What Does Homeowners Insurance Cover?

You've spent years saving and have finally started to look at houses. If you're reading this article, you're being thorough in your research.

Understanding what home insurance covers and how it works will help you confidently step into your new role of homeowner.

A homeowners insurance policy includes covered perils and covered items. For your home's structure and your personal belongings, you can choose between replacement cost and actual value coverage.

The level and types of coverage included in your policy affect your insurance rate. While it's tempting to find the lowest rate, you still need to maintain good coverage should you need to file a claim.

Here are the details you need to know:

Considering insurance coverage and cost from the beginning of your house hunt can also help you better assess your price range and negotiate.

Ricardo Mello

Real Estate Expert

Consider insurance costs early:

The cost of homeowners insurance can be surprising, especially in states like Florida, when features like the roof are over 25 years old. That's why it's essential to ask these questions at the beginning of your home search. Find out how old the roof is and even how much the seller is currently paying for their policy. Any information you can get, the better because you can use it as leverage in your offer, potentially getting a better purchase price.

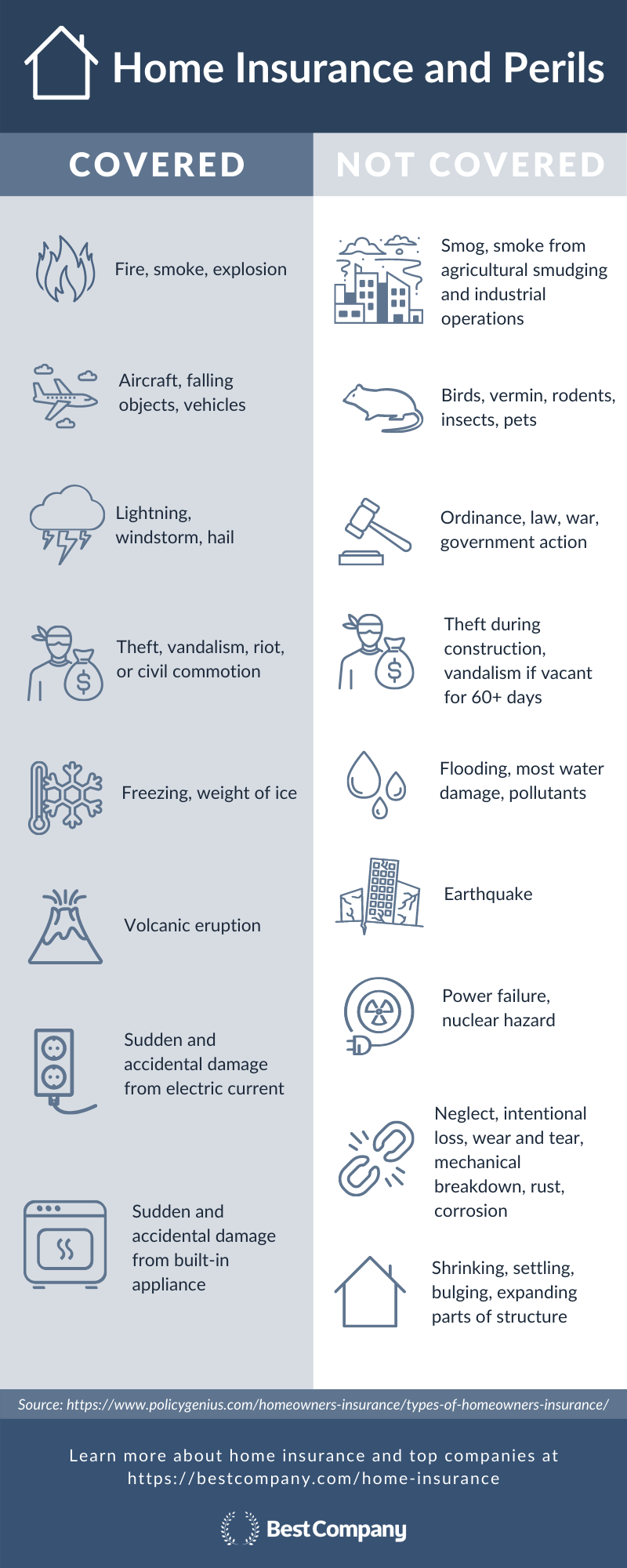

Covered perils

Home insurance policies have specific terms around when coverage applies. These are called covered perils.

Some policies are "open perils" or "named perils." Policies with open perils list the exclusions, or the situations where your policy doesn't offer coverage. Policies with named perils list the specific circumstances where the policy's coverage is in force.

Some of the common covered perils include the following:

- Explosion

- Fire

- Smoke

- Riot or civil commotion

- Lightning

- Windstorm

- Hail

- Aircraft

- Vehicles

- Smoke

- Vandalism

- Theft

- Falling objects

- Freezing

- Weight of ice

- Accidental water discharge or overflow

- Sudden and accidental tearing

- Cracking

- Burning

- Bulging of built-in appliance

- Sudden and accidental damage from artificially generated electrical current

- Volcanic eruption

Consider everything you keep in your home and your home itself. Obviously, if any of the above events affected your home, a homeowners policy would offer valuable protection.

Customer Review: Mandie Bremer from Upper Marlboro, Maryland

"My parents had this insurance about 20 years ago our basement caught on fire and Allstate did everything they could to make sure the process ran smoothly and we got everything that was lost in the fire replaced."

Whatever your approach to covered perils, be sure to understand what perils your policy covers as there can be variation. For example, events like floods and earthquakes are not covered. In some cases, you may be able to add coverage for uncovered perils or purchase a separate insurance policy.

"Many do not realize that many water items such as sewer back up and hidden water are not included in their policy without specifically endorsing or adding it on. Oftentimes, when quoting you need to specifically ask what is not included to be aware of what add ons are available," advises Marissa Sweet, commercial property and casualty insurance advisor.

Take Sweet's advice and review your policy before purchasing it so that you understand the coverage you're getting. Reviewing your water damage coverage can pay off in big ways.

Customer Review: Megan Rigby

"When our water heater went out and water leaked through the walls, carpet and required repairs, State Farm stepped up and handled everything. It was such a smooth process and took a lot of the stress away associated with such an event."

Home insurance reviews on BestCompany.com generally focus on the reviewer's experience with their agent and customer service. However, a small number of reviews discuss specific claims experiences. Claims related to water damage were mentioned more frequently than other types of claims.

Customer Review: Spencer Shuenman from Pleasant Grove, Utah

"They were very helpful when we had a water line burst in our bathroom and provided excellent service and assistance."

Personal experience: Damage from animals

Christopher Adams, ModestFish founder

"We live in a house with a densely populated wooded area in the backyard — less than 100 yards from my back door. We often have spot deer and other wildlife making an appearance in the yard. Last year though, in late August, we arrived home to find a medium-sized buck stuck partially inside our house, having jumped straight through a large pane glass window that is direct to our backyard. After a lot of panic, and several phone calls later — it turns out that this absurd accident would not be covered by our standard homeowner insurance policy. In fact, they let us know that any damage caused by insects, birds, and wildlife would not be covered in most situations.

While we were aware of some more commonly known things that would not be included, such as flood insurance, this was a shock out of the blue for us. While we weren’t able to have nearly 3,000 dollars reimbursed — we now have a pretty nice fence around the woodline."

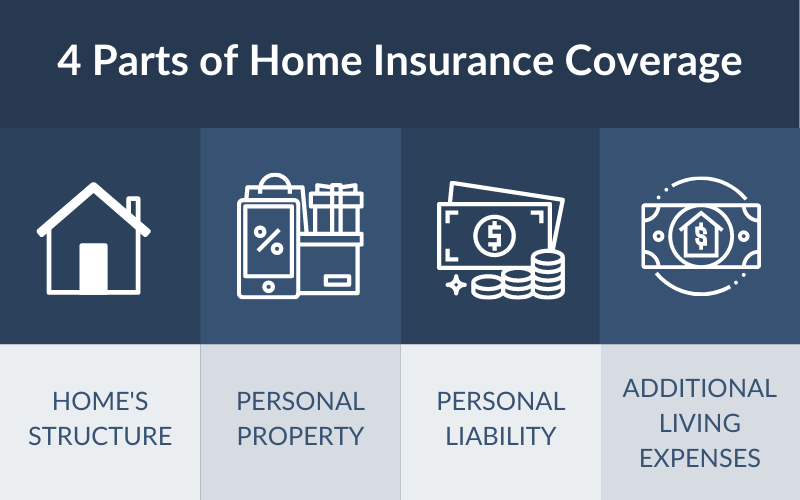

Covered items

Home insurance policies usually cover the following four things:

- Dwelling — Coverage for the home structure and any attached structures like a garage. If you have unattached structures on your property, you can often add separate coverage for those.

- Contents — Coverage for your personal belongings. If you have high value items, you can insure them separately for better coverage.

- Personal liability — Coverage if someone is injured on your property or you damage someone else's property accidentally.

- Additional living expenses — Coverage for some living expenses if your home is damaged and you can't live in it temporarily.

All of these coverages protect your finances in worst case scenarios. One of the helpful aspects of contents coverage is that it covers your belongings even outside of your home. One State Farm customer review demonstrates the value of this coverage:

Customer Review: Mike Halliday

"When my wife, kids and I moved from one state to another, our moving truck was in an accident. All of our furniture and most personal belongings were lost or damaged beyond use. Our State Farm agent helped us submit a claim and we were able to furnish our new house, which brought a great deal of piece of mind. Thank you SF!"

Keeping track of your personal property will help you as you determine whether you need to buy additional coverage for some items and will come in handy when you file a claim.

"It is advisable that homeowners take a home inventory of their personal property and the structure of their home. Then they can share it with their insurance company or agent who can actually review what is inside your home. Then you can make sure you are properly insured and prepared in case you ever needed to make a claim," says John Bodrozic, Homezada cofounder.

Additional living expenses coverage came in handy for another reviewer:

Customer Review: Rashida Laumatia from Saint George, Utah

"When my house flooded due to plumbing, not only did they put my family up in a hotel, they covered all the damges. Love the customer service and how helpful they were."

Instead of having to pay for your mortgage and another place to live while your home is inhabitable and undergoing repairs, additional living expenses coverage offers peace of mind because it covers these extra living expenses.

Coverage strategies

Some home insurance policies offer actual value coverage for your belongings and home. With this approach, your insurance company will payout the value of your home or belongings when you make a claim. The value of many things depreciates over time, so this coverage strategy does not pay for the full cost of replacing something.

Actual value coverage is cheaper because the insurer is responsible for less. If you could afford to replace many things in your home, then actual value coverage may be a good fit.

Replacement cost coverage means that the insurer will pay what it costs to replace your home and belongings up to your policy's limits. If you couldn't afford to replace your things or home, then opting for replacement cost coverage can be a smart move.

"Although you want to insure it for what you may have paid for it, if you do not insure it at the replacement cost and are not within the correct percentage of that, the insurer is able to pay claims based on percentages or actual cash value. It is good practice to go over with your agent the replacement cost and how they were able to get to the dwelling value," suggests Sweet.

You'll pay higher premiums for replacement cost coverage since the claims payouts are typically higher compared to actual value coverage.

Most policies cover the dwelling at replacement cost and personal property at actual value. Some insurers offer the option to increase your replacement cost value coverage with a rider. You can also change your personal property coverage to replacement cost if you want to.

Premium costs

After you've considered coverage and policy features, you need to look at cost. Of course, you have to be able to afford monthly premium payments, and it's tempting to adjust coverage levels and the deductible to cut costs.

Opting for replacement cost coverage generally means higher premiums because it offers more coverage. Actual value coverage is cheaper because coverage is lower.

You can also adjust the size of your deductible. A higher deductible means you take more financial responsibility for expenses initially when you file a claim. A lower deductible puts more of that initial responsibility on your insurer.

Adjusting the deductible doesn't affect the coverage limits on your policy. Once the coverage limit is met, you'll resume financial responsibility for repairs and damage.

Beyond making changes to the type of coverage included and deductible amount, many home insurance companies offer discounts. Specific discounts vary by insurer; however, some common offerings for the industry include the following:

- First-time homeowner — Discount applied if it's your first time buying a home.

- New home — Discount applied if you purchase a newly built home or a new-to-you home depending on the insurer's terms.

- Claims-free — No claims filed within a specified time period.

If you bundle auto and home insurance policies from the same insurer, you'll often receive a discount on your auto insurance rate.

Personal experience: Increasing the deductible

Kris Lippi, Real Estate Broker and CEO of ISoldMyHouse

"The question I wish I asked before was: Is it wise to increase my deductible so that I can save on premiums? This is because doing so entails a bigger responsibility falling on your shoulders, should a claim be made.

Plus, there is really no one-size-fits-all answer to this question because the correct answer depends on the financial position of the insured. So, while on the onset, increasing the deductible looks like the better choice, the decision should not be taken lightly — which is why I wished I asked about this before."

Protect Your Home with Home Insurance

Learn more about homeowners insurance by looking at the top-rated companies and their offerings.

Learn More

The Top Home Insurance Companies

The Top Home Insurance Companies

Related Articles

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Home Insurance and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy