A Physician's Guide to Disability Insurance

Topics:

GuidesYou've made a large investment in your career with years of expensive medical training and professional education.

What would happen if you became unable to work due to a disability?

Disability insurance can protect your finances by replacing lost income when you file a claim. These insurance benefits can be used to pay for your recovery, keep up with debt payments, and continue to provide for yourself.

"The word 'disability' is really misleading, creating incorrect assumptions around what the insurance offering is. What disability insurance is, in essence, is a way to protect your income should things go wrong. If you aren’t able to work, you need something that covers your income so that you can survive, so you can pay your bills, your mortgage," explains Alex Williamson, co-founder and CEO of Asteya.

Protecting your income with disability insurance is an important way to care for yourself. Yet, disability insurance policies have multiple features and terms that can make finding a good disability insurance policy challenging.

Will Peach

Medical Student

We'll break down disability insurance in this expert guide so you understand what to look for and pitfalls to avoid. You'll learn more about

- long-term disability insurance vs. short-term disability insurance

- important policy considerations

- pitfalls to avoid

- companies to consider

Long-term disability insurance vs. short-term disability insurance

| Long-Term Disability Insurance | Short-Term Disability Insurance | |

| Waiting Period | 90 days or more | 7–14 days |

| Benefit Period | 2, 5, 10 years, until age 65, or for a lifetime | 3, 6, or 12 months |

Long-term disability insurance is designed to cover disabilities that last years rather than months. The waiting period, or elimination period, usually lasts a few months. The elimination period is how long you have to wait before the insurance company starts paying monthly benefits.

The benefit period for long-term disability insurance lasts several years or until you reach a certain age. The benefit period is how long you'll receive monthly payments.

Long-term disability insurance offers valuable coverage if you lose your ability to work for a long period of time. Some employers offer long-term disability insurance. Insurance companies also commonly offer long-term disability insurance policies that you can purchase for yourself.

In contrast, short-term disability insurance helps with disabilities that last a few months. The elimination period is a set number of days. The benefit period is usually several months and can be up to one year.

Short-term disability insurance is most commonly available through employers and harder to find if you want to purchase your own. If you have a good emergency fund, you may not need to get short-term disability insurance because you'll be able to meet your short-term needs if you experience a disability.

Important policy considerations

Nick Schrader

Insurance Expert

Focus on the details:

When [physicians] purchase disability insurance, they don't go in-depth about the coverage due to some unknown reasons. When the situation needs it, they will face difficulties filing a claim because the insurance company's term of "disability" is different from what they think of, which makes the insurance useless.

You want the coverage you need to be there if you need it. Pay attention to the following policy elements as you evaluate disability insurance policies:

- Definition of disability

- Income potential

- Inflation

- Debt

- Non-cancelable and guaranteed renewable feature

Working with a trusted financial advisor can also be beneficial because they have valuable industry experience and insight.

Edward Alferoff, CFP®

Finance Expert

Benefits of a financial advisor:

An experienced financial advisor can be a major help should the physician have a pre-existing medical condition — physical or mental. The advisor can make the difference in the type of offer received from the carrier. One carrier may make a substandard offer, while another would make a full offer. And, should you ever think you have a claim, you may want to start with your advisor, who can provide some valuable direction. While they can’t ensure an outcome, they can help you have a much better experience.

Definition of disability

It's essential to understand your policy's definition of disability. Some policies define it as totally unable to work or have broader definitions of your occupation. Others offer an "own occupation" definition that defines disability as being unable to perform your typical job functions.

Choosing a "true own occupation" definition is a narrower definition of disability, which offers better coverage.

Nick A. Ortiz, Board Certified Social Security Disability Advocate by the National Board of Social Security Disability Advocacy and Ortiz Law Firm owner, offers a helpful example of why the disability definition matters:

"Let's take a cardiac surgeon for example. A cardiac surgeon is a doctor that routinely performs heart surgery. If the surgeon develops a hand tremor, he or she may no longer be able to perform surgery. However, he or she may still be able to conduct consultations with patients.

If the definition of the doctor's 'own occupation' is simply 'someone who has a degree in medicine and treats people who are sick or injured,' then a disability insurance claim may be denied because the doctor can still see patients.

However, if the definition of 'own occupation' is more narrowly defined as a cardiac surgeon, then the physician may qualify for benefits with a hand tremor as he or she can no longer perform heart surgeries."

Partial disability

In addition to ensuring your policy has a favorable definition of disability, partial disability (also called residual disability) allows you to receive part of your policy's benefits if you develop a disability that limits how much you can work.

"Being able to make a claim on a partial disability is crucial for a doctor's disability policy. If a physician can only work part time because of a disabling health condition and suffers a loss of earnings because of that, they should own a policy that allows them to go on claim," says Raymer Malone, CFP®, High Income Protection Insurance Agency owner.

These partial benefits can help ensure that you remain financially stable when you must reduce your work hours due to a disability.

Mental health

If you are concerned about your current or future mental health, it's worth finding a policy that offers some coverage for disabilities related to mental health. However, it can be hard to find.

"Mental Protection is a clause that most companies have reduced. There are currently only a couple companies in the market that treat mental concerns (stress, anxiety, depression, burn-out…) like any other illness and/or injury. Most companies have limited coverage," shares Brian Carlson, CFP®, CLU®, GCG Financial Wealth Management Vice President.

Mental health is just as important as physical health and can result in disability, so pay attention to how your policy and insurer handles disabilities related to mental health.

Back to "Important policy considerations"

Income potential

If you're still finishing up your training or just beginning your career as a physician, you likely haven't reached your full income potential. You're in a spot where you can't yet purchase the full coverage you may need later and at a prime time for getting a favorable rate through underwriting.

Adding a future increase option to your policy allows you to get the most favorable rate now and increase your coverage as needed later without more medical underwriting. Ask the insurer or your financial advisor about any deadlines associated with this feature so you make the change when needed.

"This rider is very important as a resident since once you become an attending you’ll want to bump up your protection. Each company works a little differently so it’s important for you to have an understanding and be comfortable with the rider with the company of your choosing," advises Carlson.

Back to "Important policy considerations"

Inflation

You'll also deal with inflation and want to protect your spending power if you become disabled. Adding a Cost of Living Adjustment (COLA) rider will preserve your spending power by automatically adjusting your benefit for inflation.

"For example, a monthly benefit of $10,000 per month may be an adequate replacement of income today but completely inadequate 15 years from now in the event the disability is long-term," offers Sam Price, Assurance Financial Solutions owner.

Back to "Important policy considerations"

Debt

You likely have student debt for your professional training. If you become unable to work, you'll want a way to continue making payments. A disability insurance benefit can be used to meet your financial obligations.

Some policies go further because they offer an additional rider that helps make payments on your student debt. Adding this rider to your policy can provide additional peace of mind for your finances because your student debt payments will be taken care of.

Back to "Important policy considerations"

Non-cancelable and guaranteed renewable feature

Most disability insurance policies include a non-cancelable and guaranteed renewable clause which means that your policy's terms and benefits will remain the same as long as you keep your obligations and do not cancel your policy. This protection keeps the insurer from making unexpected changes or ending your policy.

Pitfalls to avoid

As you make important considerations to ensure that your disability policy will meet your needs, you should also be aware of common pitfalls regarding disability insurance:

Understanding these pitfalls and the long-term effects they can have will help you make better choices as you protect yourself and dependents.

Relying on employer-sponsored coverage

Although your employer may offer short-term and long-term disability insurance with its benefits package, most experts say it's a mistake to rely on these benefits. Remember that your employer-sponsored benefits end when you change employers. If you develop a disability between employers, you won't have coverage.

Second, the monthly benefit payments from an employer-sponsored plan are taxed because the premiums are paid with pre-tax money. When you buy your own policy, you're using taxed money to pay the premiums which means that the benefits are not subject to the federal income tax.

You'll keep a higher percentage of your monthly benefit from your own policy than you will with an employer-sponsored policy.

For example, if your monthly disability benefit is $1,800, you would pay $213 each month in taxes with an employer-sponsored plan. That adds up to $2,556 per year. If you were receiving benefits from a disability insurance plan you purchased on your own, you would have the full benefit each month to cover your needs.

When you consider that a doctor's disability insurance policy would have a higher benefit, the difference in the cash you'd have available with your own policy compared to one through your employer.

Delaying coverage

Since your disability insurance rate is determined based on the policy features and underwriting, rates typically increase as you age. Underwriting is how insurers assess the risk of providing insurance and considers your medical history.

"Even a slight change in health can cause the premium to go up by more than 25 percent. That doesn't sound like much, but over the course of a career, that can be a significant amount of money. So as a general rule, physicians and young doctors in training are always better protected by locking in a policy or even a supplemental as soon as they're able to," advises Price.

Take advantage of your good health now, so you can get good pricing on your policy.

Choosing an unreliable insurer

When you purchase disability insurance, you're counting on your insurer to make benefits payments when you make a claim. Your financial stability and a large amount of money are on the line.

"There are a number of companies that will offer protection for a physician. Many of those insurers can be ruled out though based on their poor claims experience," says Price.

Good independent insurance agents can offer valuable insight on trusted insurers because of their industry experience. Beyond working with a trusted insurance agent, there are several other factors you can research.

Check the financial strength ratings of the insurer issuing your policy. These ratings indicate an insurer's financial stability and likelihood that the insurer will be able to meet its claims obligations.

You may work with an insurance agent, financial advisor, or agency to buy a policy, but the insurer is the entity that backs the policy financially. If you're working with a third-party, ask which insurer offers the policy and check their financial strength.

You can also check for official complaints and past lawsuits to understand more about the insurer. The nature of these complaints and lawsuits and how many there are will help you gauge how well the insurer treats policyholders and handles claims.

Customer reviews are another way to understand how well an insurer treats its policyholders. Pay attention to what reviews say about their experience after they've purchased a policy because this insight is more valuable than how the purchase process went.

Price shares why choosing a reliable insurer is more important than finding the lowest price:

"I have a personal client who dropped an excellent disability policy eight years ago for a policy with a lower premium but with a substandard insurer as 'all insurers are roughly the same.' She couldn't have been more wrong though.

Within a year of making that change, she developed a macular degenerative issue which caused a permanent disability. She's been completely disabled for roughly six years now with no monthly benefit as the insurer has denied the claim for years."

Companies to consider

Many insurers offer disability insurance, and it's important to find a trustworthy company. Any insurance provider you choose should have high financial strength ratings. These ratings indicate an insurance company's financial stability and likelihood to be able to meet claims obligations.

When it comes to shopping for a policy, you can work with an agency or directly with an insurer. Best Company collects customer reviews for both agencies and insurers to help you understand the customer experience and find the best company.

Currently, Best Company hasn't received many reviews for disability insurance, so conclusions about the customer experience with the companies below are limited. Despite this lack of valuable data and insight, the companies below offer helpful features as you take care of your disability insurance needs.

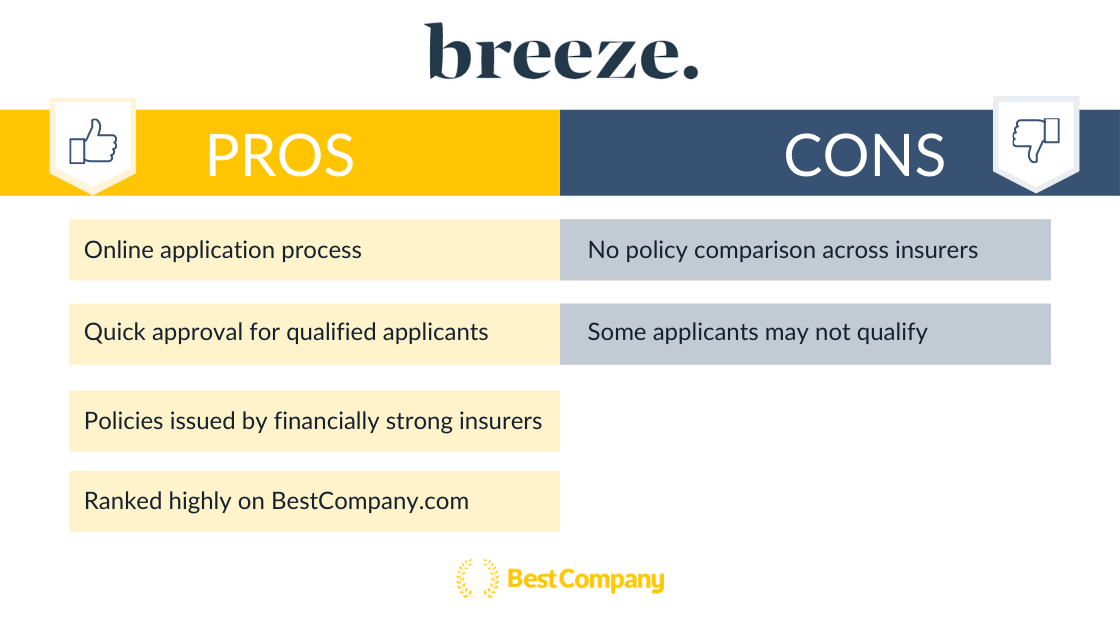

Online application and policy issue: Breeze

Breeze ranks #2 on BestCompany.com. The company offers a quick online application, and qualifying applicants can apply and buy a policy in one sitting. Although some applicants may not qualify, this streamlined process makes Breeze stand out and ideal for people trying to get disability insurance quickly checked off their to-do list.

Customer Review: ConnorMeuret from Omaha, Nebraska

"I discovered Breeze while searching the internet for disability insurance coverage. Breeze made it easy for me to understand exactly what coverage I was getting and really just made the overall experience much more enjoyable then I was expecting. Thank you, Breeze!"

Breeze doesn't issue the insurance policies it sells. Instead, policies are issued by either Assurity Life Insurance Company or Principal Life Insurance Company. Both of these insurers have high financial strength ratings, so you can be confident when working with Breeze.

Disability Insurance from Breeze

Learn more about Breeze's quick application process and read customer reviews.

Learn MorePolicy comparison: Policygenius and LeverageRx

Both Policygenius and LeverageRx make it easy to compare disability insurance policies from multiple insurers. You'll find policies from financially strong insurers from both companies.

Although there are some similarities between the two, there are key differences that make each one stand out.

Policygenius doesn't have enough customer reviews to rank on BestCompany.com. However, the company makes it easy to view premium pricing ranges online.

For specific quotes and policy information, you'll need to provide contact information to Policygenius so you can receive details about policies from multiple companies that may fit your needs. The company also has experience helping people with complex medical histories find a disability insurance policy to meet their needs.

Policygenius only works with insurers receiving high financial strength ratings, so you can have peace of mind that your policy will be issued by a dependable insurer.

Although Policygenius's process isn't as fast a Breeze's, the advantage of working with Policygenius is the ability to compare rates and policies across insurance providers.

Disability Insurance from Policygenius

Learn more about Policygenius's application process and customer service.

Learn More

Similar to Policygenius, LeverageRx doesn't have enough customer reviews to have a rank on BestCompany.com. However, LeverageRx specializes in disability insurance for medical professionals and offers a three-step process to view quotes online.

It's convenient to view policy options and pricing from multiple insurance carriers online. When you find one that meets your needs, you can finalize your application with an agent.

LeverageRx also works with highly rated insurers, so you can be confident in the financial stability of the insurer.

Disability Insurance from LeverageRx

Learn more about LeverageRx's online tools and insurer comparision.

Learn MoreThe Top Disability Insurance Companies

The Top Disability Insurance Companies

Related Articles

Disability Insurance

Disability vs. Long-Term Care Insurance: Who Needs What...

By Guest

May 20th, 2021

Disability Insurance

Do I Need Disability Insurance?

Disability Insurance

Disability vs. Critical Illness Insurance

By Guest

May 18th, 2021

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Disability Insurance and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy