Teen Driving 101: What Your Teen Should Know About Insurance

Topics:

auto insurance 101Beginning to drive is a great opportunity to help your teen learn about how insurance works. Our survey found that 39 percent of people who had either gifted or received a car as a gift didn't know what kind of insurance coverage they had. Most of the people responding "don't know" had received the car as a gift (89 percent).

Below are some important things to understand about coverage requirements, coverage options, and claims.

Coverage requirements

Most states require drivers to carry a certain amount of liability insurance coverage with their car:

California

Motor vehicle liability insurance minimum requirements: $15,000 for injury/death to one person; $30,000 for injury/death to more than one person; $5,000 for property damage

If you don't want to get insurance, you can work with the DMV to do a cash deposit, self-insurance, or a surety bond.

Texas

Motor vehicle liability insurance minimum requirements: $30,000 bodily injury coverage per person up to $60,000 per accident, $25,000 coverage for property damage

New York

Liability coverage minimum requirements: $10,000 property damage, $25,000 bodily injury and $50,000 for death for a person involved in an accident; $50,000 bodily injury and $100,000 for death of two or more people

Work with your insurance agent and financial advisor to determine the right amount of liability coverage for your situation.

Beyond liability insurance, some states also require uninsured/underinsured motorist or personal injury protection coverage. Your insurance agent should know what the requirements are.

If you purchased a car with a car loan, your loan carrier may require you to add other coverages to your insurance policy.

Coverage options

Whether other coverages are required or not, it can be helpful to add them to your policy for additional protection:

- Comprehensive — covers damage to your vehicle resulting from non-collision events (e.g. falling objects)

- Collision — covers damage to your vehicle from collisions; generally speaking, coverage is for damage where you're the at-fault driver

- Uninsured/underinsured motorist — depending on the kind you buy, this coverage can offer payouts for medical bills, lost income, and property damage if you're in an accident with a driver without sufficient liability coverage

- Medical payments — helps pay medical expenses for you and your passengers

- Personal injury protection — helps pay your medical expenses and may replace some income if you're injured and unable to work

- Roadside assistance — assistance if you encounter problems on the road

- Rental car — covers some rental car costs if you're unable to use your car while it's in the shop for covered repairs

Claims

You need to ensure that your current insurance cards are in your car or with you at all times. If you are pulled over or get in an accident, you'll need to have your insurance information available to exchange with the other driver or show the police officer.

Insurance is there for the big things. If your car has minor damage or a scratch from backing into a pole or your garage door, it may not be worth filing a claim. Generally speaking, your insurance premiums can increase if you file a claim or someone else files a claim on your insurance with the company.

Before you file a claim, assess your needs and coverage. Depending on the coverage you have and the circumstances of the claim, you may be on your own. For example, if you don't have collision coverage and backed into a pole, you can't make a claim.

Or, if you're in an accident and the other driver doesn't have sufficient insurance, you can turn to your own insurance coverage if you have uninsured/underinsured motorist coverage.

When you file a claim, you'll need to have your insurance information handy. You'll also want to have a copy of the police report or the information for locating the incident report.

