Private vs. Federal Student Loans: A Roadmap Out of Student Debt

The second highest consumer debt category, student debt, has risen exponentially over the years with 45 million borrowers collectively owing nearly $1.7 trillion in 2021. To add salt to the wound, student loan debt is projected to increase to $2 trillion by 2022.

Those are massive numbers, aren’t they? Although they might seem scary and daunting, there are ways to finance your college education and plan ahead that can keep you from falling into large amounts of student debt.

As far as student loans and student debt are concerned, there are two options available to you: private or federal loans.

But which is the best choice?

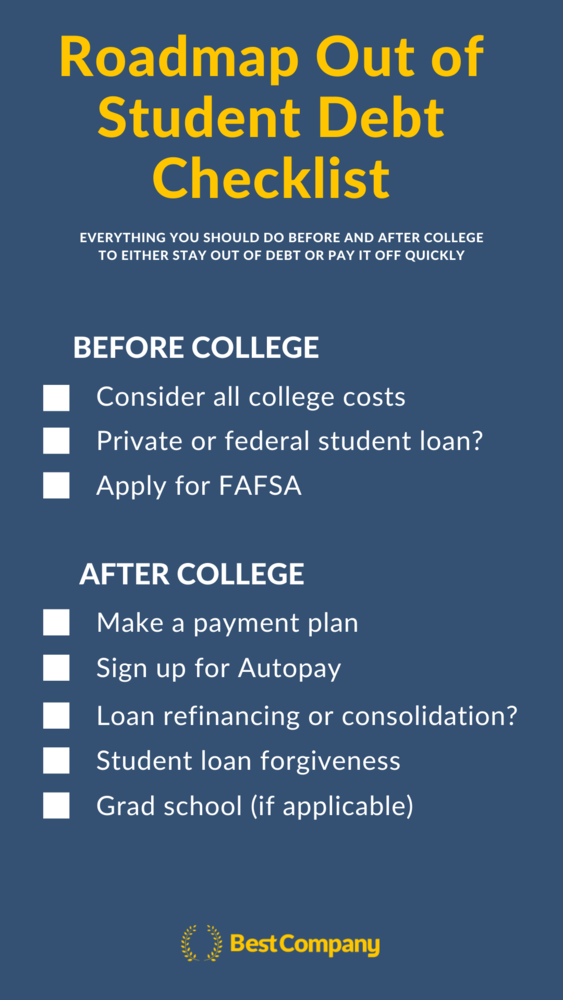

To make the journey through private and federal loans as easy as possible, use this guide as a roadmap to help you navigate your student loans before and after college.

Before college

Once you’ve applied to the colleges of your choice, it’s a good idea to get started on applying for student loans right away. Federal student loans are funded through the U.S. Department of Education, while private student loans are funded through private companies/lenders.

It is important to know the difference between private and federal student loans because they have different advantages and disadvantages depending on your circumstances. To this point, Brian Martucci, a finance editor at Money Crashers, says, “For most undergraduate students, federal loans make more sense; private student loans can be useful for professional school students with good credit and high income potential…”

With that in mind, let’s break them both down.

Federal student loans

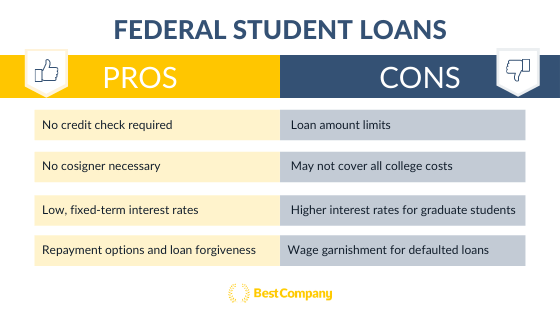

Funded through the U.S. Department of Education, federal student loans are available to undergraduate and graduate students alike.

Experts agree that the best place to start is with federal student loans. With fixed interest rates that are generally lower than those for private student loans, students have more options and benefits available to them as they pay off their loan, allowing them to potentially save more money over time.

Travis Hornsby, CFA and founder of Student Loan Planner says, “You should always seek federal loans first because they are administered by the government and have more valuable programs and protections such as student loan forgiveness, repayment plans, deferment and forbearance.”

The first step is to apply for a student loan through the Free Application for Federal Student Aid (FAFSA). Submitting your FAFSA application is easier than you think and requires your personal and family financial information as well as a list of colleges that you’ve applied to.

To complete the FAFSA application, you must create a Federal Student Aid (FSA) ID. This ID allows you to access your information online, and apply for FAFSA each year. If a parent is applying for a Direct PLUS loan or would also like access to their child’s financial aid information, they will have to create their own FSA ID.

Once you’ve completed your FAFSA application, it’s time to choose your loan. There are four types of loans available to students:

- Direct Subsidized — Only available to undergraduate students. Loan amounts are determined by the U.S. Department of Education, which also covers the cost of interest if a student is enrolled in school at least part-time. Interest costs are also covered for the first six months after a student leaves school, as well as during a deferment period.

- Direct Unsubsidized — Available to both undergraduate and graduate students. Students who apply are not required to show proof of financial need, but they are responsible for paying all interest on the loan.

- Direct PLUS — Available to graduate or professional students, as well as parents of undergraduate students. With the U.S. Department of Education acting as the lender, a credit check will be conducted, and applicants are required to have a good credit score to receive approval.

- Direct Consolidation — Allows students to merge all loans into one with a single loan receiver.

It is important to note that subsidized direct and unsubsidized direct loan amounts for undergraduate students range from $5,500–$12,500 for each year. The amount of money you can receive is dependent on your year in school and whether or not you are listing your parents’ information along with your own. Graduate students can receive up to $20,500 each year in direct unsubsidized loans.

Various repayment options with federal student loans can make it easier to manage and pay off your debt quickly. You should always plan to make your payments on time, but it is important to know the consequences of late payments nonetheless.

In most cases, if you are late on a payment you will be charged a late fee. Furthermore, if you were to miss consecutive payments and end up defaulting on your loan, the government can garnish your wages to secure repayment on your student loan.

With that being said, there are pros and cons about federal student loans that you should weigh and consider when looking at options to pay for college.

Private student loans

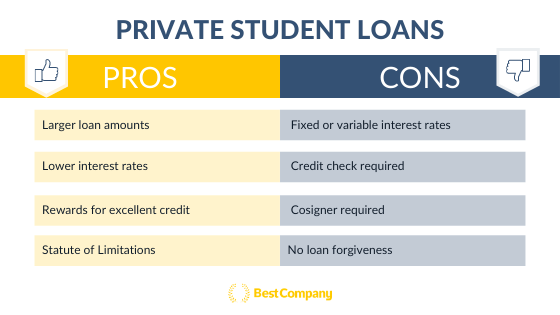

Private student loans are funded through private lending companies, and are a great option for refinancing student loans later on. Make sure that you do your research on different companies that offer student loans. Each company offers similar services, but it is important to check requirements for each.

Basic requirements for private student loans include a credit check and a cosigner to ensure the lender that the loan will be paid back. Although neither a credit check or a cosigner is required for federal student loans, these requirements allow borrowers to receive larger loan amounts through private lenders, and receive lower rates if they, or the cosigner, have an excellent credit score.

Private student loans also have something called the statute of limitations. This refers to the period of time that a lender can sue if payments are not being made. Once that period of time expires, lenders can still attempt to collect money, but they are not allowed to sue. Federal student loans do not have this statute of limitations, meaning that borrowers can be sued at any time if payments aren’t being made.

Weighing the pros and cons of private student loans is very important as you’re looking for a student loan. That, in addition to assessing your own needs and circumstances, will help you know which option is best for you.

Important note: Many of these pros and cons are dependent on the lender.

.

Additional college costs

Tuition is a major college cost, but it is not the only one to consider. In addition to tuition, you should consider the cost of room and board, books and other school supplies, as well as other expenses including emergencies.

Student loans (both federal and private) can be put towards rent, room and board, and fees, in addition to tuition.

Monthly payments

There are various repayment plans available for federal student loans. The repayment options allow flexibility and you can switch your plan for free at any time. It is important to note that federal student loans do not require payments while you’re in school. In fact, payments generally aren’t due until after a student graduates.

Private student loans often require payments while a student is in school, with potential opportunity for payment deferment, but that is dependent on the lender.

Fixed or variable interest rates

One large advantage of federal student loans is that they have fixed-term rates. This means that the interest rate of the loan will not fluctuate or change during the loan term, allowing you to know exactly how much your payments will be each month. The ability to know your monthly payments can provide some security and peace of mind as you plan accordingly.

Whether or not you can get a fixed-term rate with a private student loan is dependent on the lender.

After College

After a couple years of stress, occasional all-nighters, and hopefully some fun, graduation day comes, leaving you with a degree and likely some student debt to pay off. To make these payments easier to manage, there are a couple of options available to you, especially if you have multiple loans.

Make a payment plan

For successful loan repayment it is important to establish a plan and/or budget that you can stick to throughout your loan term.

Robert Farrington, student debt financial expert and creator of The College Investor.com, suggests the following for making a repayment plan:

“Develop and use a dedicated budget plan each month. Follow it, stay disciplined, and make the largest payments you can in order to get out of student debt as quickly as possible. Try to pay more than the minimum payments each month. Even just an extra $20 or $30 a month can shave time and a large amount of interest off of your loan balance.”

Sign up for autopay

Autopay allows your student loan lender to set up automatic monthly payments from your bank account, which can also lower your interest rate. Both federal and private loan lenders offer up to a 0.25% interest rate discount. Make a point of contacting your lender to see if autopay is an available option for you.

Additionally, setting up automatic payments can give you peace of mind, removing the chance of missing a payment and getting hit with late fees.

Federal student loan consolidation

If you have multiple federal student loans, the U.S. Department of Education provides an option to consolidate all your loans into one single loan. Consolidation loans can lower monthly payments, but also make it easier to keep track of payments, as you’ll only have to pay one instead of multiple loans.

Student loan refinancing

Refinancing and consolidation may appear to be the same thing, but there is a small difference, which could make a big difference in the long run.

Debt consolidation only combines multiple loans into one, whereas debt refinancing seeks to combine multiple loans in order to find lower rates and more agreeable terms. Refinancing pays all your loans at once, creating one new loan with lower interest rates. Loans can’t be refinanced on a federal level, but many private lending companies offer student loan refinancing services.

Top student loan refinancing and consolidation companies on BestCompany.com:

1. Credible

Credible is a third-party student loan refinancing company, meaning that once you fill out a short application, you’ll be connected with multiple loan rates from various lenders. Although Credible doesn’t provide refinancing loans directly, it offers APR rates as low as 3.5 percent.

Refinancing through Credible is not available to currently enrolled students, but is a great option for those who have graduated, or are no longer enrolled. A credit check is required to qualify for student loan refinancing through Credible, but an initial soft credit check is performed, which will not affect your credit score.

Customer reviews on BestCompany.com are overwhelmingly positive, awarding Credible with 4.4 out of 5 stars overall. Many customers applaud its simple and easy online application, low rates, and great customer service.

Credible Customer Review: Kellie Rae from East Troy, Wisconsin

"Credible was fast and easy to use. It offered me the lowest interest rate to refinance my student loans compared to the other companies I tried. They will save me over $13,000 in interest and help me pay off my debt quicker."

Read more verified Credible customer reviews.

2. Docupop

Docupop specializes in assisting federal loan borrowers find the fastest and easiest way to find the perfect student loan repayment or student loan forgiveness program.

Once a borrower enters their information into Docupop’s system, a list of repayment plans will be generated. Docupop offers a fixed APR rate for any program chosen by the borrower. Within the industry these rates are competitively low, ranging from 3.76 percent to 6.31 percent.

It is important to note that Docupop only offers student debt consolidation services, not refinancing services. Most lenders offer both. This means that you can combine all your debt into one, but you may not get lower rates or terms.

The majority of Docupop customer reviews on BestCompany.com are positive, with customers talking most about how quick and easy the application and approval process is.

Docupop Customer Review: Richard from Hollywood, South Carolina

"They have been able to handle my student loans with no stress being put on me."

Read more verified Docupop customer reviews.

3. SoFi

SoFi is quickly becoming one of the largest student debt consolidation and refinancing companies.

In addition to competitively low rates, ranging from 2.99 to 6.238 APR (with AutoPay), Sofi offers unemployment protection, and efficient customer support. The application process is quick and easy and there are no limits on how much can be borrowed to consolidate or refinance a loan. However, a minimum credit score of 650 is required to qualify for SoFi, which might be difficult for students who have not yet built up their credit history.

SoFi customer reviews on BestCompany.com are positive, awarding the company 4 out of 5 stars. Customers most frequently comment on the ease of applying and then consolidating debt, in addition to great customer service and great rates.

SoFi Customer Review: Steph from Gulfort, Mississippi

"I wish more things in life were as easy as using SoFi. Thanks for making my experience effortless."

Read more verified SoFi customer reviews.

Student loan forgiveness

Student loan forgiveness is only a possibility for federal student loans, and refers to no longer being required to pay all or some of your loan.

The most common and well-known type of student loan forgiveness is Public Service Loan Forgiveness (PSLF).

PSLF forgives the remaining balance on direct loans. A borrower qualifies if they have made 120 monthly payments under a qualifying repayment plan while working full-time for a qualifying employer — a government or nonprofit organization. It generally takes at least 10 years before an individual can qualify for PSLF.

Graduate school

Perhaps you’ve recently finished your bachelor’s degree and are jumping straight into graduate studies, or perhaps you’re deciding to go back to school later in life to further your career opportunities with an additional degree. Whatever your reasoning, there are financial considerations to be had when looking into graduate school.

The cost of graduate school generally falls between $30,000–$40,000 per year. This cost doesn’t include room and board, rent, books, and other personal expenses. There may also be existing debt from your undergraduate studies to consider in this equation. Overall, graduate school is a large financial investment.

Federal student loans are available to graduate students, offering up to $20,500 each year. However, with all costs considered and existing debt, a larger loan through a private lender could be more advantageous.

If you have existing debt, refinancing or consolidating your debts could also be a good way to reduce not only the number of payments you need to make, but could lower your interest rates, saving you money in the long run.

The bottom line

When it comes to financing your undergraduate or graduate studies, there are financial options available to you, providing the means to pay for all of your expenses, but to also have the peace of mind that you’ll be able to pay off your debts.

Federal student loans are a good option, especially for undergraduate students, who have never taken out a loan before and do not have an established credit score. The ability to postpone loan payments until after you’re done with school can relieve pressure while pursuing your studies, but it is important to make a plan to pay off your debts, setting you up for future financial success and independence.

Private student loans are a great option for consolidating or refinancing your loans, but may not be the best option for a first loan, particularly for undergraduate students. However, if you’re looking for a loan that could cover all your college expenses, a private student loan would be a better option, offering larger loan amounts with lower rates.

When approaching a student loan or your student debt, don’t be discouraged. The numbers involved with student debt may seem overwhelming at first, but you have options. It may take some time and discipline, but whether or not you choose federal or private student loans, you can be debt free before you know it.

The Top Student Debt Refinancing and Consolidation Companies

The Top Student Debt Refinancing and Consolidation Companies

Related Articles

Student Debt Refinancing and Consolidation

Adventure Awaits: Your Field Guide to Outdoor and Natur...

Student Debt Refinancing and Consolidation

5 Things to Know About Career Certifications [with 300+...

Student Debt Refinancing and Consolidation

2021 Guide to Private Student Loan Forgiveness

March 2nd, 2021

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Student Debt Refinancing and Consolidation and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy