This Startup Is Making One of Life’s “Hard Knocks” a Little Easier

Topics:

Buying Tips

Many people cannot refinance their house if needed. If you are among them, you understand the scary truth: if you fall on hard times, refinancing your home is not an option.

You could be kicked out of your home, forced to move, and still be up to your neck in debt. Founded in October 2016, EasyKnock created the program Sell and Stay to help prevent this.

Sell and Stay was created to give those who can’t refinance their home a chance to sell their home to EasyKnock, become the immediate renters, and not have to move.

BestCompany.com was created to help educate consumers and compare companies so you can feel confident choosing the best company for your specific needs. To help you understand this option of releasing your home equity, we’ve taken a closer look at this product and company.

A quick glance at Sell and Stay

So what is Sell and Stay?

“Sell and Stay is a product from EasyKnock which has seen massive adoption among customers looking to release equity by becoming renters of their own home. It enables people with less than optimal credit or small business owners with complicated W2s to access equity by renting their home with the ability to buy back whenever they want. A significant portion of our client base is taking advantage of EasyKnock's Sell and Stay to reinvest into their property, business, or to pick up another.” — Jarred Kessler, Co-founder of EasyKnock

In order for you to know whether Sell and Stay is the right product for you, we’ll take you through EasyKnock’s unique service by pointing out the upside, the downside, the bottom line, and everything else you may need to know about EasyKnock and its product.

The upside to Sell and Stay

Perhaps EasyKnock’s most impressive quality is its originator, Jarred Kessler. After many years in the business world with Credit Suisse, Morgan Stanley, and serving as Vice President of Goldman Sachs, Kessler has transitioned to become the co-founder and CEO of EasyKnock. EasyKnock’s product Sell and Stay is starting to change the home equity market.

Positive features of EasyKnock’s Sell and Stay approach include the following:

- You are more likely to qualify

- You do not have to move

- You can access this asset quickly and easily

- You can buy back your home whenever

You are more likely to qualify

EasyKnock's Sell and Stay, has a qualifying criteria that is much less rigid than most banks, allowing more people to access their equity. In an age where it feels like you need a good credit score to buy groceries, credit checks do not affect the probability of qualifying. Sell and Stay currently works best for individuals with homes valued at $150,000 and above, and have at least 50 percent in equity.

You will not have to move

You can probably remember why you bought your home in the first place, and you could probably still make a whole list. Maybe your kids were closer to school, you were near family, closer to work, better neighborhood, the list keeps going. It is no small task to make a house a home. You’ve created memories and created an atmosphere that is yours. The fact that you can get what you need without moving is a huge benefit of this program.

You will never have to put a for sale sign in the front yard and your Sell and Stay transaction will remain confidential, so people won't even know that you now rent. And hopefully, you won’t have to rent long and can buy your house back quickly.

You can access this asset quickly and easily

If you've paid off the majority of your mortgage, there could be tens of thousands of dollars sitting in your home that you could be using. Sell and Stay is one of only a few ways in which you can release the home equity in your home.

With the average American household carrying more than $130,000 in debt, people need money now. This is one of the fastest ways you can access the equity in your largest asset.

Because EasyKnock is not a lending company, it can close a deal in 21 days, meaning you can have that much-needed money now.

You can buy back your home whenever

EasyKnock wants you to buy your home back in the future. Their goal is to make that possible. The repurchase price is established upfront and will be explained to you at the beginning of the process.

The downside to Sell and Stay

Though EasyKnock has a good product and solid company management, there are still some downsides that everyone should consider to ensure that this option is right for them. Ask yourself the following questions:

- Do you trust yourself?

- What are the costs?

- How experienced is the company?

Do you trust yourself?

In a time when the majority of people are in debt, are you going to be able to afford to pay the monthly rent, or are you just going to waste the money EasyKnock gives you?

Just because you do not lose your house right away, that doesn’t mean that you are in the clear forever. If you fall behind on rent payments, you will be treated just like anyone who pays rent. You’ll be out on the curb, now without any assets.

You know yourself better than anyone. If you do not feel like you will be smart with the money you receive from EasyKnock, then this option is not for you. It may be a better option to sell your house and move into a smaller home.

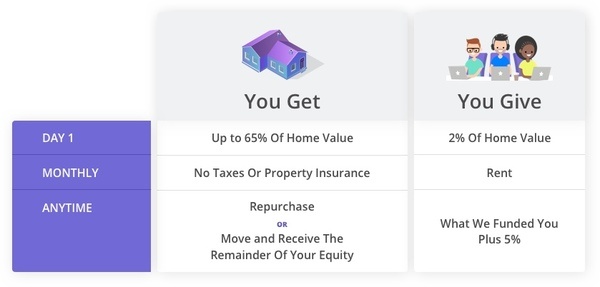

What are the costs?

EasyKnock makes a profit through fees. The required fees come both now and later. These fees are your cost for tapping into your equity early.

- Immediate fees:

- EasyKnock fee — The EasyKnock Fee is 2 percent.

- Closing costs — The company charges 1.5 percent of the appraised value to cover closing costs. This is to pay for title insurance, an appraisal fee, some processing fees, a survey fee, and legal fees.

- Future fees:

- Rent — Rent is decided by comparing similar houses in your area. The rent cost can be flexible, according to how much money you are wanting to take out.

- Repurchase — If you repurchase your home within the first year, you may buy it back for what EasyKnock funded you, plus 5 percent. The price increases annually by 2.5 percent of the funding amount.

- Sell and move — If you decide to move, you will receive the remainder of your equity (the Sellout Value).

How experienced is the company?

This is a new approach to accessing home equity. There will be growing pains as this company creates a new path. The silver lining is the experience Jarred Kessler has. He brings his years of experience in the business world to this endeavor, giving the company an advantage compared to most startups.

Although this company has an intriguing product, it still seems to be in the experimental phase. This causes some concern, but we haven’t seen any significant issues as the company finishes its second year.

The bottom line

Tapping into any asset early comes at a cost. Whether it is your life insurance policy or your home equity, if you tap into any asset early you will lose money.

For most people, their home equity is one of their biggest assets. Thousands and thousands of dollars are in your home, so if you’re strapped for cash, this could be an option for you to pursue. This company’s services are for those who need a quick and safe solution to access a big asset.

How does Sell and Stay work?

Sell and Stay has five simple steps:

- See if you qualify. After filling out a form, you will be notified if you qualify and a representative will reach out to discuss steps.

- Create your customized contract. You will discuss plans, fees, and your personal situation with the representative to ensure this process meets your needs.

- EasyKnock buys your home, and you receive your home’s equity.

- You get to stay in your home.

- You can buy back your home from EasyKnock for the repurchase price, or choose to move whenever and the company will place your house on the market and give you the sellout value once sold.

How it affects both parties

The Top Reverse Mortgages Companies

The Top Reverse Mortgages Companies

Related Articles

Reverse Mortgages

3 Tips to Lower Your Next Utility Bill

By Guest

December 7th, 2020

Reverse Mortgages

Your Guide to the Pros and Cons of a Reverse Mortgage

Reverse Mortgages

The Hidden Fees: Reverse Mortgages

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Reverse Mortgages and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy