Energy Efficiency Financing | Why and How You Should Invest in an Energy Efficient Home

A home uses a lot of energy, which impacts the environment as well as your wallet.

The average monthly utility bill for a home in the United States is nearly $400, with approximately $115 of that bill accounting for the cost of energy use (heating, cooling, lighting, etc.).

And household energy accounts for 20 percent of greenhouse gas emissions in the United States.

What if there was a way to offset both spending hundreds of dollars on utilities each month and contributing to greenhouse gas emissions?

Table of Contents:

Why you should buy an energy efficient home or invest in energy efficient upgrades

Energy efficiency financing options

How to qualify for energy efficiency financing

Question and answer with an energy efficiency expert

Why you should buy an energy efficient home or invest in energy efficiency upgrades

An energy efficient home can save you 25 percent on utility bills, amounting to over $2,200 in annual savings. These savings can make up for the higher price tag of an energy efficient home and help relieve financial stress while paying down a mortgage.

If you currently have a home, investing in home energy efficiency upgrades could save you hundreds of dollars each month. Not to mention that making energy improvements will raise the value of your home, bringing in extra cash if you decide to sell in the future.

Additionally, an energy efficient home purchase, or investment in upgrades, has a positive impact on the environment — reducing electricity and fuel use that contributes to a large percentage of greenhouse gas emissions in the United States. Greenhouse gases are a leading cause in climate change and making even the smallest of energy use adjustments in your home can benefit the environment.

Energy efficiency upgrades

Focus on where you’re using the most energy in your home and the cost-effective fixes available to you.

Home energy use

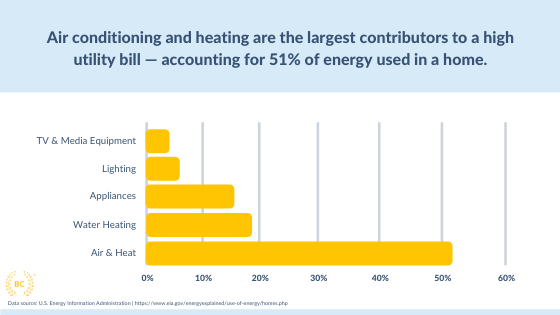

More than half of the energy consumption in your home comes from heating and air conditioning — combined, heating and cooling account for approximately 51 percent of energy use.

Beyond heating and cooling, water heating accounts for nearly 20 percent of energy use with lighting, refrigeration, appliances, and TV and media products accounting for the remainder of energy used in a home.

It is worth noting that while heating and cooling are combined in the graph above, heating actually accounts for approximately 46 percent of home energy use on its own.

Home energy upgrade options

There are many energy efficiency upgrades you could make to your home. If you want to do them all, more power to you, but you don’t need to do everything at once.

Insulation

Insulation is key to reducing heat loss in your home and is a recommended home energy upgrade.

Insulation makes the biggest difference when installed in the attic, basement, or crawl space — any spaces where there are likely to be more air leaks. And insulating these spaces can save you up to 15 percent on your heating and cooling costs.

There are different types of insulation available:

- Blanket batts and rolls

- Spray foam insulation

- Blown-in insulation

- Foam board or rigid foam panels

- Reflective or radiant barrier

If you’re looking for a DIY insulation option, blanket batting or rolls is an easy installation that is also cheaper than other insulation types. Another popular option is spray foam insulation, which would need to be installed by a professional. There are two types of spray foam: open cell and closed cell foam. Closed cell foam has a higher insulation value, but will be more expensive than its open cell counterpart.

Insulation costs will be entirely dependent on the type of insulation you choose, but you may want to budget between $1,500 and $3,500.

Solar panels

Solar panels have become a popular clean energy option over the last decade. Purchase and installation has become more affordable, making it easier to save money on your utility bills, while also reducing your carbon footprint.

Additional incentives for installing solar panels include a U.S. federal tax credit of 30 percent, as well as state-specific tax credits and rebates. To know exactly which tax credits and incentives are available in your area, you can speak with your solar provider.

While solar panels are designed to generate energy from direct sunlight, they can still be a viable option for those who live in cooler climates — photovoltaic solar panels are an all-climate option.

The cost of solar panel purchase and installation ranges from $17,000 to $24,000.

New doors and windows

Old windows and doors can account for a significant portion of your heating bill through heat loss. It can be costly to replace windows and doors, and if you’d prefer to invest in a more cost-conscious option you could insulate windows and doors instead.

Replacing doors could cost you $900 to $2,600. Replacing windows can cost anywhere from $400 to $900.

Smart fixtures

The fixtures in your home, such as your thermostat, lights, and power outlets, can use a lot of energy. But, you can purchase light switches, outlets, and thermostats that can help you control your energy use instead of eating it up.

Smart thermostats, in particular, are a recommended fixture that can control how much heat and air you use in your home. A smart thermostat can cost anywhere from $100 to $500, while installation can cost anywhere from $200 to $500. This may seem like a steep cost, but it could save you hundreds of dollars each year. Not to mention the positive impact it can have on the environment — according to Energy Star, 13 billion pounds of greenhouse gas emissions (equivalent to emissions of 1.2 million motor vehicles) could be offset each year if everyone used a smart thermostat.

New water heater

The second highest cost on your utility bill, after heating and cooling, is water heating. Replacing a water heater can cost anywhere from $500 to $1,800, but could save you upwards of $100 a year on your utility bill.

Furnace filters

It is recommended to replace your furnace filter every three months, or at least once a year, depending on the size of your furnace. It is important to replace the filter regularly because an old, dirty filter will require your furnace to work much harder, using up much more energy that it would otherwise.

Priority energy upgrades

As seen above, there are many energy efficiency upgrades that you can make in your home, and that doesn’t mean that you need to do all of them.

If you’re unsure where to start in completing energy efficiency upgrades, it is best to start with smaller, simple fixes, allowing you to prepare for larger upgrades down the road.

Energy efficiency financing options

In most cases you can finance energy efficiency upgrades or a home purchase through your mortgage, but it is important to work closely with your lender.

Beyond a mortgage, there are various options available to finance an energy efficient home purchase or energy upgrades:

Energy Efficient Mortgage (EEM)

An Energy Efficient Mortgage (EEM) can be used to purchase or refinance an energy efficient home, like an ENERGY STAR certified home, or to finance energy efficient improvements to your current home.

EEMs are backed by either private lenders or federal mortgage programs through the Federal Housing Administration (FHA) and Veteran Affairs (VA).

Department of Energy’s (DOE) Weatherization Assistance Program

The U.S. Department of Energy (DOE) Weatherization Assistance Program (WAP) is intended to cover the costs of energy efficiency improvements for low-income households.

Each state has specific weatherization services and WAP programs that can connect you with local weatherization organizations.

Fannie Mae HomeStyle Energy Mortgage

With a Fannie Mae HomeStyle Energy Mortgage you can borrow money to purchase or refinance an energy efficient home, reduce utility costs by financing energy efficiency upgrades, and/or finance natural disaster damage prevention improvements to your home.

For weatherization upgrades you can finance up to $3,500 without acquiring a home energy report, and borrowers may also qualify for a $500 Loan Level Price Adjustment (LLPA) credit.

Freddie Mac GreenCHOICE mortgage (home purchase or refinance)

Finance an energy efficient home purchase or energy efficiency upgrades with a Freddie Mac GreenCHOICE mortgage. In most cases you must have an energy report to apply for financing, but for basic upgrades less than or equal to $6,500 an energy report isn’t required.

GreenEnergy Money

GreenEnergy Money (GEM) is an organization that offers financial solutions for new energy efficient home builds and retrofit projects. GEM partners with mortgage and financial companies, as well as builders and developers, allowing affordable energy reductions to be made in communities across the country.

Property Assessed Clean Energy Programs (PACE)

Property Assessed Clean Energy (PACE) programs exist for both commercial and residential properties. PACE programs offer solutions to cover the upfront costs of energy and energy improvements.

PACE financing is tied to a property, not individuals.

On-bill financing (OBF) & On-bill repayment (OBR)

With on-bill financing (OBF) or on-bill repayment (OBR), a private lender or utility provider arranges financing to fund energy efficiency or renewable energy improvements. These loaned funds are added and repaid through existing utility bill payments. OBF and OBR are typically low-to-no interest rate financing options, but are not available in all regions or states.

How to qualify for energy efficiency financing

In most cases, qualifying for an energy efficiency mortgage or other financing services requires a home energy rating. Your home is rated on a scale from 0 to 150 with a lower score indicating a more energy efficient home.

To get a home energy rating you will need to schedule a home energy assessment with a certified home energy rater. The energy rater will inspect multiple features in your home such as insulation, windows and doors, heating and cooling systems, and potential air leakage. After this inspection, you will be given an energy rating and energy report. The report will include energy efficiency improvement suggestions and estimated costs, as well as potential annual savings.

To qualify for financing if you are purchasing an energy efficient home, your home energy report must indicate that the home is energy efficient.

To qualify for financing for home energy efficiency upgrades, your home energy report must indicate that the upgrades will make the home more energy efficient and that these improvements are cost-effective.

Bonus: Question and answer with an energy efficiency expert

We asked Anna DeSimone, an energy efficiency expert and author of “Live in a Home that Pays You Back A Complete Guide to Net Zero and Energy-Efficient Homes,” some common questions that homeowners might have when approaching the topic of energy efficiency.

1. What are common financing options for purchasing an energy efficient home or financing energy efficiency upgrades? Are there certain options that you would recommend?

Homebuyers looking to complete energy improvement are able to finance a good portion of the improvement costs with their mortgages. The amount of costs can be as much as 20 percent over the purchase price. Mortgage lenders who are authorized to originate loans to Fannie Mae, Freddie Mac, FHA or VA can offer such programs.

Lenders generally require an energy assessment, along with an estimate from a licensed contractor. If you’re planning to purchase or lease solar photovoltaic panels, they would ask for copies of the agreements. For smaller projects (less than $5,000) energy assessments are not required.

2. What are the priority energy efficiency improvements homeowners should make?

Most energy consultants recommend that homebuyers upgrade the heating, ventilation, and air conditioning (HVAC) system — since a good operational system helps deliver the maximum efficiency.

Upgraded HVAC will improve indoor air quality, and today’s technologies have systems that capture biological pollutants and other toxins that result in cleaner air and a healthier environment for your family and pets.

Other key energy measures include adding extra insulation, air sealing, and installing energy-efficient doors and windows. Small changes can make a difference — such as programmable thermostats and LED lighting.

3. What if you don't own your home? What energy efficiency improvements could you make?

People who are renting a single-family home could “lease” solar photovoltaic panels. However, renewable energy systems require upgraded electrical systems which may not be feasible.

Renters of condos, townhouses, and apartments can reduce their energy by installing window treatments (shades or curtains) that help keep the warm air inside in the winter, and reduce the heat of the sun in the summer. Other changes can include buying Energy Star appliances, LED lighting, and programmable thermostats.

4. When buying a house, how do you know it's energy efficient? What should you be looking out for?

Most homebuyers order a professional home inspection which assesses the entire structure of the home, HVAC, and its operational systems. To determine whether or not the home is energy-efficient, homebuyers can also order a home energy assessment from a professional rating company.

The home energy rater will assign a relative performance score such as the well-known HERS Energy Score from the Residential Energy Services Network (RESNET). You can learn about the HERS Index, Energy Score, and locate a HERS energy rater on the RESNET website.

The U.S. Department of Energy offers a program called Home Energy Score, and provides detailed explanations about the testing process and assessor locator by zip code.

5. Should energy efficiency upgrades be a priority for homeowners?

Energy efficient upgrades are best completed in an efficient manner.

An outdated HVAC system, or insufficient electrical panel can become a home’s “weakest link” when you’re attempting to reduce energy. If you are considering a solar photovoltaic system (or other type of renewable energy system such as geothermal, wind, or power) keep in mind that such systems are far more effective on homes that are well-insulated and with sound operational HVAC systems.

The results of your home inspection report — coupled with an energy assessment — can be the basis for developing a strategic plan. Many important priorities in a home need to be met for your family’s health and safety, and each of these priorities can be implemented in accordance with your household needs, budget, and environmental goals.

The Top Mortgage Lenders Companies

The Top Mortgage Lenders Companies

Related Articles

Mortgage Lenders

Planning to Refinance Your Mortgage? 5 Questions You Sh...

By Guest

April 12th, 2023

Mortgage Lenders

How Much Harder Is It to Get an Investment Property Loa...

By Guest

April 12th, 2023

Mortgage Lenders

When Should You Take Out a Second Mortgage?

By Guest

October 27th, 2022

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Mortgage Lenders and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy