Dental Insurance with No Waiting Period Guide: What You Need to Know

Topics:

GuidesYou have a toothache and are worried about what the potential costs of treatment might be.

Or, you're going to need an extraction and an implant and that care is beyond your budget.

Whatever the reason, you need dental care ASAP and don't have insurance to help control costs. You need coverage now.

Many dental insurance plans have waiting periods for non-preventive care. Luckily, there are some plans that do not have waiting periods for these restorative services.

As you review no waiting period dental plans, read the plan information to understand what the waiting periods look like and what coverage exclusions are part of the plan. You can read part two of this series for more information on what top dental insurers offer or continue reading this piece for expert insight on choosing a no waiting period dental plan.

Key Takeaway: Confidently choose a no waiting period dental plan by making these considerations.

Evaluate the plan like you would any other dental plan

Dental insurance plans vary widely, so you need to be thorough as you consider plans. You can evaluate plans on your own or with the help of an insurance agent.

To ensure that you find a a good fit, check each dental plan's

Network

There are two main network options offered with dental insurance: Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO). HMO plans only cover in-network dentists. PPO plans cover in- and out-of-network dentists but have better cost-sharing rates for in-network care.

If you already have a dentist you like, check to see if they are part of the plan's network. You should be able to check this online. Sometimes there are errors on the insurance company's provider list, so you can also contact your dentist office to see if they participate in the plan's network.

If you want to keep your dentist, you can work the other way around:

"Call your dentist to find out what insurance plans they are contracted with. Then, call some of those insurances to find out premiums, maximums, and coverage percentages," advises Summer Holloway, DMD, Floss Dental Boutique.

Back to "Evaluate the plan like you would any other dental plan."

Coverage

Be sure you understand what services the dental plan covers. You probably have immediate coverage needs, but don't let those be your sole focus, especially if you plan on keeping the plan in the long term.

"When choosing a plan, think about the future. If you know you need root canal treatment now, pay attention to other treatments. Will a tooth extraction be covered at 100 percent or 80 percent? Often simple procedures are covered in full, but implants are only half covered," advises Henry Hackney, DMD, Authority Dental Content Director.

You'll also want to go beyond covered services to get into the details looking for any exclusions and limitations.

"The plan may exclude certain treatments or services. Some can only be made available in the following months of membership. They may depend on price or complexity or internal classification. Scaling may be available in the first week, but the jaw X-rays may not be available until the third month," says Hackney.

Dental insurance companies have waiting periods and exclude pre-existing conditions to help prevent people from only buying coverage when they need care. If there were no limitations, insurance companies would lose a lot of money.

You also need to check for lifetime or annual limitations on the dental work you have performed. Some plans only cover a set amount of fillings on the same tooth during a certain time frame. The plan may also only cover one implant per tooth. In most cases, these limitations won't keep you from having the care you need covered. However, it's important information to keep in mind.

Back to "Evaluate the plan like you would any other dental plan"

Cost

It's easy to focus on monthly premiums as the primary cost of dental insurance. After all, it's going to be a monthly bill. However, the cost of dental insurance also includes your out-of-pocket expenses. Insurance plans have set coverage levels for services, and you'll need to be aware of these cost-sharing features to understand your full financial obligations.

First, you'll want to look at the cost-sharing arrangement for specific services. Most plans break services into three categories: preventive, basic or restorative, and major. Coverage for preventive services is typically high. These services include cleanings and regular check-ups. Basic and restorative care includes fillings. Major care includes things like root canals, bridges, and implants. Note that some plans classify implants as cosmetic dentistry and do not cover it.

(Read more about dental insurance and implants.)

Understand what percentage of the cost your plan will cover and whether or not the coverage level changes over time. In some cases, the longer you have the plan, the higher the coverage levels are.

"If you want to use it on the day of signing the contract, it may turn out that you will pay 90 percent or even 100 percent of the visit price. Plans are built in a variety of ways, and it's worth checking your contribution in each month of membership," recommends Hackney.

You also need to consider the annual deductible.

"Before an insurer will pay any expenses, you will have to pay some of them out of your pocket. Deductibles vary between plans, so choose the one that fits your budget," Mike Golpa, G4byGolpa CEO.

If both the out-of-pocket expenses and monthly premiums fit into your budget, then you've found a good contender.

Back to "Evaluate the plan like you would any other dental plan"

Maximum benefits

Before you enroll in a plan, you also need to understand what maximum benefits apply to the plan. There are two types of maximum benefits: annual and lifetime. The annual maximum benefit is usually listed as a per person amount. This is the most that your dental insurance company will pay towards claims in one year.

"What are the maximum benefits? There can be a yearly or lifetime limit set on the coverage of your dental costs. Unlike the deductible, you want this one to be as high as possible," says Golpa.

Some plans also have lifetime maximum benefits for certain services like implants. You need to know these maximum benefit amounts because you'll assume full financial responsibility once these limits are met.

If the costs of the plan are higher than the benefit it offers, you may want to investigate other plans and options. It's a pain to run the numbers, but running the numbers will help you know if buying a plan is worth it.

Back to "Evaluate the plan like you would any other dental plan"

Effective date

The last item to check before you enroll in a dental plan is when your coverage will start, especially if you need coverage ASAP.

"It is very important to know exactly when the plan will work. Whether it's on the same day, the next day, after seven days or even a few months when you can go to the dentist and use it. If you want to be able to use it right away, inform your agent at the beginning of the conversation," says Hackney.

Back to "Evaluate the plan like you would any other dental plan"

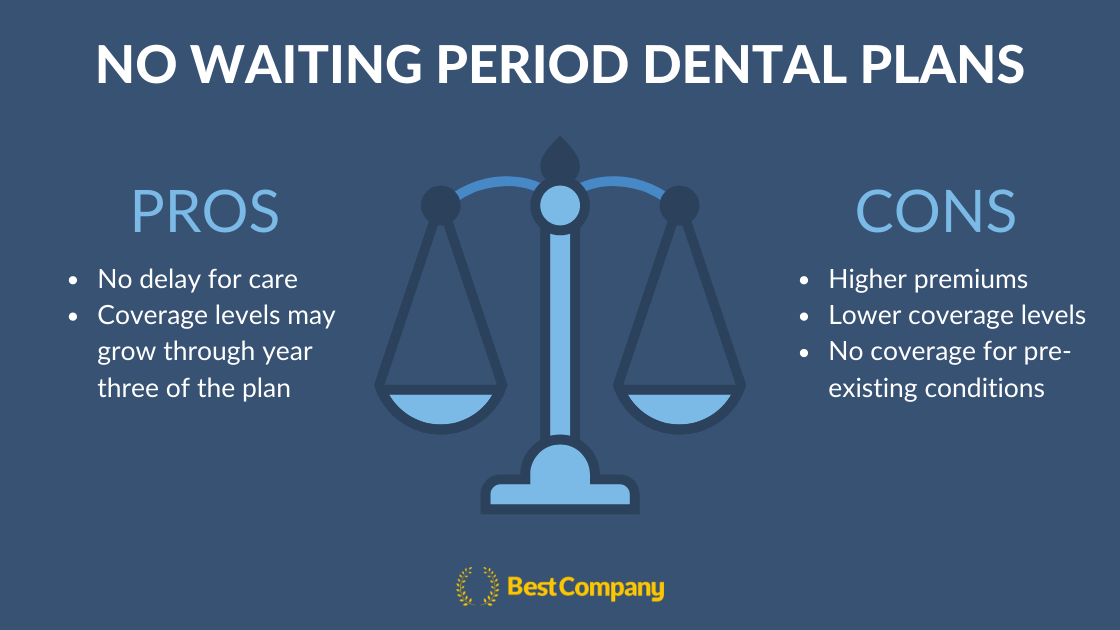

Understand the pros and cons of no waiting periods

Dental insurance with no waiting period has advantages and disadvantages. Consider these as you determine what kind of dental insurance to buy.

"Despite the name, it’s very likely that there will be some waiting period. It usually applies to major works, such as bridges, crowns, and dentures. Your freshly bought No Waiting Period insurance will cover upcoming cleanings and fillings, but not a new crown just a week after. Read carefully terms and conditions," warns Golpa.

While it's frustrating that some companies categorize their plans as no wait plans, even if it's just preventive care that has no waiting period, looking at the plan's brochure will help you quickly eliminate plans that do have waiting periods for basic and major dental services.

Pros

You can receive the care you need with the insurer contributing to the cost without waiting six months to a year.

"Dental insurance without waiting periods is a huge advantage for patients! Usually if there is a waiting period (which is rare now), it is six months to a year. Without any waiting period you can get procedures completed before things progress and get worse," says Holloway.

Immediate cost-sharing is the primary benefit of dental insurance with no waiting period.

Cons

Two main drawbacks of no waiting period dental insurance are the cost and potential exclusions. Remember that these are tradeoffs you make for having immediate coverage. You'll need to determine if these tradeoffs are worth it.

Costs

No waiting period dental insurance plans' premiums tend to be higher compared to plans with waiting periods. While this increased prices can make it trickier to fit dental insurance into your budget, remember that you're paying for the convenience of having immediate cost-sharing for the treatment you need.

"No waiting period plans generally cost more. Is the increased premium worth the expected outlay for a major procedure in the first three years?

Whether or not there are waiting periods, does coverage increase in the second and third year?" Art Young, Art Young Insurance principal.

The costs of dental insurance with no waiting period aren't limited to the monthly premium. Max Meinerz, DDS, of The Good Dentist, identifies other costs: network size, coverage levels, and maximum benefit amounts.

Network size

"Plans with no waiting period may also have less robust coverage networks because the discounts they negotiate with their network dentists are more steep, giving you less choice in your dental provider. That dental provider also has to see more patients per day to accept a lower fee and still pay the bills," he says.

Coverage levels

"For example, the percentage of a given dental procedure (filling, cleaning, or dental implant) which the insurance company is willing to pay may be lower in a no wait plan than a plan with a six-month waiting period. These insurers can say they cover fillings and cleanings but that might be at 50 and 80 percent instead of 80 and 100 percent respective to an insurance policy with a waiting period," adds Meinerz.

Maximum benefit amounts

"Lastly, dental insurance companies use a coverage maximum or amount they will not pay above in a given period of time. A no wait plan often has a lower ceiling at which the insurer refuses to pay and the patient shoulders the remainder of the bill," finishes Meinerz.

Potential exclusions

In addition to these cost and quality trade-offs, you'll also need to check how your no waiting period plan treats pre-existing conditions. These plans can still exclude them. So, if you're looking for coverage for treatment you need now, even a no waiting period plan may not help you with the cost-sharing you need.

"Dental insurance without waiting periods may still include limitations regarding the types of procedures they cover. Or they may exempt procedures that are required due to pre-existing conditions," says Chris Lewandowski of Princess Center Dentistry.

As you're looking at no waiting period plans, you may still run into waiting periods. Some plans only immediately cover preventive care. Others only immediately cover preventive and basic care. A few immediately cover preventive, basic, and major care.

"No waiting dental insurance implies that there is no waiting period to use the insurance benefits after the insurance policy is in place. However, there may be limitations as to what procedures are immediately covered. Although there is a wide range of policy norms, and a lot of fine print to differentiate themselves, typically major dental procedures (the expensive ones) do have a 90-day waiting period and may be subject to a pre-existing conditions clause. Be sure to ask what procedures are subject to these types of limitations," recommends Lewandowski.

Considering the pros and cons of dental insurance with no waiting period, I researched what Best Company's top-ranked dental insurers offer. Read my evaluation of the offerings to learn more about what types of no waiting period policies are available and see which plans may be a good fit for you.

Explore alternatives

If a dental insurance plan with no waiting periods is a good fit for you, then feel confident about your choice. However, if the premiums are beyond your budget or you want to make sure you've looked at every option, I'll review some alternatives with you:

Waiting period waiver

If you previously had dental insurance and no longer have coverage due to job loss, for example, you can look at dental plans with waiting periods and check to see whether the insurer would waive the waiting periods because you've had comparable coverage previously.

When you're talking to the insurance company, ask about what the waiver process is, when it occurs, and how quickly you'll be approved or denied. If the approval process only happens after you enroll, you should be careful about proceeding with enrollment and check plan cancellation and refund policies in case waiting periods aren't waived.

Back to "Explore alternatives"

Dental discount plans

A second option is to look at dental discount plans. Dental discount plans are also referred to as dental savings plans. These plans are not insurance. Instead, they offer set rates for dental care received by participating dentists. These plans are nice because the subscription fees are usually cheaper than insurance premiums, the pricing for services is transparent, and there are no waiting periods.

While these plans have many advantages, they also have some disadvantages. Lewandowski identifies a few:

"Dental savings plans, often called discount plans, can be a viable and financially sound option if the procedures that you require are covered on the plan. Often, only a short list of basic dental procedures are covered on the plan, leaving the majority of procedures uncovered (and billed at the dentist normal price). So not all plans are the same.

It may be best to first visit a dentist to find out what treatment is needed, then to shop online for the best saving plan that covers those procedures. Unfortunately, after you find the dental savings plan you want, you may have difficulty finding a dentist you like that takes the plan. After all, the better the discount is for you, the worse it is for the treating dentist!"

Attention: Dental discount plans are not dental insurance.

Depending on your state, discount plans may not have regulatory oversight like insurance does. Dental discount plans are also not available in all states due to restrictions. Read "Dental Insurance vs. Dental Discount Plans" to learn more.

Back to "Explore alternatives"

In-house discounts and payment plans

A third option is talking to your dentist about office discounts and payment plans.

"Always ask your dentist if they have an ‘in-house plan’ for their patients without insurance. Some offices have great programs that will provide patients with discounts for services.

Some offices also offer cash discounts as well," says Holloway.

Even if your dentist doesn't offer a discount plan, you may be able to work out a payment plan that can make receiving the care you need easier to fit into your budget. Take advantage of these payment plans and pay more than the regular minimum when you can to pay off your debt faster.

Before opting for these plans, make sure that you have a dentist you trust. Like dental discount plans, in-house discount programs do not have regulatory oversight. It's important to find a dentist that puts patient care first.

Back to "Explore alternatives"

Preventive care

Another option is to be proactive with your dental care. It may be too late now, but it can save you money in the future.

"In my opinion, the most cost-effective plan is prevention. By staying well hydrated, using topical fluoride, a focus on brushing and flossing and a diet low in acid and sugar, dental disease can be prevented," says Meinerz.

If you have a good dentist, their priority is helping you maintain your own dental health.

"My goal is to always have the patients not need us. If I take the time to understand your needs and make intelligent recommendations that you follow, most people do not need to spend very much at all on dental services and should be able to stay healthy without dental insurance," adds Meinerz.

Regular dental visits allows dentists to catch problems early and take steps to avoid bigger, more expensive treatment. This is why many dental plans offer very good coverage for preventive care, up to covering it fully.

Back to "Explore alternatives"

Consider your needs — dental and financial — as you evaluate your dental insurance options and weigh the advantages and disadvantages of each. Doing so will help you find a good fit and be prepared to manage the costs of the care you need.

The Top Dental Insurance Companies

The Top Dental Insurance Companies

Related Articles

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Dental Insurance and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy