offerings and customer review data.

Learn More7. Know the application process.

You can apply for a policy by working with a life insurance agent, using an online platform, or working directly with an insurer. However you decide to apply, ask questions about the application process to make sure you understand what to expect.

Most online applications are straightforward and user-friendly. However, you should understand how the platform uses your application. Does it stay with the insurer? Does the site allow you to compare policies from multiple insurers? Will your application be sent to multiple insurers or just to the insurer you selected? Does the company keep your information anonymous until you decide to buy a policy?

If you're working with a life insurance agent or directly with the insurer, ask questions about how long the process will take and what to expect from underwriting.

8. Ask about policy transfers.

You can change the ownership of a life insurance policy. Be sure you understand how to change the ownership of the policy. Review any tax ramifications associated with transferring policy ownership.

This is particularly important if you're buying a whole life insurance for a child or grandchild and plan to transfer ownership to them. You may be required to pay gift taxes, so evaluate your options and plan the transfer with a tax adviser.

"The Internal Revenue Service limits the amount that people can give tax free to a child in a particular year. For larger premium policies, a properly structured ownership arrangement allows you to take full advantage of those limits. The policy’s cash value grows on a tax-deferred basis and may eventually be worth far more than your original gift," says Malitsky.

If you transfer ownership, you may also pass along responsibility for premium payments. If you want to avoid this situation and the potential of a policy lapsing, One Stop Life Insurance owner Zhaneta Gechev recommends buying a financed policy:

"What we recommend is if you want to buy life insurance as a gift, make sure you pay off the policy before signing off to them. There are 10-Pay or 20-Pay policies. For a few extra dollars a month, you will have the opportunity to completely pay off the policy before signing it to the insured. In this case, you would gift them a life insurance policy, without the monthly bill. It will stick and they will appreciate it more."

The Top Life Insurance Companies

The Top Life Insurance Companies

Related Articles

Life Insurance

How Much Life Insurance Do Dads Need?: Breaking Down th...

By Guest

June 24th, 2021

Life Insurance

New Parents and Life Insurance: What to Consider

By Guest

May 20th, 2021

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Life Insurance and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy