Should I Refinance My Car Loan?

Auto refinance refers to replacing your current car loan with a new one — a new loan with more favorable rates and terms that can help you lower your monthly payment, and/or lengthen or shorten the life of your loan depending on your needs.

Applying for auto refinancing is generally a simple process that can be completed online (depending on your lender). Upon approval, your new lender will pay off your existing loan, and you will then be responsible for your new loan.

In most cases, auto refinance lenders can help borrowers save approximately $150 per month on their auto loan, which can add up to a lot of saved money!

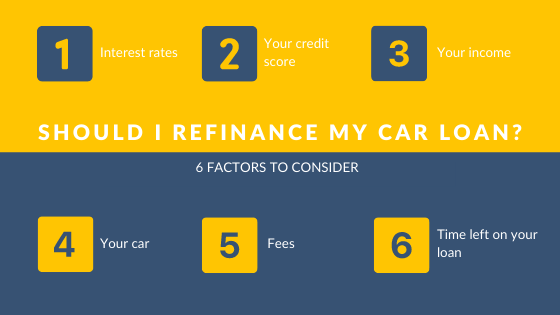

This might sound ideal — lowering your car loan monthly payment and saving more money — but you might still be wondering: should I refinance my car loan?

It’s an important question to ask, and there are some important factors to consider that can help you answer this question.

Interest rates

If interest rates have dropped since you took out your original car loan, it could be a good opportunity to refinance, lowering your monthly payment and increasing your savings.

Your credit score

If your credit score has improved since you took out your current car loan, you could qualify for a lower interest rate through refinancing which could save you hundreds of dollars over the life of your loan.

However, if you’ve had a difficult time making your current auto loan payments and/or you’ve missed payments, this could significantly impact your credit score making it difficult to qualify for refinancing.

Imani Francies, an auto loan expert with Loans.org, offers this important advice:

Although you can legally refinance your car as soon as you buy it, a bad time to refinance is any time where your credit score is not in a better place than where it was when you initially purchased your car. …You should wait at least six months to a year to allow your credit score to rebound from the first car loan, create a payment history, and catch up with any deterioration that happened when you bought it.

Your income

If your income has increased, allowing you to pay down other debt, and in turn decreasing your debt-to-income ratio (DTI), it could be a good time to refinance your auto loan. Lenders will look closely at your income and DTI to verify that you can afford to make your payments, and that you are able to responsibly manage your debts in conjunction with your earnings.

Your car

If your car is a year old or less, and worth more than your current remaining loan balance, lenders will likely be more willing to work with you. New cars begin to depreciate as soon as they’re driven off the lot, and can lose up to 20 percent of their original value within the first year of ownership. So, in most cases, it is best to refinance sooner rather than later, to ensure that your car is still worth enough, helping you qualify for refinancing.

If you have an older vehicle, refinancing isn’t out of the question, but lenders generally don’t refinance vehicles 10 years or older.

Fees

If you are comparing auto refinance lenders it is important to compare fees.

John Peterson, editor of Safe Drive Gear, a comprehensive resource about tires and safe driving, explains, “When comparing your refinancing options, be sure to include what fees they charge. Paying too much to transfer your car loan could cost more in the end than staying put.”

Typical auto refinance fees include a lender fee and title fee. While these fees won’t necessarily break the bank, it is important to double check the fees and stipulations included with your current loan. For example, perhaps your current lender requires you to pay all remaining interest, which would make refinancing pointless because you would then be responsible for interest on two loans — the current and refinanced loan.

Another fee to look out for with your current lender, is a prepayment penalty. If your current lender doesn’t have this fee and you can pay off your loan early, without penalty, it could be to your advantage to just pay off your original loan, if you can afford to do so.

Time left on your loan

If you are having a hard time making your current auto loan payments, it can be a helpful option to lengthen your loan term, spreading your loan balance over a longer period of time, and in turn lowering your monthly payment.

But, if you don’t have much time left on your loan it may not be the best idea to refinance since you could possibly pay more in interest, especially if you extend your loan to lower your monthly payment.

Auto refinance lenders

There are multiple auto refinance lenders to choose from, but here are our top-three recommendations based on customer reviews:

| iLending | Auto Approve | RefiJet | |

| Rates | As low as 1.99% APR | As low as 2.25% APR | As low as 2.49% APR |

| Min. credit score | 560 | 580 | 580 |

iLending

- Good option for high-mileage vehicles

- No fees

iLending is a top auto refinance lender on BestCompany.com. With competitively low rates as low as 1.99 percent APR, you could save a significant amount of money on your auto loan monthly payments.

iLending reviews are primarily positive with 95 percent of customers awarding the company 5 stars. Customers most frequently highlight the following:

- Low rates, significantly lowering payments

- Quick and easy process

- Exceptional customer service (often naming specific company representatives)

Although reviews are limited in number, the amount of positive feedback suggests that iLending would be a great choice for your auto refinancing needs.

Auto Approve

- Free online quote

- No application fee

As a top auto refinance lender, Auto Approve offers a simple refinancing process with particular emphasis on providing outstanding customer service. You are assigned a loan consultant who will work to find you the best refinancing solution, securing a low interest rate and lowering your monthly payments.

The majority of Auto Approve reviews are positive, with customers awarding the company 5 stars in value, quality, service, and trustworthiness. Reviews frequently highlight the following:

- Low rates, significantly lowering payments

- Simple application process with quick approval

- Exceptional customer service (naming specific Auto Approve loan consultants)

Auo Approve reviews are currently limited in number, but reviews shed a positive light on the company, suggesting that it could be a reliable choice for your auto refinancing needs.

RefiJet

- Good option for low credit borrowers

- Apply with a co-borrower

RefiJet is a top auto refinance lender offering personalized service and support to borrowers of all credit levels. As a marketplace lender, RefiJet has a network of leading financial institutions, providing multiple refinancing options with low rates.

RefiJet reviews are limited and are a fairly even mix of positive and negative sentiments. Based on these customer reviews, RefiJet has 3 stars for value, quality, service, and trustworthiness. Positive reviews most frequently highlight the following:

- Excellent customer service with responsive and transparent representatives

- Straightforward application process

On the other hand, negative reviews frequently comment on the following:

- Difficulty connecting with service representatives

- Delays in refinancing

Best Auto Refinance Companies

Learn more about auto refinance by looking at the top-rated companies, their products and services, and verified customer reviews.

Learn MoreThe Top Auto Refinance Companies

The Top Auto Refinance Companies

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Auto Refinance and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy