Do I Need Disability Insurance?

Topics:

GuidesWhat would happen if you were injured or severely sick and couldn't work?

Disability insurance is designed to help replace your income if you are unable to work. These policies offer peace of mind and help protect your financial stability.

As you consider whether or not to purchase a policy, use this guide to learn more about disability insurance and to help you consider your coverage needs.

- Understanding disability insurance

- Deciding whether or not you need disability insurance (includes personal stories)

- Applying for and purchasing disability insurance

Understanding disability insurance

Disability insurance offers set monthly payments that can help replace your income if you become unable to work. This valuable protection helps you maintain your financial stability.

You can find two types of disability insurance on the market: short-term and long-term. Social Security also provides some disability insurance.

Alex Sampson

Insurance Expert

Expert Tip:

Many people confuse disability insurance with long-term care. Long-term care is there to protect you in case you're unable to do activities such as getting dressed, eating, or using the bathroom. Disability insurance covers your income.

Social Security

The federal government offers several programs to help people experiencing disability, including Social Security Disability Insurance and Supplemental Security Income. You must apply for benefits and will only receive benefits if you meet the eligibility guidelines. You can apply and check your eligibility online.

Short-term disability insurance

Short-term disability insurance is typically offered by employers as part of a benefits package. These policies generally have short waiting periods (e.g. seven days) and shorter benefit periods (e.g. two months).

Waiting periods are how long you have to wait before your policy will start paying benefits. The benefit period is how long the insurer will pay regular benefits.

Short-term disability policies are designed to help when you experience a disability that you can recover from relatively quickly and return to work. Some short-term disability insurance policies cover pregnancy.

Kevin Haney, Growing Family Benefits president, underscores the value short-term disability insurance can offer women:

"Only seven states have mandatory temporary disability insurance, and only six have paid family leave programs. Employers offering paid time off are the exception.

Women who buy short-term disability before conception can enjoy partial income replacement benefits while unable to work during three common scenarios.

- Medical complications of pregnancy before her due date

- Recovery from labor and delivery after childbirth

- Postpartum medical disorders that delay her return to work."

Long-term disability insurance

If you're buying your own disability insurance policy, you'll usually purchase long-term disability insurance. Employers can also offer long-term disability insurance.

These policies have longer waiting periods (e.g. three months) and longer benefit periods (e.g. until age 65). Long-term disability insurance is designed to cover disabilities that aren't easy to recover from to return to work.

Since employer-sponsored disability insurance generally ends if you change employers, buying your own insurance can be a more stable coverage option. Depending on your income, you may be able to get more coverage though an independently purchased policy than an employer-sponsored plan.

Emory Smith, founder of EJS Financial Management, advises purchasing your own long-term disability coverage if you have a high income:

"For high income earners, workplace disability coverage rarely protects enough income so individually underwritten LTD is a must."

Another key advantage of purchasing your own policy is that the benefits will typically not be subject to income tax. Benefits from an employer-sponsored policy are taxable because the premiums are typically paid with pre-tax dollars.

If you buy your own policy, the benefits aren't subject to taxes because the premiums are usually paid with post-tax dollars, which lets you keep more of the benefit to take care of your needs.

Deciding whether or not you need disability insurance

It's easy to view disability insurance as unimportant until you need it. It's too late to buy disability insurance if you didn't buy it before you needed it.

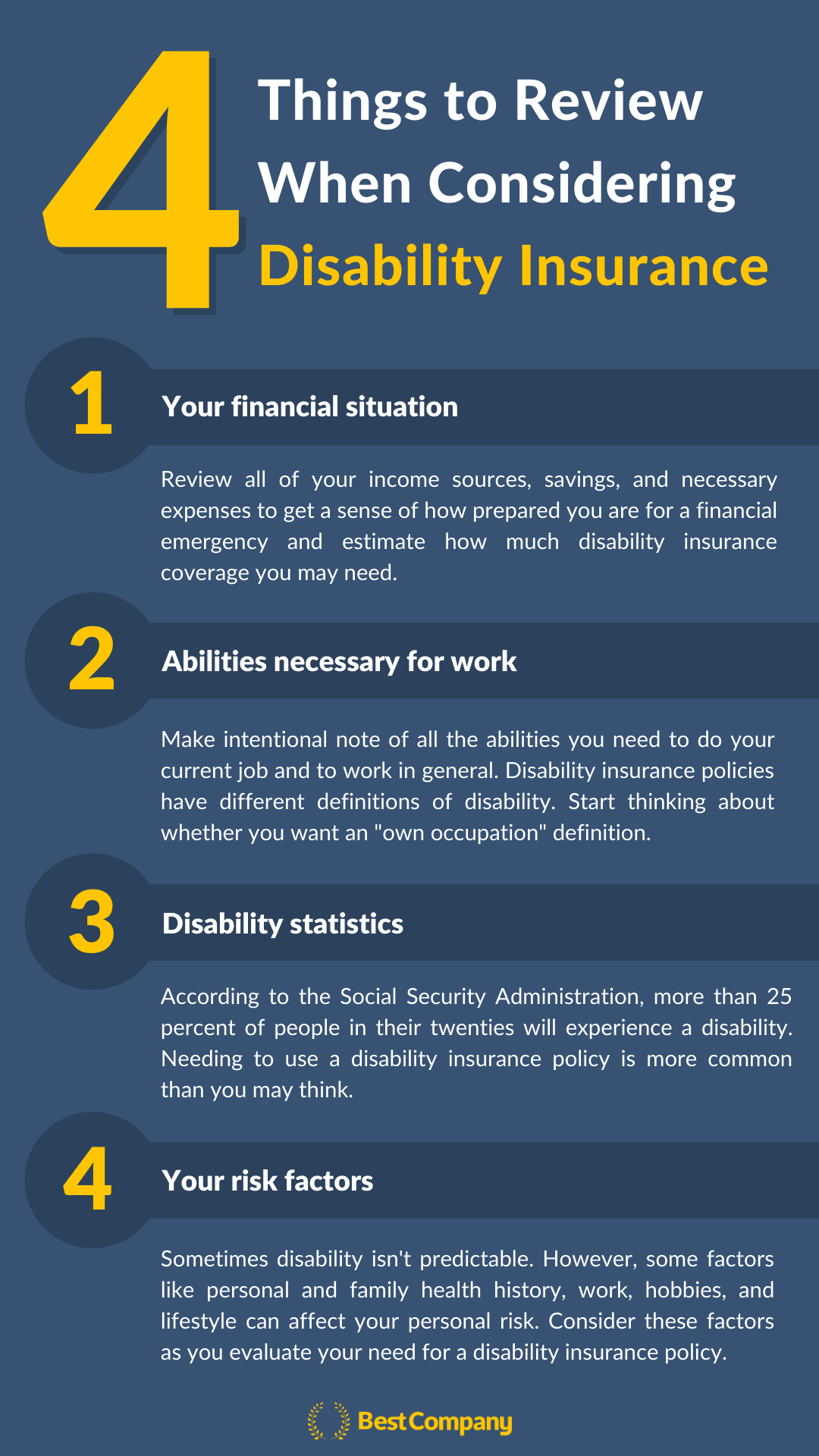

As you make a decision about purchasing your own policy, here are four things to review:

- Understand your financial situation.

- Review the abilities you need to work.

- Consider the statistics.

- Assess your risk.

Understand your financial situation.

Ask yourself the following questions:

- Where does your money come from?

- Do you rely on one job or a string of part-time jobs?

- Do you earn from investments or rental properties?

- Do you have a side gig?

- How much do you have saved?

- What do your debt payments look like?

- What expenses could you cut from your budget if necessary?

Answering these questions will help you evaluate how prepared you are if you were to experience a financial emergency or change in income.

Emory Smith

Finance Expert

Expert Tip:

A simple question determines the need for disability insurance — if my income disappeared, how would life change?

If other income sources would continue uninterrupted, you probably don't need disability coverage. But if your income is critical, disability insurance is vitally important.

Personal experience

Dianne Birtley, freelance B2B copywriter:

"I have purchased disability insurance. In fact, I've purchased two kinds of disability insurance: employment disability insurance and mortgage disability insurance. They were a significant cost, but I decided it would be worth it to buy both because if I were unable to work, I wouldn't be able to pay my bills or mortgage.

Having the insurance gave me peace of mind. I also believed that if I had disability insurance, I wouldn't need it. Of course, I also believed that if I didn't have it, I would need it. So I decided to take the risk-averse approach, and buy both types.

As it turned out, I actually did get sick and couldn't work. I used both insurance policies and was grateful that I had bought them. Being sick is very stressful, but having both types of disability insurance relieved the financial stress which eased my burden and allowed me to focus on getting healthy."

Back to "Deciding whether or not you need disability insurance"

Review the abilities you need to work.

What cognitive functions and physical abilities do you need to do your current job? What about working in general?

Disability insurance policies have specific definitions of disability. Policies generally only cover complete disability, or the total inability to work.

Some policies allow for an "own occupation" definition, which means that you'll receive benefits if you can no longer work in the job you trained for.

For example, a surgeon who experiences an injury on their hands may not be able to perform surgery even after recovery. Under an own occupation definition, the surgeon would likely receive disability payouts for the entire benefit period. Under a typical disability definition, the surgeon may not receive disability benefits because they could still work in another job, for example.

Most insurers offer the option to include residual disability insurance coverage. This coverage allows you to receive partial disability benefits if you are still able to work but not at the same level as before.

As you weigh the different disability definitions, consider your career and your finances. What would living off a part-time salary look like? What investments (e.g. school and professional training) have you made in your career that you want to protect?

Back to "Deciding whether or not you need disability insurance"

Consider the statistics.

According to the Social Security Administration, over a quarter of people in their twenties will become disabled before retirement.

While some factors may put you at higher or lower risk, life is unpredictable. You can experience injuries from an accident or develop an illness that can affect your ability to work and provide for yourself and family.

Personal experience

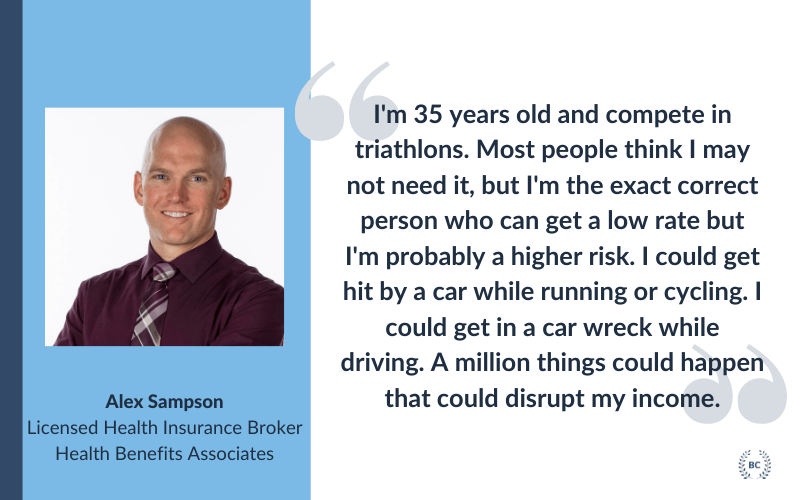

Alex Sampson, licensed health insurance broker with Health Benefits Associates:

"I own my own disability policy and I've helped others set them up. I'm 35 years old and compete in triathlons. Most people think I may not need it but I'm the exact correct person who can get a low rate but I'm probably a higher risk. I could get hit by a car while running or cycling. I could get in a car wreck while driving. A million things could happen that could disrupt my income."

Back to "Deciding whether or not you need disability insurance"

Assess your risk.

Although some events are unpredictable, others can be anticipated.

- Review your health and family health history. Some health conditions and health histories may increase the likelihood of a disability. Even if you're in good health now, preparing for the possibility of a different future is worthwhile.

- Consider your job. Some jobs are more prone to injuries than others. Office jobs tend to have lower physical risks than construction jobs, for example. Workers compensation offers some protection for work-related injuries. However, if you want to be confident in your income protection, purchasing your own disability insurance policy can help.

- Think about your hobbies and lifestyle. Some activities like skiing and slot canyon hiking can increase your risk of experiencing a disability. Of course, this isn't a reason not to do them. You just want to make sure you've taken care of yourself and protected your income.

Personal experience

Sandra Henderson, licensed professional counselor and LifeHacks founder:

"I bought one just a year ago after my anxiety became a problem. When the pandemic started, I just noticed that it became a bit worse, to the point that controlling it (even with the use of meds) has turned to be a challenge for me.

Such kind of insurance is important for me, especially that I work for a marketing company where quotas have a huge role in my professional responsibilities. Sometimes, when my anxiety kicks in, I have no other choice but to rest for some minutes until it stops. And so far, I still haven’t used it since this is just a backup option for me in any case the worst-case scenario arrives."

Applying for and purchasing disability insurance

Underwriting for disability insurance policies can take a little bit of time depending on your circumstances and where you apply, so you may not be able to apply and purchase a policy on the same day.

Fortunately, the insurtech company Breeze offers an online application process. Some applicants may be able to apply and purchase a policy in one sitting.

Customer Review: Brian K. from Omaha, Nebraska

"Awesome company to work with. I was able to apply and get a policy completely online on my phone. Price was great."

Breeze is also one of Best Company's top companies for disability insurance. (We use an algorithm that weights customer reviews to rank companies.) Breeze has received a 5/5 average star rating.

Apply with Breeze

As a top-ranked company with high customer ratings, we recommend working with Breeze. You'll benefit from an online application process and may be able to be approved for and purchase a policy in one sitting.

Apply with BreezeThe Top Disability Insurance Companies

The Top Disability Insurance Companies

Related Articles

Disability Insurance

A Physician's Guide to Disability Insurance

Disability Insurance

Disability vs. Long-Term Care Insurance: Who Needs What...

By Guest

May 20th, 2021

Disability Insurance

Disability vs. Critical Illness Insurance

By Guest

May 18th, 2021

Get Our Newsletter - Be in the Know

Sign up below to receive a monthly newsletter containing relevant news, resources and expert tips on Disability Insurance and other products and services.

We promise not to spam you. Unsubscribe at any time. Privacy Policy