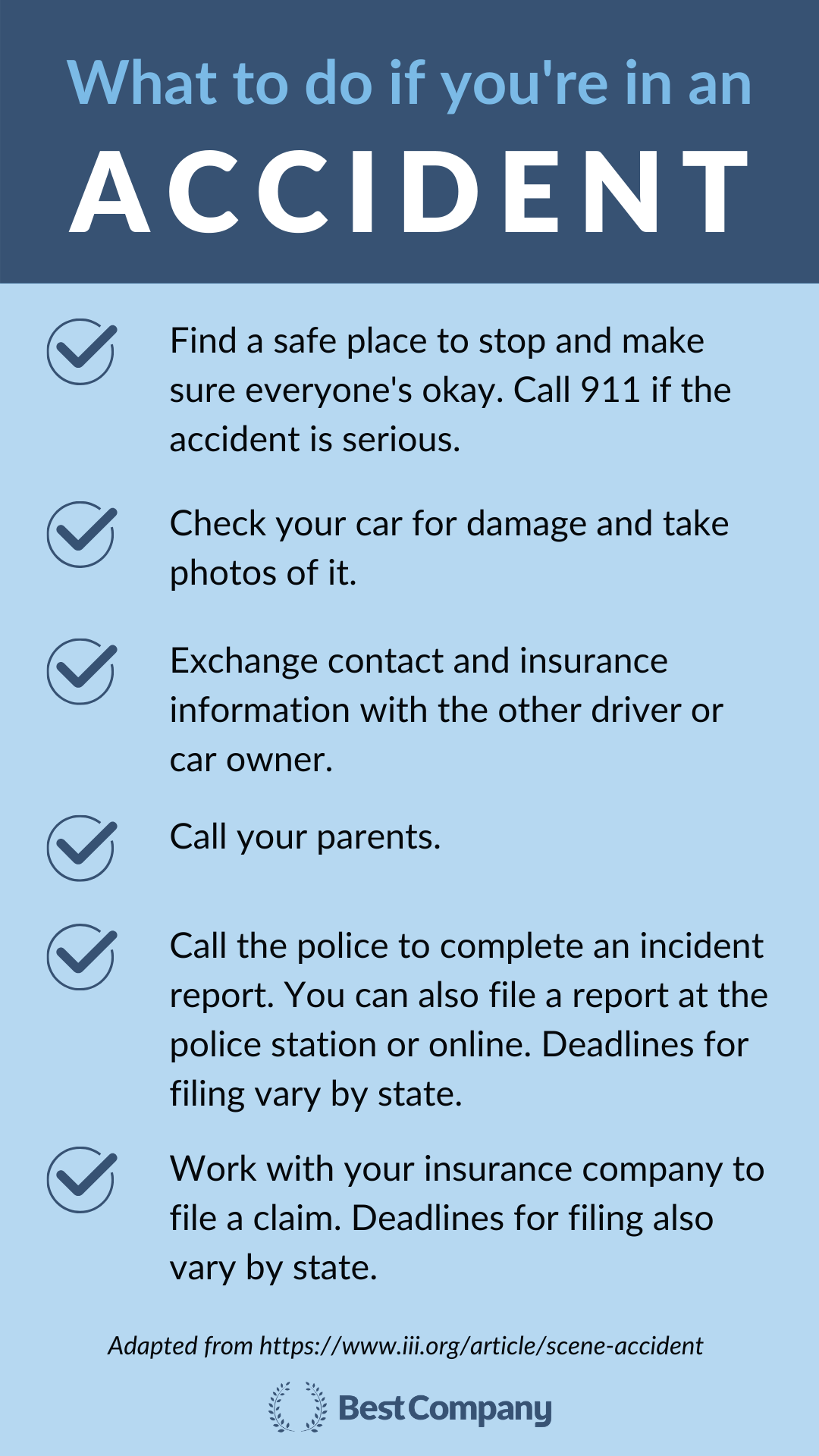

What to do if you're in an accident

If you're in an accident, find a safe place to pullover. Make sure everyone is okay. If you need emergency assistance, call 911. You should also call your parents to let them know what happened.

Exchange insurance information with the other driver. Take photos of damage. Call the police to file an accident report.

Be timely with all of the actions you take. States have deadlines for filing accident reports and insurance claims.

Download Accident Checklist

Download, screenshot, and save this checklist to your phone so you know what to do if you're in an accident.

Download ChecklistSurvey Methodology: Survey data was collected in March and April 2021 with 137 respondents through SurveyCircle, Survey Monkey, and emailing Best Company reviewers.

This article is the third in a series on teen drivers. Read the complete guide by following the link below:

The Top Auto Insurance Companies

The Top Auto Insurance Companies

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Auto Insurance and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy